What is estate planning?

Estate planning refers to all measures taken during one’s lifetime to organize the transfer of one’s assets after death. This anticipatory approach allows you to determine who inherits, in what proportions, and under which conditions, while complying with Swiss law.

An effective estate planning approach serves several objectives:

- Protecting loved ones and ensuring their financial security

- Optimizing transfer taxation

- Preventing family conflicts

- Respecting personal wishes within legal limits

- Integrating the occupational and private benefits dimension

- Ensuring the continuity of a family business where appropriate

Swiss Legal Framework for Succession

Legal heirs and the forced share

Swiss law distinguishes between several categories of heirs organized in order of priority. The Swiss Civil Code provides for an inheritance reserve, a fraction of the estate that must be inherited by certain heirs, thus limiting testamentary freedom.

The protected heirs include:

- The descendants (children, grandchildren), with a reserve of 50% of their legal share

- The surviving spouse, with a reserve of 25% from the estate

- The parents, only in the absence of descendants, with a reserve of 25%

The disposable portion represents the share of the estate that the testator may dispose of freely, either to favor certain heirs or to benefit third parties. This portion varies depending on the family situation, ranging from 25% to 100% of the estate.

The different matrimonial regimes

The matrimonial property regime has a considerable influence on inheritance. In Switzerland, three regimes are available:

- Participation in Acquired Property (default legal marital regime): Assets acquired during the marriage are shared equally in the event of dissolution, while own property remains the exclusive property of each spouse.

- Community of property: All assets, unless otherwise agreed by contract, form a joint estate to be shared equally upon dissolution of the marriage.

- Separation of property: Each spouse retains exclusive ownership of his or her property, with no division in the event of dissolution.

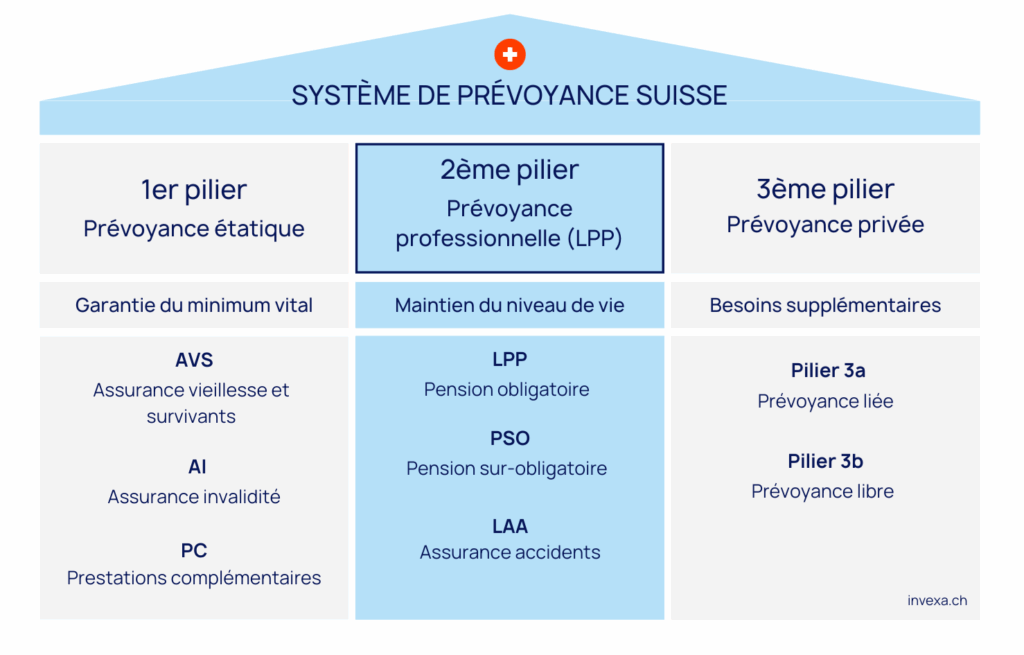

Pensions and inheritance: the impact of the 3 pillars

Pension planning plays a crucial role in Swiss estate planning. The three-pillar system structures financial security and directly affects the transfer of assets.

First pillar (AHV/IV)

The old-age and survivors’ insurance provides benefits for widows, widowers, and surviving children. These pensions are not part of the estate as such, but they ensure income for the family and should therefore be considered in the planning process.

The widow’s and widower’s pensions are paid under specific conditions, while orphan’s pensions protect minor children or those still in education.

Second pillar (occupational benefits)

The assets held in the pension fund often represent the largest portion of the estate. Several elements must be considered when transferring these assets. In the event of death, the BVG/LPP provides:

- In the event of death during the working life, the BVG provides a spouse's pension (60% of the disability pension) and orphan's pensions (20% of the annuity).

- If, on retirement, the insured has not opted for a lump-sum payment, the same applies (see above).

- If you choose to withdraw all or part of your capital at retirement, the capital will be paid to your beneficiaries in accordance with the law.

The beneficiary of the occupational pension plan can be determined by a beneficiary clause. The legal order of beneficiaries favors the spouse or registered partner, followed by descendants, then parents or dependent siblings. The beneficiary clause can be modified to benefit certain individuals within the limits set by law.

Benefits differ depending on whether death results from illness or accident. In the event of accidental death, the first insurances to intervene are Old-Age and Survivors' Insurance (AVS) and Accident Insurance (LAA). Occupational pension plans (BVG) only come into play as a complement, if the preceding benefits are insufficient.

Third pillar (individual pension provision)

Pillar 3a (tied pension)

In the Pillar 3a, The order of beneficiaries is fixed by law. It cannot be changed freely, but certain priorities within the categories can be adjusted. In concrete terms:

- The spouse or registered partner always takes priority.

- If there isn't one, then the direct descendants, dependants, or a person with whom the insured has lived continuously for the past five years, or a person requiring significant support from the insured.

- Then come the parents, then brothers and sisters, and finally other heirs.

You can sometimes specify how the share is divided among several people within the same group (for example, distributing differently among the children), but you cannot freely name an arbitrary beneficiary outside the legal order. The framework is strict because this product is tied to tax advantages. Starting on January 1, 2027, the OPP3 reform provides that holders of a 3a account or policy will be able to designate their children as priority beneficiaries, even if they are married or in a registered partnership.

Pillar 3b (free)

In the 3b pillar, it’s the opposite. The insured person can choose anyone as beneficiary, without specific legal constraints: spouse, friends, unmarried partner, distant relatives, charitable organizations, etc. You can also set custom proportions. The 3b pillar is a far more flexible estate-transfer tool because it isn’t restricted by the regulations governing the 3a pillar.

However, you must still respect the forced shares established under Swiss inheritance law (the legal heirs protected by statute).

Optimizing pension provision as part of estate planning

The intelligent integration of pension provision into estate planning helps optimize the transfer of assets.

1. Pension fund buy-ins increase retirement capital while providing tax deductions. This strategy boosts the benefits paid to survivors and can serve as a tax-optimization tool.

2. The early withdrawal for the purchase of a home alters the composition of the estate and must be considered in the planning process. If death occurs before retirement, the property becomes part of the estate, while the reduced pension assets may limit survivors’ benefits.

3. The coordination between the various pillars and other estate assets avoids gaps coverage. A global analysis helps identify risks (under-coverage of spouse, inadequate protection of children) and remedy them with appropriate solutions.

Estate planning tools

The will

The will is the fundamental tool of estate planning. It enables you to express your last wishes, while respecting the inheritance reserve. In Switzerland, three forms of will are recognized:

1. The holographic will must be entirely handwritten, dated, and signed by the testator. This simple and accessible form remains the most commonly used. It does not require a notary, but it must comply with strict formal requirements to be valid.

2. The public will is executed before a notary in the presence of two witnesses. It offers maximum legal security and is particularly suitable for complex situations or substantial estates.

3. The oral will may only be used in extraordinary circumstances (imminent danger of death, disaster, epidemic) and loses its validity after 14 days if the testator survives.

A will can be used to appoint an executor, formulate charges and conditions, make specific bequests and organize the distribution of the available portion of the estate. The will must be regularly revised to adapt it to changes in the family and its assets.

The inheritance agreement

The inheritance agreement is a contract concluded between the future deceased and their heirs. Unlike a will, it requires the consent of all parties and cannot be revoked unilaterally. This form is particularly useful for the succession of family businesses or for resolving complex situations in advance.

A pact of inheritance can be used to institute an heir, proceed with an anticipated partition, or obtain a renunciation of the hereditary reserve in return for compensation. It must take the form of an authenticated deed.

The donation

- Advance transmission for the benefit of your heirs

- Possibility of assisting beneficiaries in managing the assets transferred to them

- Potential tax optimization by canton

- Reducing the future estate

Donations must respect the hereditary reserve of the legal heirs. They may be subject to an inheritance tax, unless expressly exempted, which means that they will be taken into account when the estate is settled.

The mandate in the event of incapacity

The mandate in the event of incapacity (also called a precautionary mandate) allows you to appoint a trusted person to manage your affairs if you lose decision-making capacity. This tool, often overlooked, usefully complements estate planning by ensuring continuity in the management of your assets.

The mandate must be drawn up in holographic or notarial form and must specify:

- The identity of the representative(s)

- The scope of powers conferred (asset management, medical decisions, personal matters)

- Any remuneration arrangements

- Specific instructions to follow

Tax optimization of the estate

Cantonal inheritance tax

In Switzerland, inheritance taxes fall under cantonal authority, creating a patchwork of tax regimes. Most cantons exempt the surviving spouse and direct descendants, but rates and amounts vary significantly for other heirs.

The deceased’s tax domicile and the location of real estate determine the competent jurisdiction. International estate planning must account for double-taxation treaties and conflict-of-law rules.

Optimization strategies

Several strategies can help optimize inheritance taxation:

- Staggering donations over several years can make it possible to benefit from repeated tax allowances in certain cantons, thereby reducing the overall tax burden.

- Choosing a matrimonial regime influences the rights of the surviving spouse and can optimize the transmission within the couple.

- The use of legal structures (family foundations, trusts, subject to compatibility with Swiss law) can meet transmission and protection objectives.

- Liquidity planning avoids heirs having to sell assets in a hurry to pay inheritance tax or equalize shares.

Special situations

Estate planning for entrepreneurs

The transfer of a family business requires targeted planning to ensure the continuity of operations. The stakes go beyond merely dividing assets and extend to governance, operational stability, and fairness among heirs.

The creation of a family holding company, the drafting of a shareholders’ agreement, and the use of different classes of shares (voting rights versus economic rights) are tools that help reconcile business succession with family fairness.

Unmarried couples and registered partnerships

Unmarried couples (cohabitants) enjoy no legal protection in matters of inheritance. Without testamentary provisions, the surviving partner inherits nothing. Estate planning is therefore absolutely essential for these couples.

Available solutions include :

- A will bequeathing the available portion to the partner

- Life insurance policies with the partner as beneficiary

- Acquiring co-owned property

- Gifts during your lifetime

The registered partnership for same-sex couples has offered the same inheritance rights as marriage since its introduction in 2007 (although it has no longer been possible to enter into one since July 1, 2022). Registered partners benefit from the same legal protection as spouses.

Blended families

Blended families present particular challenges in estate planning. Children from a first marriage retain their forced-share rights, which can limit the rights of the new spouse and their children.

A combination of tools can be used to reconcile interests: wills favoring the spouse within the limit of the available portion, adoption of the spouse's children if appropriate, life insurance policies with designated beneficiaries, and family agreements.

International dimension

International estates, involving heirs, assets, or a deceased person domiciled abroad, raise complex questions of applicable law and jurisdiction. The European Succession Regulation (Rome IV) simplifies certain situations, but Switzerland is not a party to it.

International wills must be carefully drafted to ensure their validity in all the jurisdictions concerned. The assistance of specialists in private international law is often indispensable.

Estate settlement procedure

Opening the estate

The estate is opened upon death, generally at the deceased’s domicile. The competent authority conducts an inventory of assets and debts, then reviews any existing testamentary dispositions.

Heirs may :

- Accepting the estate outright

- Acceptance subject to inventory (protection against debts exceeding assets)

- Renounce the estate within three months

Inheritance division

The division of the estate distributes the assets among the heirs according to their respective rights. This step can be completed amicably or, in case of dispute, may require judicial intervention.

Sharing must take into account :

- Hereditary reserves

- Redeemable gifts made during the lifetime of the deceased

- Specific bequests provided for in a will

- Estate debts

Common mistakes to avoid

Let the law decide for you

Relying entirely on legal rules means accepting a standard distribution which does not necessarily reflect the deceased's family situation, assets or true intentions. This approach can lead to unexpected results, even contrary to the objectives sought.

Insufficient liquidity in the estate

A patrimony composed mainly of illiquid assets (real estate, businesses, unlisted holdings, valuables) can create major constraints. Heirs may be forced to sell quickly to pay taxes, settle debts or ensure equal shares. These high-pressure sales often lead to loss of value and family tensions.

Lack of coordination between testamentary and pension provisions

Beneficiary clauses in life insurance and provident products (3rd pillar, LPP) are not automatically aligned with the wishes expressed in a will. In most cases, the beneficiary clause prevails. Discrepancies between these documents lead to inconsistent results and, often, frustration among loved ones.

Neglect of tax implications

The tax aspectsx are decisive. Failure to do so can result in a disproportionate burden for heirs, particularly in the case of transfers to unrelated persons, unplanned gifts or substantial real estate holdings. Careful tax optimization can preserve more value for the beneficiaries.

No regular updates

Family, estate and professional situations change. A will drawn up many years ago no longer corresponds to today's reality. Review periodically estate arrangements, particularly after a major event (marriage, divorce, birth, acquisition of a major asset, death of a designated heir), is essential to ensure their relevance.

Imprecise or ambiguous formulations

A will must be drafted with maximum clarity. Vague wording or incomplete instructions can lead to differences of interpretation, and often to disputes. Precise, structured drafting is the best protection against conflicts between heirs, and ensures that your wishes are faithfully carried out.

When should you start estate planning?

- Marriage or registered partnership

- The birth of a child

- The acquisition of a major property

- Starting up or taking over a business

- A significant professional change (substantial increase in assets)

- Divorce or separation

- Early retirement or cessation of activity

L'anticipation is the key to successful estate planning. Decisions taken in a hurry or under duress (e.g. serious illness) are rarely optimal. A calm, timely approach allows you to explore all options and make informed choices.

Conclusion

Estate planning goes beyond the simple distribution of assets after death. It represents a act of foresight and responsibility to those closest to them, guaranteeing their protection and respecting their personal wishes. In the Swiss context, the integration of the occupational and private pensions is particularly important, as the three pillars often account for the majority of inherited wealth.

Effective estate planning relies on anticipation, regular review and adaptation to personal and legislative developments. The legal tools available offer considerable flexibility in reconciling protection of loved ones, respect for family balance and tax optimization.

Far from being a morbid subject to be avoided, estate planning represents a investment for yourself and your loved ones. It allows you to look to the future with confidence, knowing that the arrangements you have made will ensure the harmonious transmission of your estate, a faithful reflection of your values and commitments.

Frequently asked questions

This is the set of measures taken to organize the transfer of one's estate according to one's wishes, in compliance with Swiss law. It includes choosing a matrimonial regime, drawing up a will, managing beneficiary clauses and tax optimization.

In the absence of special provisions, the estate is divided among the legal heirs: surviving spouse, descendants or, failing that, parents and collaterals. The legal order and the reserved portion of the estate determine the minimum share of each heir.

The "réserve héréditaire" is the minimum share of the estate that must go to certain heirs (descendants, spouse, parents in the absence of children). The testator can only reduce it in very specific and exceptional cases.

A will is a unilateral document that you are free to change. The inheritance agreement is a concluded contract with your heirs and can only be modified with their agreement. It is often used for business transfers or renunciations of reserve.

They determine the benefits paid to your survivors. OASI and BVG provide for pensions or capital according to precise rules. Pillar 3a is regulated with regard to beneficiaries, while pillar 3b offers complete freedom. Coordination with your will is essential.

For each major event: marriage, divorce, birth, death of an heir, acquisition of a major asset, significant professional or asset change. Regular review ensures consistency.