In Switzerland, the market offers several types of life insurance, each designed to meet different objectives. Some focus on coverage in the event of death to protect family members or financial partners, while others emphasize savings or investments for long-term needs.

In this article, we'll review the main types of life insurance, their respective advantages and the criteria to consider when choosing the best option for your needs.

Death insurance

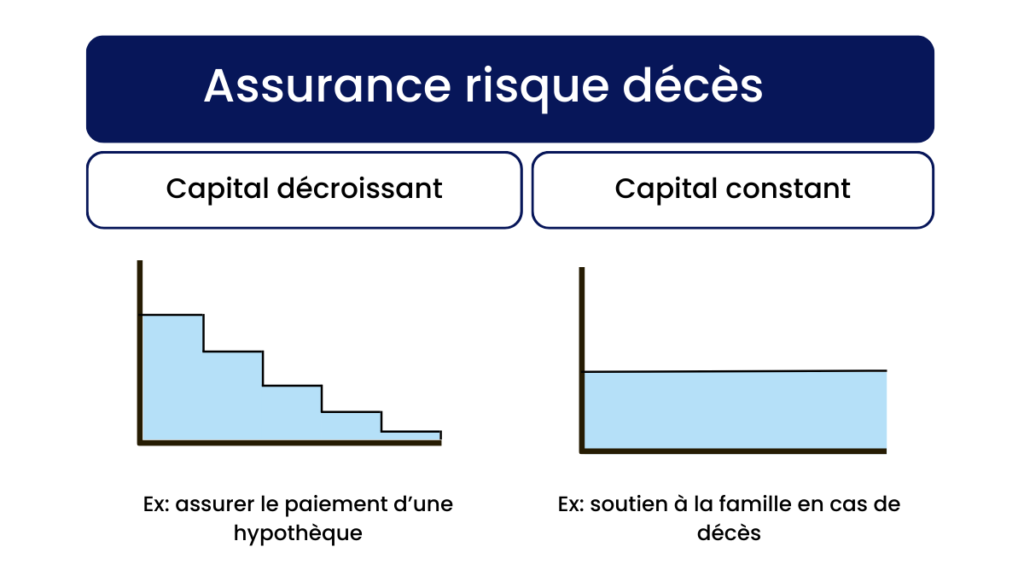

Death insurance is a pure risk insurance that provides for the payment of a lump sum or an annuity to the designated beneficiaries if the insured dies before the end of the period covered by the policy.

The benefits can be used to maintain the family’s standard of living, pay off debts such as a mortgage or loan, cover funeral costs and other unforeseen expenses, or finance children’s education.

Single life insurance

With single-life insurance, only one person is insured. In the event of the policyholder's death, the beneficiary receives the death benefit.

Joint life insurance

In joint life insurance, two people are insured. When one of them dies, the other receives the death benefit.

Constant capital death risk insurance

Increasing capital death insurance is designed to meet financial needs that grow over time. The amount of insured capital increases regularly, according to a percentage or a fixed amount defined at the time the policy is taken out.

This type of policy is particularly suited to situations where financial responsibilities—such as children’s education, maintaining the household’s standard of living, or accounting for inflation—increase over the years. However, due to the insurer’s progressively increasing risk, insurance premiums are generally higher.

Constant capital death risk insurance

Decreasing capital death insurance, on the other hand, is specifically designed to cover temporary financial needs that diminish over time. The sum insured gradually decreases according to a defined trajectory, often in parallel with a debt, such as a mortgage or other credit.

It offers a targeted and cost-effective solution, as premiums are generally lower than those of increasing capital policies, since the insurer’s risk decreases over time.

Loss of earnings insurance

Loss of earnings insurance is a pure risk insurance that provides financial protection to a person who loses their ability to work and earn a living due to illness or an accident. It also covers the needs of individuals who depend on the insured.

This insurance pays benefits proportional to the degree of disability, determined according to the same criteria as social insurance. For working individuals, the calculation is based on the difference between income before and after disability. For non-working individuals, the loss of ability to perform their usual tasks is assessed.

Life insurance with restitution

Survival insurance with capital repayment is a simple capital insurance primarily aimed at building up a lump sum. The premiums paid by the insured finance the agreed benefit, increased by a technical interest rate.

- In event of life: The policyholder receives the capital sum due at the end of the contract, plus any surplus.

- In the event of death: Beneficiaries receive at least the savings premiums paid, supplemented by surplus and/or interest in accordance with the general terms and conditions.

This type of insurance is suitable for people with a specific financial goal, as it imposes a discipline of regular payments, which favors the realization of their project compared to more flexible bank savings.

Combined life insurance

Endowment life insurance combines savings with protection in the event of death.

- If the policyholder is still alive at the end of the contract, he or she receives the capital sum and any surplus.

- In the event of death before maturity, the beneficiaries receive the sum insured and any surplus shares, in accordance with the terms of the contract.

This type of insurance is used both to protect loved ones in the event of death and to prepare a savings for retirement. It is particularly popular with families for its role in the 3rd pillar, offering security and long-term provision.

Fund-linked life insurance

Fund-linked life insurance combines savings and death protection, just like a traditional mixed policy. However, it differs in the way the investments are managed.

- In the event of death before the end of the contract: The beneficiary receives at least the agreed death benefit. If the value of the fund units is higher, the beneficiary receives the higher value.

- If alive at maturity: The policyholder receives the value of his or her fund units at the market price, with no guaranteed minimum amount, but with the possibility of an attractive capital gain if the financial markets perform well.

The key feature is that the savings premiums are invested in funds chosen by the insured, who decides the level of risk and can adjust their investments during the policy term. Unlike traditional insurance, where the insurer alone bears the investment risk and guarantees a minimum amount, the policyholder in a fund-linked insurance takes an active role in decision-making and assumes the risks.

This type of policy offers a high return potential, but also exposes the policyholder to market fluctuations, with the risk of losses in case of poor performance.

Life annuities

Life annuities provide the policyholder with a regular income for the entirety of their life, regardless of their longevity. The policyholder purchases this annuity by paying a lump sum, often as a single premium, or by gradually building a capital through annual premiums before the payments begin. Life annuities can be immediate, starting shortly after purchase, or deferred, beginning at a later date, allowing time to accumulate the necessary capital.

These annuities are generally chosen by individuals approaching retirement or who have accumulated sufficient capital. They can be taken out on a single life or joint lives. An option with capital repayment allows the remaining unused capital to be paid to the beneficiaries, while a no-repayment option maximizes the annuity payments, but no capital is returned.

Temporary annuities

Temporary annuities, unlike life annuities, cover only a fixed period chosen at the time of purchase. They are useful for meeting specific financial needs, such as funding an early retirement until AVS or 2nd pillar benefits begin.

They are less expensive than life annuities because they do not extend over an indefinite period. Temporary annuities are suitable for individuals with clear financial goals over a limited period, such as funding specific projects or covering a temporary financial gap.

Invexa guides you in choosing a life insurance

Protect your loved ones, optimize your savings, and benefit from tax advantages with our personalized life insurance solutions. Our experts guide you at every step to find the policy that perfectly matches your needs and goals.

Frequently asked questions

The choice of life insurance primarily depends on your personal and financial goals:

- Protecting loved ones: Opt for death or risk insurance (single or joint life) to guarantee payment of a lump sum or annuity in the event of death.

- Building savings or preparing for retirement: Life with restitution" or "joint life" contracts combine protection and savings.

- Investment: Fund-linked life insurance gives you a choice of investment vehicles, with attractive potential returns but exposure to market fluctuations.

In principle, there is no legal maximum amount for taking out life insurance in Switzerland. The insured capital is freely determined based on your needs, the desired level of protection, and the policy terms. However, tax considerations may come into play for very large amounts.

If the life insurance is taken out within the framework of the 3rd pillar (3a), the maximum contribution is CHF 7,258 per year.

There are several advantages to opening a life insurance policy:

- Providing financial security for your loved ones in the event of death.

- Building up savings over the long term, through regular payments and/or investment opportunities.

- Benefit from an advantageous tax framework (particularly with regard to transfers, taxation of gains and tax deductions).

- Preparing for retirement by supplementing your future income.

Life insurance is mainly used to :

- Protecting beneficiaries in the event of death (death insurance).

- Build and grow your savings to finance projects or prepare for retirement (life insurance, endowment or unit-linked).

- Offering regular income solutions via life or temporary annuities, often adapted to retirement needs.

There is no legal limit on the number of life insurance policies you can take out. However, it is important that each policy serves a specific purpose in order to optimize your wealth management and make the most of the tax benefits.

A term life insurance policy is established for a specific period of time:

- Regular monitoring and review : Check that your contract still meets your needs as it nears expiry.

- Conversion or renewal : Depending on the conditions, you may consider converting it to a lifetime contract, or taking out a new contract to continue benefiting from coverage or savings.

- Use of funds : At the end of the contract, if you are still alive, you receive the accumulated capital, which can be used to finance a project or strengthen your retirement savings.

Yes, life insurance policies must be declared to the tax authorities. Taxation varies according to :

- Premiums paid,

- Surrender value,

- Annuities received, etc. Gains often benefit from advantageous tax treatment, but it is advisable to consult a tax advisor to ensure that all reporting obligations are met.

The "cash surrender value" is the amount you can recover if you decide to terminate your policy early. This amount generally includes :

- Premiums paid,

- Earned interest or bonuses,

- Possibly less management fees or exit penalties.

The calculation of the surrender value depends on the specific terms of the contract:

- It includes the cumulative amount of premiums paid,

- Technical interest or capital gains,

- Any closing costs or penalties for early redemption.

Funds can be released in several situations:

- Contract expiry date : You receive the lump-sum or annuity payments.

- Partial or total repurchase : You can request early surrender of the contract, which involves recovering the surrender value, possibly subject to fees or penalties.

- Special cases : Certain exceptional events (disability, proven financial difficulties, etc.) provide for specific unlocking procedures.