The 3rd pillar in Switzerland is a system voluntary retirement savings scheme (private pension plan) designed to supplement AHV (first pillar) and pension benefits. pension funds (second pillar). It comes in two main forms. On the one hand, the Pillar 3aA retirement savings plan offers tax advantages in exchange for certain withdrawal restrictions. On the other hand, the pillar 3b offers more flexible savings, although it does not offer the same tax incentives.

Did you know?

The combined benefits of the 1st pillar and 2nd pillar generally cover only about 60% of previous income.

Pillar 3A: private pension provision

Get your personalized comparison

Fill in our 3rd pillar quotation request form and one of our pension experts will contact you shortly with a personalized, no-obligation analysis.

The Pillar 3a offers a structured solution to supplement AHV and pension fund income, enabling you to build up savings on advantageous terms. With a 3A, you can:

- Withdraw the available funds to acquire a primary residence

- Pledge your 3A for the purchase of a principal residence

- Building a comfortable retirement

- Making 2nd pillar purchases

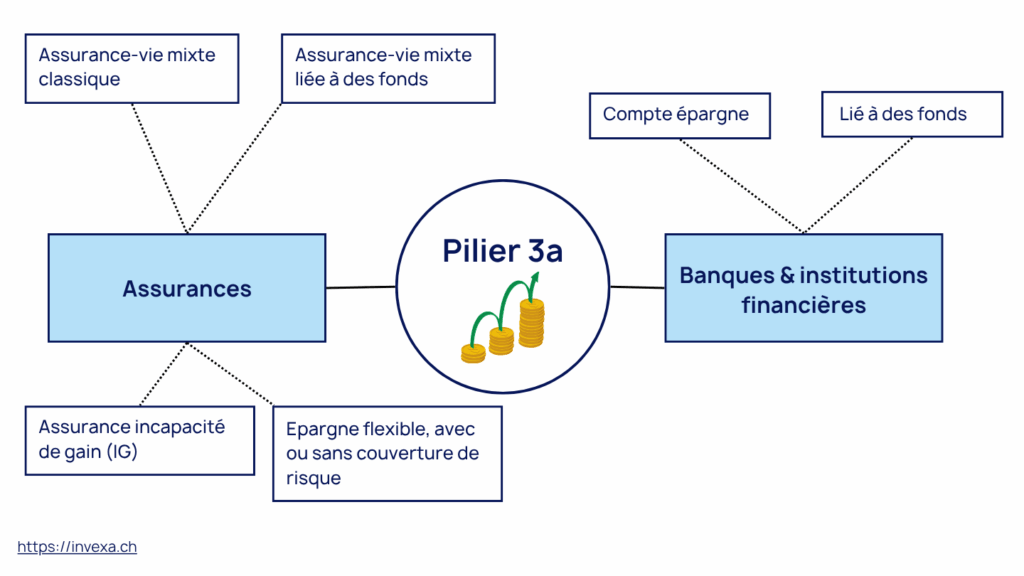

It is possible to take out a 3a with a bank or an insurance company, with some differences in terms of payment flexibility and risk coverage.

1. Possible forms

The 3rd pillar A exists under two shapes banking and insurance.

On the banking side, this may involve a traditional savings account — secure but with limited returns. Others choose investment funds, which offer higher return potential but also carry market-related risks. Between the two, some hybrid solutions provide a balance between security and performance by combining a guaranteed portion with an invested portion.

On the insurance side, the 3a pillar often takes the form of life insurance contracts, investment funds, ETFs, or pure savings plans. These products allow you to save while benefiting from protection in the event of death or disability. Depending on the contract, the capital may be guaranteed or linked to the performance of the underlying investments.

Why choose Invexa for your 3rd pillar?

- We are one of the few brokers who clearly explain the real costs, in plain language, with no hidden catches.

- We focus on fund performance, the transparency and the relevance for your situation, not about pushing a product.

- We work exclusively with selected service providers, and we only recommend solutions that really suit you.

2. What are the conditions for opening a 3A?

You can take out a 3rd pillar A in the following cases:

- You are gainfully employed and receive a income subject to AHV (self-employed or employed)

- You work in Switzerland while living abroad (e.g. cross-border commuters)

- You receive a daily allowance from theSwiss unemployment insurance

- You receive a daily allowance from thedisability insurance subject to AHV

- You become partially disabled with income subject to AHV

- You've reached retirement age but keep working (up to 5 years after age 65)

- You have temporarily stopped working (civilian service, illness, unemployment, etc.)

3. Pillar 3a tax benefits

Tax incentives are one of the main attractions of Pillar 3a. Here are just some of the tax benefits associated with this scheme:

Deduction of contributions

The maximum amounts that you pay into a Pillar 3a account are entirely deductible from your income taxable up to CHF 7'258 / year (limit 2025), while a person not affiliated to a pension fund (e.g. self-employed) can pay in up to 20% of their income, capped at CHF 36,288.

This translates into an immediate reduction in your tax base, and reduces your tax bill each year. However, only frontier workers quasi-residents can deduct Pillar 3a contributions. If they do not have this status, this product will not be of interest to them, and they will have better time to turn to other solutions.

Advantageous taxation on withdrawal

When a withdrawal is made, whether at retirement or for the purchase of a primary residence, the amount withdrawn is subject to the capital benefits tax. It is therefore taxed separately from income, at a reduced rate (1/5 of the regular tax).

Exemption from wealth tax

During the term of your 3a pillar contract, the surrender value is not subject to wealth tax, which represents a real advantage compared to a 3b pillar.

Buybacks in 3a

From 2026 and for fiscal year 2025, it will be possible to buy back unpaid contributions. This novelty offers an interesting lever for tax optimization and retirement planning for people working in Switzerland.

4. What are the other advantages of Pillar 3a?

A 3rd pillar A also allows you to withdraw or pledge part of your savings to finance the purchase of your primary residence, making it easier to access home ownership. Additionally, by regularly contributing to this account, you build up an essential supplementary income to ensure a comfortable retirement and maintain your standard of living after the end of your professional activity.

Finally, pillar 3a offers the possibility of making buy-ins into the 2nd pillar, which can help fill gaps in your occupational pension plan and thus optimize your overall financial coverage.

A few figures on tied pension plans

In 2022, over CHF 137 billion were invested in tied pension plans, of which CHF 87 billion in banking and CHF 50 billion in insurance¹.

¹Federal Social Insurance Office. Statistics [online]. Available at: https://www.bsv.admin.ch/bsv/fr/home/assurances-sociales/bv/statistik.html. Accessed: March 10, 2025.

5. What are the disadvantages of Pillar 3A?

Pillar 3a has a number of disadvantages to consider, such as

Blocked funds

Amounts paid are locked-in until five years before legal retirement age. A early withdrawal is only possible in situations such as the purchase of a principal residence, the start of self-employment, definitive departure from Switzerland or the purchase of years of Pillar 2ᵉ contributions.

Penalizing surrender value

In the event of an early withdrawal, especially with a pillar 3a taken out through an insurance provider, the amount recovered may be lower than the amounts paid in due to unamortized setup fees.

Pillar 3b: unrestricted retirement provision

The 3b pillar is a form of voluntary individual savings, offering greater flexibility compared to the 3a pillar. Unlike the latter, contributions to a 3b pillar are not subject to annual limits and do not offer the same tax advantages, as they are generally not deductible from taxable income — except in certain cantons.

This means that, although it does not offer such attractive tax deductions (unless conditions are met), Pillar 3b allows you to save and withdraw your capital whenever you wish. This makes it an ideal complementary solution for diversifying your savings strategy and financing personal projects.

What can a voluntary (3b) pension plan consist of?

Pillar 3b comprises all savings other than the first and second pillars, as well as tied pension provision. These can include classic cars, securities, real estate, works of art and much more.

1. Tax benefits

Tax exemption on withdrawal

The withdrawal of your Pillar 3b capital can be entirely exempted from taxes if the contract is a provident plan, i.e. if the following conditions are met:

- The term must be at least 5 years (classic) or 10 years (fund-linked).

- The contract must be taken out before age 66.

- Payment is made after age 60.

That said, voluntary pension contracts are subject to wealth tax throughout their entire duration. In Geneva, for example, a tax allowance applies: you are liable for wealth tax if your assets exceed CHF 87,632 (only the portion above this threshold is taxed).

Deduction of annual payments

The cantons define the amount of deductible annual contributions. In some cantons, a Pillar 3b is not deductible at all, while in the canton of Geneva it is possible to deduct up to:

- CHF 2,232 for a single person

- CHF 3,348 for a married couple

In the canton of Fribourg, the following deductions are available:

- CHF 750 for a single person

- CHF 1,500 for a married couple

2. Disadvantages of pillar 3B

Although Pillar 3b offers a great deal of flexibility by allowing funds to be paid in and withdrawn at any time, its major drawback is that, unlike Pillar 3A, payments are not subject to any restrictions. not deductible of taxable income in most cantons, which means that you do not benefit from a tax credit.tax savings on your contributions.

In addition, pillar 3b is subject to thewealth tax for the duration of the contract.

Pillar 3A vs 3B: Which to choose?

The choice between a Pillar 3a and a Pillar 3b depends above all on your financial objectives and personal situation. Pillar 3a is a linked solution designed primarily for retirement. It offers significant tax benefits since your contributions are tax-deductible, but in return, the money is blocked until you meet certain conditions (retirement, acquisition of a home, starting a self-employed business or leaving Switzerland permanently). This makes it ideal if you wish to prepare for retirement and benefit from substantial tax savings.

Pillar 3b, on the other hand, is a free savings account not subject to the same withdrawal restrictions. You can deposit and withdraw funds when you want, giving you greater flexibility to finance other short- or medium-term projects. What's more, it's open to everyone, unlike the 3a, which requires you to be gainfully employed. However, it does not offer the same tax advantages as the 3a, except in a few cantons where deductions are available.

In practice, a 3a pillar is the first choice, followed by a 3b pillar if there is a need to supplement 3a benefits or savings. Since payments into some forms of 3b benefit from tax deductions in certain cantons (e.g. Geneva and Fribourg), as well as tax exemption on capital benefits when the pension character is fulfilled, it can also be considered as part of a tax optimization strategy.

Find out more about our 3rd pillar reviews with different providers

Not sure which service provider to choose? We can help you choose solution 3a the most suitable.

AXA 2026 3rd pillar: analysis of SmartFlex solutions (3a/3b)

Generali 3rd pillar: Full comparison of 3a/3b solutions in 2026

BCV 3rd pillar: opinions, advantages and limits to be aware of in 2026

UBS 3rd Pillar: Analysis of Vitainvest and Fisca 3a Solutions

Which 3rd pillar for which profile?

You always start by maximizing the 3a. Once the ceiling is reached, you can add a 3b (funds, life insurance, etc.). The choice mainly depends on your time horizon and risk tolerance. The longer the horizon, the more you can invest in equities. As you get closer to withdrawal, you reduce risk, especially starting about ten years before the deadline.

A young person can aim for a 3a heavily invested in equities. A family with a mortgage will favor a 3a insurance policy with appropriate death coverage. An independent worker without a pension fund (LPP) should first maximize their 3a, then complement it with a 3b. High-income earners optimize taxes by spreading their savings across several 3a accounts. Very conservative profiles choose guaranteed solutions—but only if they keep the contract until the end.

The 3a/3b insurance products are designed for the long term: fees are charged upfront, which penalizes early withdrawals during the first few years. If the money might be needed in the coming years, it’s better to avoid insurance-based products and reduce exposure to equities.

How do you set up an effective pension strategy?

Setting up an effective individual pension strategy relies on a precise analysis of your financial, professional, and tax situation. Depending on your objectives, the 3a pillar can offer a tax-efficient solution to prepare for retirement, while the 3b pillar provides greater flexibility and investment freedom. In all cases, a personalized assessment is essential to determine the most suitable strategy.

Frequently asked questions

To end a 3a:

- Termination must be requested in writing (in the case of a transfer)

- You must be 60 years old for a man and 59 for a woman.

- You are receiving a full disability pension

- You make a withdrawal for the purchase of a principal residence and withdraw the entire capital

- You (the policyholder) disappoint

To end a 3b:

- Cancellation conditions are set out in the contract.

- The maximum amount for the 3rd pillar in 2025 is CHF 7,258 for individuals affiliated with a pension fund (LPP).

- For self-employed individuals without a 2nd pillar, the ceiling is 20% of income, up to CHF 36,288.

The 3rd pillar can be withdrawn in the following cases:

- 5 years before AHV retirement age

- Purchase of principal residence

- Mortgage amortization

- Departure from Switzerland

- Independence

- Disability or death

The pillar 3b can be removed at any time (subject to the supplier's contractual terms and conditions).

There are a wide range of options for the 3rd pillar, either through a bank or an insurance provider. Most products can be subscribed to within both tied pension schemes (pillar 3a) and flexible pension schemes (pillar 3b).

In insurance, a third pillar is often set up in the form of a life insurance policy or income protection insurance, while in banking, a 3a or 3b most often corresponds to a standard savings account or one linked to investment funds.

Comparing 3rd pillar plans will help you choose the solution best suited to your profile and goals.

People working in Switzerland—whether employed or self-employed—who generate an income subject to AHV can open a 3a pillar. The 3a is also available to cross-border workers.

Yes, it is possible to transfer your third pillar, whether from one bank to another or from an insurance company to another 3a pension solution.

In the case of Pillar 3b, the transfer terms and conditions also depend on the contract.

Pillar 3a (tied pension) It is always deductible throughout Switzerland, up to the legal annual limit. Simply enter the amount shown on your bank or insurance certificate under "tied pension provision (3a)".

Pillar 3b (free) In principle, it is not deductible at federal level. However, some cantons allow a limited deduction for certain life insurance premiums. Rules vary according to canton and family situation.

As early as possible. The younger you start, the more you benefit from compound interest and tax advantages. You pay lower taxes by paying the maximum than by paying nothing. The higher your marginal tax rate, the more attractive the deduction.

- In the bank: more flexible, no guaranteed return.

- Insurance: death/disability benefits, guaranteed savings, but less flexible and higher short-term costs

Yes. You can open as many 3a accounts as you wish. It's even strategically smart when you withdraw, as it allows you to spread the tax burden.

Get your personalized comparison

Fill in our 3rd pillar quotation request form and one of our pension experts will contact you shortly with a personalized, no-obligation analysis.