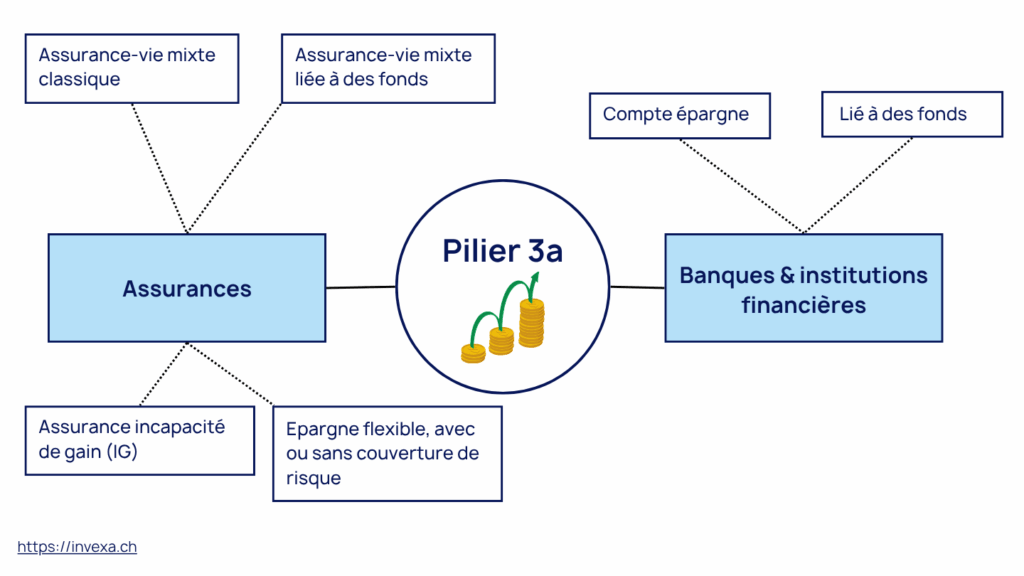

On one hand, banking solutions offer flexibility in deposits and an investment-focused management. On the other, insurance products provide additional protection, particularly in cases of death or disability.

What is the 3rd pillar?

The 3rd pillar is an integral part of the swiss pension system, In addition to AHV (1st pillar) and occupational pension plans (2nd pillar). These are voluntary savings designed to improve living standards in retirement, while offering attractive tax benefits. There are two types: Pillar 3a, known as «linked», and Pillar 3b, known as «free».

Pillar 3a is reserved for people with a income subject to OASI . It allows you to build up long-term savings, with objectives such as supplementing your retirement, optimizing your tax situation, and protecting your loved ones in the event of an unexpected event.

Characteristics of the 3rd Pillar 3a in banking

Opting for a banking solution for your 3rd pillar A in Switzerland is a popular choice for many savers seeking greater flexibility and investment opportunities.

Flexible payments

Deposits are free, This means you can adjust your contributions to suit your budget and your needs. You can stop or resume payments at any time.

Limits and drawbacks

Unlike insurance solutions, a 3rd pillar bank account does not provide coverage in case of death or disability, and returns heavily depend on financial markets for investment options, which can result in losses during crisis periods.

100% savings contributions

The entire amount paid in is allocated to savings, without any risk coverage. This makes it a particularly suitable solution for young professionals with no family responsibilities, who prefer freedom and low management fees.

Advantages of 3a banking

- Flexibility: you decide what you want to pay in at any time

- 100% savings: what you pay in goes directly to savings

- Reduced costs: management fees are often lower and you pay no risk coverage

Pillar 3a insurance features

Choose a insurance solution for your 3rd pillar in Switzerland is a popular option for those wishing to combine savings and protection. This type of provident scheme offers additional guarantees in the event of death or disability, while building up capital for retirement.

Savings and protection combined

In the event of death, the capital sum is paid directly to the designated beneficiaries. In the event of disability, the insurance generally covers the premiums, enabling savings to be maintained until the scheduled maturity date.

Long-term commitment

Premiums must be paid regularly, according to the amount set out in the contract. This helps discipline savings, but can be a constraint for those with fluctuating incomes.

Guaranteed returns

Insurance solutions often offer a guaranteed minimum return, which reduces the risk of capital loss. Some formulas include surplus dividends, allowing you to benefit from an additional return.

Profit sharing

Within a 3rd pillar insurance plan, the insured can benefit from a profit participation. This means that if the insurer achieves better financial results than expected, a portion of these profits is redistributed to clients as additional returns. While this participation is sometimes not guaranteed, it enhances the overall long-term performance.

Waiver of premiums in the event of disability

Another advantage of an insured 3rd pillar is the waiver of premiums in the event of disability. In practical terms, if the insured becomes unable to work for medical reasons, the insurance takes over and continues to pay into the policy on his or her behalf. Savings therefore continue as normal, without the insured having to pay new premiums, guaranteeing that the capital will be built up even in the event of a serious setback.

Higher costs

Unlike banks, where fees are deducted on a straight-line basis each year, insurers often apply an advance-fee model: a significant proportion of costs are paid in the first few years. This is why lower surrender value at the outset, before gradually catching up with the capital paid in as costs are amortized.

That said, fees should not be excessive: in particular, look at the « yield reduction »(aggregated conclusion, management and fund fees). By choosing a competitive insurer, you can maintain reasonable costs, relevant coverage and solid long-term performance.

Advantages of 3a insurance

- Extra blanket: the insurance pays benefits in the event of death or disability

- Profit sharing: part of the insurer's profits are redistributed to the policyholder

- 2-in-1 model: 3a endowment life insurance offers combined death/disability and savings protection

- Guaranteed return: a minimum amount of capital can be guaranteed, regardless of the health of the financial markets.

- Waiver of premiums in the event of disability: in the event of a GI, the insurer saves on your behalf.

What types of 3rd Pillar A are offered by banks?

In Switzerland, when considering opening a 3rd pillar A account with a bank, there are two main options: the classic 3a savings account and investment in 3a pension funds.

3a savings account

The 3a savings account is the simplest and most traditional form of Pillar 3a banking. Here, savings are deposited in a blocked account, earning a fixed interest rate set by the bank. This rate, while currently modest (below 1.1 %), has the advantage of offering a high level of capital security.

This solution is suitable if you plan to withdraw your 3a (for example, for a real estate purchase) within the next 5 years. However, it is important to be aware that, in the long term, the returns offered by this type of account are generally lower than inflation. Therefore, for young professionals or those with several decades ahead, this option may prove underperforming in terms of capital accumulation.

Pillar 3a banking in funds

Alongside the traditional savings account, many banks now offer 3a pension funds. This is no longer just about saving but investing your 3a assets in financial markets through diversified funds (ETFs, stocks, bonds, real estate, etc.).

Several strategies are possible depending on the investor profile (conservative, balanced, aggressive), which influences the equity allocation. However, unlike a savings account, the capital is not guaranteed in a 3a fund: the value of the savings can fluctuate, especially based on financial market performance. Nevertheless, over the long term, studies show that equity investments have historically offered better returns than fixed-income products.

What types of 3rd Pillar A are offered by insurance companies?

Insurance companies offer a more flexible 3a in terms of savings and risk coverage. They do, however, charge higher fees.

Classic combined life insurance

The traditional form of the 3rd pillar A in insurance is the classic mixed life insurance. In this model, the premiums paid by the insured are used both to build interest-bearing savings at a guaranteed interest rate and to finance coverage in case of death or loss of earning capacity.

In practice, this means that at the end of the contract (for example, at age 64 or 65), the insured receives a capital amount made up of their contributions, guaranteed interest, and possibly a profit participation if the company achieves better results than expected. In case of premature death or disability, a guaranteed capital is paid to the beneficiaries or the insured.

This type of contract is ideal for savers who value capital security and want to combine retirement savings with family protection without exposure to financial market risks. However, returns are lowand performance is often lower than that of a 3a bank account because of the additional risk-related costs.

Endowment life insurance

For those seeking higher return potential, insurance products also offer mixed life insurance with funds. In this case, the savings portion is not placed in a guaranteed interest account but invested in financial markets through proprietary funds, bank funds, or ETFs.

A risk coverage (death and often loss of earning capacity) is maintained throughout the contract duration, and the savings evolve according to the fund performances. If the markets perform well, the savings can grow faster than in a traditional savings account. However, the contract’s cash surrender value may decline in case of poor stock market results.

flexible 3a

Finally, an increasing number of insurers now offer so-called flexible 3a solutions. These contracts emphasize high customization: the savings are invested in investment funds, but the insured can choose to add protection modules.

Possible options include :

- A death cover (fixed capital or proportional to savings)

- A disability insurance (with premium waiver or annuity payment)

- A disability insurance (payment of a lump sum or an additional annuity).

- Waiver of premiums in the event of disability (the insurance covers you in the event of disability)

The main advantage of these flexible solutions is that they enable you to tailor your pension plan precisely to your needs, whether in terms of savings, risks covered or degree of exposure to the markets. They also offer the possibility of modifying certain parameters (including premiums) during the term of the contract.

Comparison of banking VS insurance fees

When choosing between a Pillar 3a with a bank and a Pillar 3a with an insurance company, the question of costs is often at the forefront. At first glance, bank solutions seem more economical. However, a detailed analysis shows that the reality is more nuanced.

In banking, fees are mainly concentrated on the investment. They take the form of fund management fees (called TERfor Total Expense Ratio), which generally vary between 0.25 % (e.g: UBS Vitainvest funds) and 1.60 % per annum. The more passive the solution (index ETFs, for example), the lower the TER. There is no death or disability protection: the bank offers only an investment vehicle. Digital pension providers also charge total annual fees of around 0.5% on average.

In insurance, the situation is different. The passive funds chosen often have lower TERs - around 0.15 % (eg: AXA SmartFlex Funds) to 0.45 % - because insurers prefer institutional funds with reduced fees. In addition to these fund fees, however, there is the so-called contract performance reduction: this includes the insurance management fees as well as administrative costs. This reduction varies from one provider to another, typically between 0.5 % and 2.10 % per year.

This mechanism makes sense: in insurance, the 3a contract is not limited to a single product. investment. It also guarantees a death benefit, protects savings in the event of an unexpected event, and often offers options such as phased withdrawal before retirement. These services come at a cost, but they meet a need for security that the banking solution does not. However, it's crucial to check the level of fees carefully before signing up, as some insurers charge high fees that can significantly reduce net returns over the long term.

Should I take out a 3a bank or insurance policy?

There is no universal answer to this question. The bank maximizes long-term performance by minimizing fees but offers no immediate protection in case of unforeseen events. In contrast, the insurance guarantees a death benefit from day one and protects the savings against life’s uncertainties, albeit with a slight reduction in net returns.

The best choice depends on the saver’s profile: their age, family responsibilities, saving capacity, risk tolerance, and personal priorities. A young single person without financial commitments might favor a pure banking strategy. Someone looking to secure a life project, protect their family, or cover disability risks will find a more comprehensive and suitable solution in insurance.

The key is to choose knowingly, understanding what each option offers, while having a transparent view of the fees involved.

3A comparison chart in banking VS insurance

- Criteria

- 3A insurance

- 3A bank

- Payment frequency

Determined in advance

Flexible

- Type of investment

- Classic (simple savings)

- Mixed (savings/risk)

- up to 100% funds

- Classic (simple savings)

- up to 100% funds

- Surplus earnings

Profit sharing

No profit sharing

- Possible coverage

- Death cases

- Disability cases

No

- Bankruptcy guarantee

Amount guaranteed to 100%

Guaranteed amount up to CHF 100,000

- Waiver of premiums in the event of disability

Possible

No

- Investment horizon

Medium to long-term

Long-term

- Share of guaranteed capital

Possible

- Pledging

Possible

Possible

- Key benefits

- Insurance coverage

- Profit sharing

- Amount guarantee

- More safety

- Higher surrender value

- Best financial performance after expenses

- Flexible payments

Frequently asked questions

No, not necessarily.

3a insurance modern often use index funds or ETFs with very low fees (TER from 0.15% to 0.45%), comparable to those of the best banking solutions.

Net performance depends above all on the contract chosen, the investment profile and overall costs (including yield reduction).

Because it offers a little more than just performance :

A death benefit guaranteed from the first payment,

Waiver of premiums in the event of disability,

Secure management at the end of the contract to protect accumulated capital.

For many people, this global security more than justifies a slight reduction in yield.

Yes, that's right.

It is possible - and in some cases advisable - to have several 3a contracts:

A banking contract in funds to maximize long-term returns,

A insurance contract to secure part of your capital and protect your loved ones.

This approach allows you to benefit from the advantages of each solution.

The insurance immediately pays out the guaranteed death benefit specified in the contract, often ranging from CHF 100,000 to 250,000.

For example, even after only CHF 7,200 paid in, your heirs can receive CHF 200,000 (depending on the contract). With a bank solution, only the actual accumulated savings are paid out (e.g., CHF 7,200 plus any potential gains).

Yes, a 3a bank is generally more flexible:

You can pay in what you want, when you want (within the legal limit).

You can stop payments without penalty.

With 3a insurance, you commit yourself to paying a regular premium over a fixed period. However, today's modern insurances offer greater flexibility (premium adjustment, release of the insurance in case of need).

Yes, but with caution. Cancelling a 3a policy in the first few years can lead to serious losses (cash surrender value less than premiums paid). That's why it's essential to choose a contract that meets your long-term needs before committing yourself.

The 3a bank account is more suitable for long-term savings, as you can choose not to pay into it for as long as you wish (no payment obligation).

Whether in banking or insurance, the maximum amounts are as follows:

- CHF 7,258 per year if you are an employee with a pension fund

- Up to CHF 36,288 per year (or 20% of net income) if you are self-employed (or employed) without a pension fund.