Pillar 3a Expert in Switzerland

A 3rd pillar tailored to you

The pillar 3a comes in two main forms: banking or insurance. The banking solution offers greater flexibility and access to investment funds, while the insurance solution also includes risk coverage (death, disability). We help you objectively compare these options so your savings align with your priorities: performance, security, or a balance of both.

Depending on your income, your investment horizon and your plans, the choice of contract and medium (bank or insurance) can vary greatly. A personalized analysis is essential to make the most of this system.

Reduce your taxes today with the deductions offered by the 3rd pillar A. Every franc you invest lowers your taxable income and helps you build retirement capital under advantageous conditions.

The 3rd Pillar A exists in two main forms: banking or insurance. The banking solution offers you great flexibility and access to investment funds, while the insurance solution also includes risk hedges (death, disability). We help you compare these models objectively, so that your savings match your priorities: performance, security or a balance between the two.

A pillar 3a contract goes beyond retirement savings. By including additional coverage, it can financially protect your family in the event of life’s unexpected risks. You safeguard your loved ones while ensuring that you maintain your quality of life, even in unforeseen circumstances. It’s a comprehensive wealth protection strategy that goes far beyond a simple savings product.

Calculate your return potential

Find out how much you can potentially save between now and retirement with a pillar 3a solution.

Past or simulated performance is no guarantee of future performance. This projection is provided for information purposes only.

Frequently asked questions about 3rd Pillar A

Here are the answers to the most frequently asked questions about the 3rd Pillar A in Switzerland.

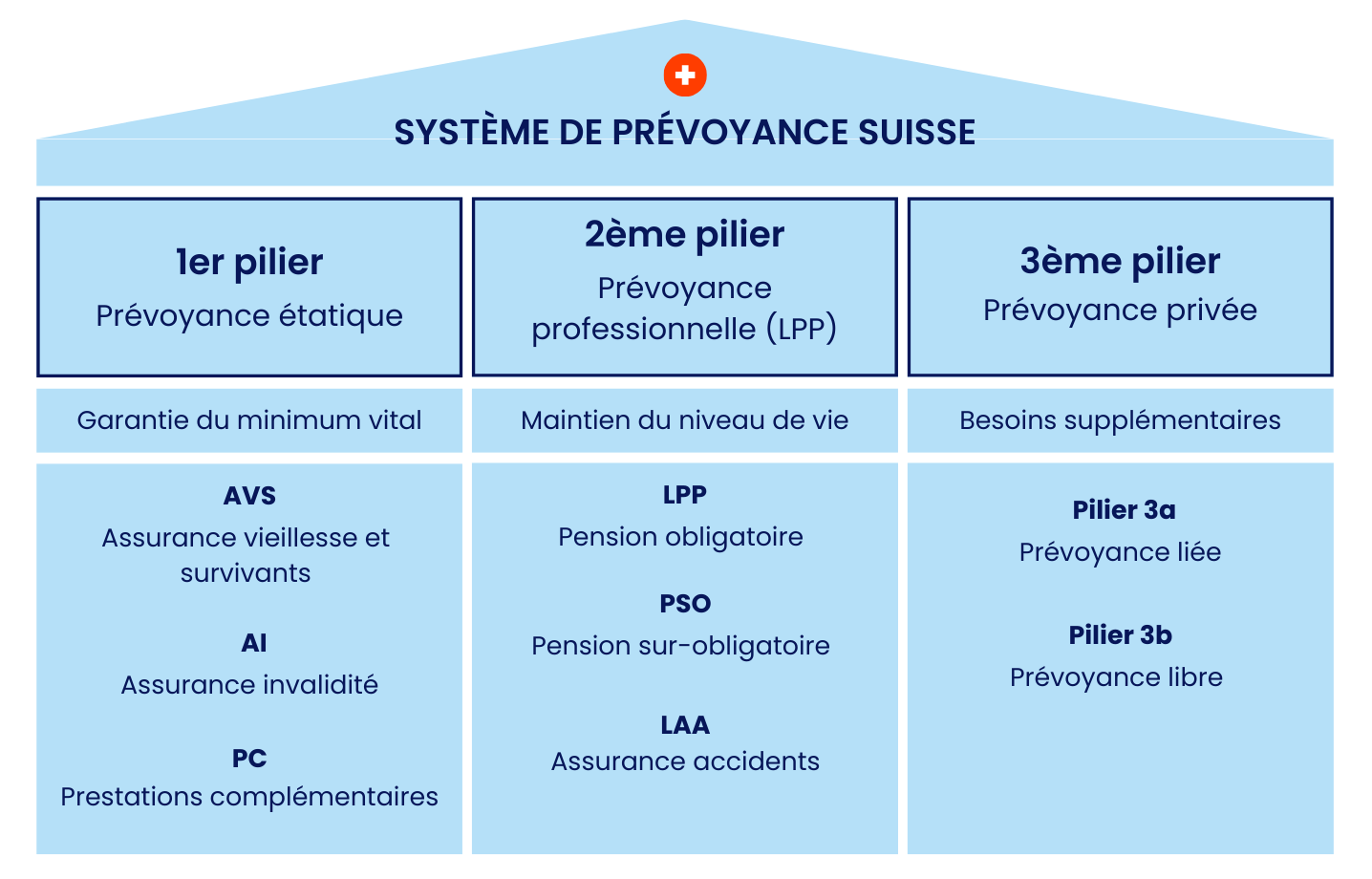

The 3rd pillar A is part of the Swiss pension system and represents the tied individual pension plan.

It allows you to build up savings for retirement while enjoying tax benefits. Payments are deductible of taxable income, within the limits set each year.

Any person domiciled in Switzerland and receiving a income subject to OASI can contribute.

The maximum amounts for 2025 are as follows:

Employees affiliated to a pension fund (LPP): up to CHF 7,258 per year

Self-employed without 2nd pillar : up to 20% of net income, with a ceiling of CHF 36,288

No. The 3rd pillar A is a tied form of savings. Withdrawals are only possible under the following conditions:

Retirement (no earlier than 5 years before OASI retirement age)

Buying your primary residence

Definitive departure from Switzerland

Start of self-employed activity

Total disability

Death (payment to beneficiaries)

It depends on your needs:

The banking 3rd pillar A is a flexible product, with low fees and good return potential through investment funds.

The insurance 3rd pillar A includes risk coverage (death, disability), as well as the payment of premiums in the event of loss of earnings, and is therefore more expensive.

In this case, it is necessary to distinguish between a conservative product with guaranteed returns that includes risk coverage (insurance-based 3a), and a 100% performance-oriented product (banking 3a).

In all cases, you'll need to define your needs and savings objectives on an individual basis. A 3a insurance policy makes less sense for a 30-year-old with no family, whereas it will be essential for a self-employed person not affiliated to a pension fund.

Yes, it is even recommended to spread your savings across several 3a accounts, especially as retirement approaches. This allows you to make staggered withdrawals over several years, thereby reducing the tax impact.

In a banking 3a, you choose the amount you want to contribute, within the annual limit. It is not mandatory to contribute every year.

In an insurance-based 3a, however, you often have to pay the same amount every year (forced savings).

You can postpone the withdrawal for up to 5 years after your official AVS retirement age, provided you continue a gainful activity during this period. If you are retired and no longer working at all, you cannot defer the withdrawal.

The capital of the 3rd pillar A can therefore be withdrawn at latest in the following cases:

70 years old for men

69 years old for women

Deferral is not automatic: you must submit the request to the bank or insurance institution that holds your 3rd pillar A.

The 3rd pillar A is a tied pension plan designed to prepare for retirement. It offers attractive tax advantages: contributions can be deducted from taxable income, within the limits set by law. In return, the withdrawal conditions are strict.

The 3rd pillar B, on the other hand, is a flexible pension plan. It is much more adaptable: you can contribute any amount you wish, without limits, and the capital remains available at any time. Many investment vehicles are possible (life annuities, life insurance, savings accounts, securities investments, etc.). The capital withdrawal is tax-exempt if the 3rd pillar B meets the pension criteria.

Why choose Invexa?

Invexa will work with you rigorously, ethically and objectively to optimize your retirement and personal finances, without any conflict of interest.

Independent advice

Invexa is not affiliated with any bank or insurance company. We are on your side, defending your interests to the best of our ability.

Results-oriented approach

We'll help you make concrete, realistic decisions that are consistent with your tax, business and family situation.

Expert advice

Our advisors are specialists in their field and hold qualifications recognized in Switzerland.

All-round Support

Our team is at your disposal to advise and support you at all times, for simple or complex situations.

Choosing the right 3rd pillar A

Choosing the right 3rd Pillar A depends on a number of personal criteria, including your professional situation, your pension goals, your risk tolerance and your need for flexibility.

Banking solutions for greater freedom

The banking 3rd pillar is flexible and therefore recommended for young people. It comes in two main forms:

- The 3a deposit account, with a very low but stable fixed interest rate. There's no risk, but no significant return either.

- The 3a in funds , which invests your savings in portfolios of equities, bonds or sustainable funds. This solution aims for long-term performance, but involves a degree of market risk.

Our banking solutions allow you to make your own contributions, adjust them each year, and close your account without penalty. It's also worth noting that 3a's bank assets are guaranteed in the event of bankruptcy for up to CHF 100,000.

Insurance solutions for greater security

The 3rd pillar in the form of insurance is often more rigid, as it offers a degree of protection in most contracts. Several models are available:

- Themixed insurance model (savings + coverage) combines long-term savings with death and disability coverage. Benefits are guaranteed, but costs are high and returns limited.

- Thefund insurance (100 % investment): savings are invested in the markets, with the possibility of insuring certain risks. It may resemble a 3a bank fund, but with an insurance contract.

- Insurance without risk coverage (flexible 3a): some companies offer purely savings-based contracts, with no disability or death benefits, similar to a bank account.

- Thepure risk insuranceis used solely to cover death or disability, with no savings component.

What risks are covered by a 3a insurance policy?

The 3a in insurance helps you manage pension-related risks effectively, particularly for the self-employed or families:

- The disability pension pays a monthly sum in the event that the insured is no longer able to work due to illness or accident. It is strongly recommended for the self-employed without occupational benefits (LPP).

- In case of death of the insured, the beneficiaries of a life insurance policy receive a capital helping to meet expenses arising from such an event.

- Finally, insurers offer bonus release in the event of disability. This means that the insurer saves for the insured, so that he can nevertheless build up savings for retirement.

- The effective capital is guaranteed at 100% in the event of bankruptcy (compared with CHF 100,000 in a bank).

Discover our 2025 comparison of 3rd pillar A

Account comparisons, fund rankings, actual fees, contribution limits and more. capital calculator.

Get advice

Make a free appointment with one of our pension experts for personalized advice.