What is the 2nd pillar?

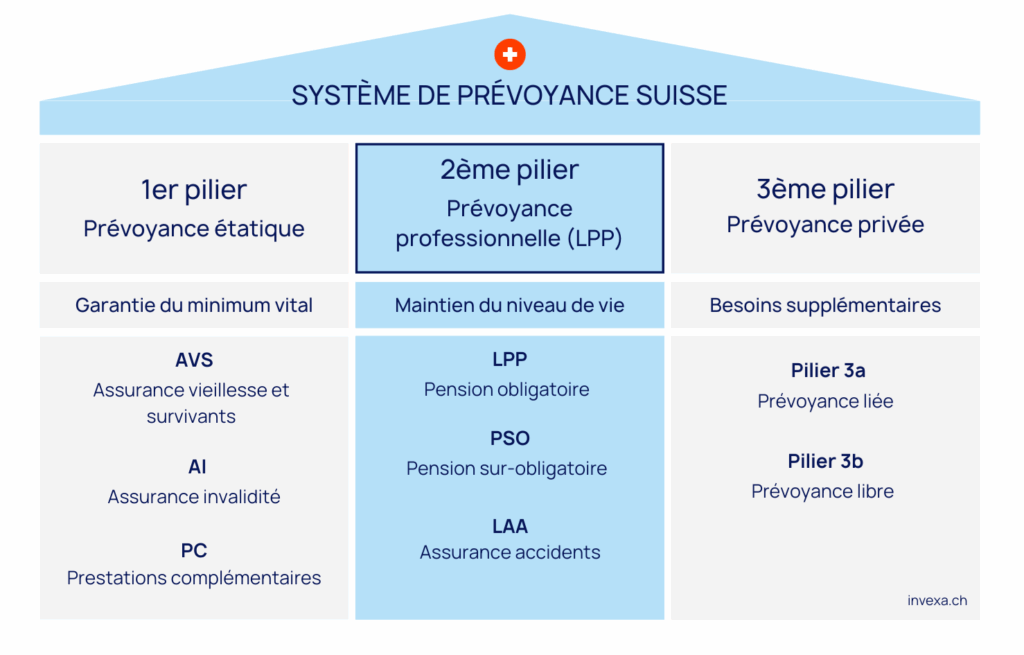

The 2nd pillar, also known as occupational pension or LPP (Law on Occupational Pensions), is a mandatory insurance system in Switzerland for employees whose income exceeds a certain threshold. It is part of the three-pillar system. Its purpose is to supplement the benefits of the AVS, ensuring a sufficient income in retirement, or in case of disability or death. Funded jointly by the employer and the employee, it is based on the principle of individual capital accumulation: each insured person saves for their own retirement.

Withdrawal from the 2nd pillar on departure

Withdrawal conditions

When an insured person permanently leaves Switzerland, they may request a cash payout of their vested benefits from the 2nd pillar, provided they can prove it (e.g., official confirmation of departure from the residents’ registry, deregistration from the AVS system, etc.). This early withdrawal is subject to a reduced tax, separate from income, and requires the written consent of the spouse or registered partner.

Since the entry into force of the agreement on the free movement of persons between Switzerland and the EU, the cash withdrawal of the mandatory LPP portion is no longer possible if the person settles in a member country of the EU or EFTA and is subject there to an equivalent social security system (old-age, disability, and survivors insurance).

In this case :

- Only the supplementary portion can be withdrawn in cash.

- The mandatory portion must remain in a Swiss vested benefits account or policy until legal retirement age, or until the event of disability or death.

Supplementary and compulsory portions of BVG/LPP

- Mandatory BVG portion: is the legal minimum under the Swiss Federal Law on Occupational Retirement, Survivors' and Disability Pension Plans (BVG). It corresponds to the compulsory pension covering coordinated salaries between CHF 26,460 and CHF 90,720 in 2025.

- Extra-mandatory portion: corresponds to everything above the legal minimum. Some pension funds offer more generous coverage than that required by law.

What happens when I return to Switzerland?

If the entire 2nd pillar has been withdrawn

When a person returns to Switzerland after having withdrawn in cash the entire amount of their 2nd pillar assets (including the mandatory LPP portion), they no longer have any coverage under the occupational pension system. They start again from scratch: no LPP pension rights can be granted at retirement for the period spent abroad, unless a buy-in is made.

This situation is common among people who moved outside Europe or became self-employed abroad. The withdrawn assets were subject to tax, but more importantly, they cannot simply be reintegrated into a Swiss pension fund upon return. A voluntary buy-in will be necessary to fill this gap.

Reconstitution of BVG rights

The Swiss system allows policyholders to buy back missing pension years, including those "lost" as a result of a withdrawal when moving abroad. This is considered a voluntary purchase, and can be made:

- as soon as the insured returns to a pension fund in Switzerland

- within the limits set by the fund, depending on age, insured salary and length of membership.

The purchase is fully tax-deductible. The aim is to replenish retirement assets and future benefits (retirement, death, disability).

A waiting period of 3 years applies before buyback benefits can be withdrawn as a lump-sum without tax penalty.

Affiliation when taking up new employment

- the activity is salaried (not self-employed),

- and the annual salary exceeds the BVG/LPP threshold of CHF 22,680 in 2025.

As soon as the employee starts work, the employer is obliged to join the employee's pension fund. The new employee thus starts contributing to the 2nd pillar, to finance future old-age, disability and survivors' benefits.

In the case of part-time work or low income, the LPP threshold may not be reached, which excludes mandatory affiliation. In this situation, it is recommended to opt for an individual solution (3rd pillar) or a voluntary affiliation.

What should you do if you don't find a job immediately?

Vested benefits account or policy

If you return to Switzerland without immediately resuming gainful employment, and provided you have not withdrawn the entirety of your 2nd pillar (or if you have rebuilt an asset through a buy-in), you must place your pension assets in a vested benefits institution.

Two forms are possible:

- Vested benefits account with a bank (often paying a fixed rate of interest).

- Vested benefits policy with an insurance company (often with a lump-sum or annuity component).

- find a job covered by the 2nd pillar (and transfer the amount to the new fund),

- reach retirement age,

- or encounter a contingency (disability, death).

Any change of address must be reported to the vested benefits institution. Otherwise, after two years, the funds may be transferred to the BVG/LPP Substitute Occupational Benefit Institution Foundation, which acts as the default solution.

Optional insurance with the Fondation institution supplétive

- be domiciled in Switzerland,

- and be affiliated to the AVS.

Special cases

Return to self-employment

If you return to Switzerland to become self-employed, you will not be automatically affiliated to a pension fund, as occupational pension provision (2nd pillar) is optional for the self-employed.

You have two options:

- You can voluntarily join an occupational benefits scheme (the same as your own, or the BVG/LPP Supplementary Fund).

- You can also opt for the tax-advantaged 3rd pillar A, with higher contribution limits if you are not affiliated to a 2nd pillar (up to 20 % of net income, max. CHF 36,288 in 2025).

The 3rd pillar A is a key tool for compensating for the lack of BVG/LPP coverage, especially in the event of disability or in preparation for retirement.

Unemployment on arrival

If you are unemployed at the time of your return, you are insured for the risks of death and disability with the LPP supplementary institution, provided that your daily allowance exceeds 87.10 CHF per day (2025 threshold).

You do not make any pension contributions during this period and the coverage ends when unemployment benefits stop or if you no longer reach the threshold.

You can, on a voluntary basis, contribute to a pension fund (former employer or substitute institution) to continue building retirement capital. This option must be activated immediately upon leaving the last pension fund.

Conclusion

Returning to Switzerland after withdrawing from the 2nd pillar abroad raises complex legal and financial issues. In the absence of automatic coordination, insured persons often have to start from scratch, whether in terms of old-age, disability or survivors' coverage.

There are, however, concrete ways of getting back into the system: buying into the pension fund, voluntary affiliation, building up a reinforced 3rd pillar, or depositing assets in a vested benefits institution. These options help limit pension gaps and restore a solid insurance situation. For each scenario (return to work, self-employment or no activity), it's crucial to act quickly and in an informed manner. A personalized analysis, accompanied by specialized advice, remains the best strategy for safeguarding your rights and securing your future in Switzerland.