What is early retirement?

In Switzerland, it is possible to retire before the ordinary retirement age (65 for men, 64 for women until the full entry into force of the AVS21 reform). However, leaving working life early also means giving up several years' income, with significant consequences for OASI pensions, BVG/LPP benefits and personal finances.

Successful early retirement cannot be improvised. It requires solid preparation in terms of occupational and private pension provision, a detailed analysis of future needs, and appropriate tax strategies.

Harmonization of retirement ages

The AVS 21 reform sets the reference retirement age at 65 for everyone. For women in the transitional generation (born between 1961 and 1969) who do not opt for early retirement, a lifetime pension supplement is planned.

What is early retirement in Switzerland?

Early retirement refers to the option of stopping professional activity before the legally established reference age for the OASI and occupational pension schemes. In Switzerland, the three pillars of the pension system each have their own conditions:

- OASI (1st pillar): early retirement is possible from the age of 63 (men) or 62 (women), with a reduction in pension ranging from 6.8 % to 13.6 % per year of early retirement.

- BVG (2nd pillar): Most pension fund regulations allow early withdrawal from the age of 58, with a reduced pension depending on age and the fund's technical parameters.

- Tied pension provision (pillar 3a): Linked individual pension assets can be withdrawn as early as 5 years before the normal AHV retirement age, currently 60.

Calculate my retirement benefits

- You can request an estimate of your AHV pension.

- Estimate the amount of your OASI pension online

Early retirement: is it a good idea?

The prospect of early retirement is a dream come true: more free time, a better quality of life, the chance to travel or engage in personal projects.

From a financial perspective, retiring earlier means living longer without income from employment. By advancing your retirement, you will receive a permanently reduced OASI pension, and your occupational pension benefits (2nd pillar) will also be lower. You will also need to compensate for several years without a salary while covering living costs, which may be higher than expected (health, leisure, unforeseen expenses).

Despite these challenges, early retirement can still be an excellent idea if it is well thought out and carefully planned. By anticipating the impacts, building sufficient reserves, and optimizing your pension and tax situation, it is entirely possible to fully enjoy this new stage of life.

How much will my early retirement benefit be?

1st pillar (AHV)

You can calculate your own OASI retirement pension based on your average annual income and the scale 44, reduced by the corresponding early retirement percentage:

- For a departure 1 year before legal retirement age, the pension is reduced by approximately 6.8 %.

- For a departure 2 years before, the reduction can be as much as 13.6 %.

The compensation fund allows the AHV pension to be anticipated between 1 month and 2 years at the most. This corresponds to an earliest departure of 62 years old for women born between 1961 and 1969, and 63 years old for the remaining policyholders.

- Anticipation period

- Reduction

- 6 months

- 1 year

- 1 year and 6 months

- 2 years

- - 3.4%

- - 6.8%

- - 10.2 %

- - 13.6 %

If you're not sure of your calculation, ask the AVS for a simulation. Conversely, a deferment of annuity is possible up to age 70. Once your AVS/AHV pension has been defined, you will have to reduce it in line with the anticipated early retirement date (maximum 2 years before the reference retirement age):

Harmonization of retirement ages

The AVS 21 reform sets the reference retirement age at 65 for everyone. For women in the transitional generation (born between 1961 and 1969) who do not opt for early retirement, a lifetime pension supplement is planned.

Example of early receipt of AHV pension

Let's imagine that Mr. Y decides to take early retirement 2 years before the reference age, and has an average annual income of CHF 85'000.

- He would normally receive a pension of CHF 2,460 / month or CHF 29,520 / year.

- As a result of the anticipation, he would only receive CHF 25,505 / year, or CHF 2,125.44 / month, for the rest of his life.

- 29,520 x (100% - 13.6%) = 25,505.28

OASI 2025 figures

- The maximum AHV pension is CHF 2,520 / month

- The minimum AHV pension is CHF 1,260 / months

- The maximum determining average annual income is CHF 90,720

Occupational benefits (2nd pillar)

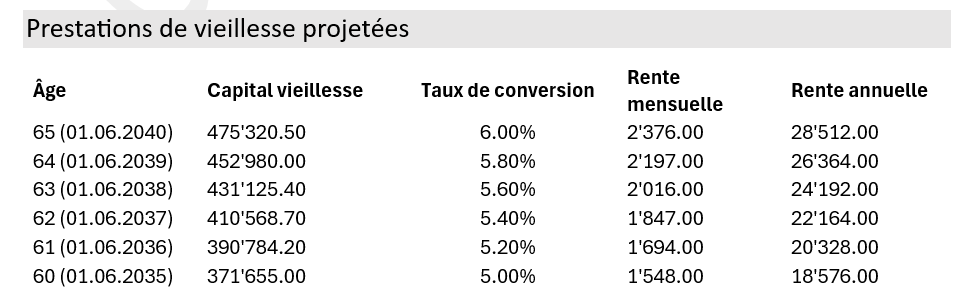

In the 2nd pillar (LPP), early retirement is generally possible from age 58 if your pension fund’s regulations allow it. If you choose to receive a pension, its amount will depend on the accumulated capital, the applied conversion rate, and your retirement age. The younger the age, the lower the conversion rate. You can find your estimated pension amount on your pension statement.

You can also choose a full or partial lump-sum payment. The LPP allows a capital withdrawal of at least one-quarter of your assets (for the mandatory portion). In the case of a lump-sum withdrawal, the amount will be subject to capital benefits tax (at a reduced rate). The choice between a pension and a lump sum should be carefully assessed before making any decision, as it is irreversible.

If you have LPP assets in one or more vested benefits accounts or policies, they can be paid out no earlier than 5 years before and no later than 5 years after retirement. In most cases, the amount is paid as a lump sum, though this depends on the product. The full capital must be withdrawn. To avoid excessive taxation, it is recommended to open two separate accounts with different vested benefits foundations (this option can only be chosen when opening the account).

If you have doubts about the existence of LPP assets in vested benefits accounts or with the Substitute LPP Foundation, it is recommended to launch a free search with the Second Pillar Central Office to identify and repatriate your vested benefits assets.

Individual pension provision (3rd pillar)

If you’ve saved in a tied 3rd pillar (3a), you can withdraw your funds up to 5 years before the legal retirement age — that is, from age 60. However, be careful: just like a withdrawal from your pension fund, a 3rd pillar withdrawal is subject to capital tax at a preferential rate, but it also reduces your future reserves. In any case, comparing 3rd pillar options will help you choose the right product based on your goals. To avoid a high tax rate on lump-sum benefits, open several 3a accounts and stagger your withdrawals over several years.

A 3rd pillar B is also an option, noting that certain tax deductions apply to contributions in some cantons (Fribourg and Geneva), and that the capital withdrawal is tax-exempt (as long as the contract meets the pension criteria). A life annuity is also possible.

Linked pension plan figures

In 2025, it will be possible to pay out the following amounts in tied personal pension plans:

- Employees affiliated to a pension fund: Up to CHF 7,258 / year

- Self-employed or employees not affiliated to a pension fund: 20% of income, maximum CHF 36,288

How can I fill the gaps?

When it comes to early retirement, it's rare that benefits from the AHV and occupational pension schemes are sufficient to fully maintain your standard of living. The gap between financial needs and expected pensions can be significant, especially as life expectancy lengthens. Fortunately, there are a number of strategies for anticipating and bridging this gap, provided you start early enough.

1. Pension fund purchases

One option is to make buy-ins to your pension fund. By voluntarily increasing your LPP capital, you directly boost the future pension you will receive. Buy-ins are especially attractive because they are tax-deductible: every amount contributed reduces your taxable income and allows you to achieve significant tax savings.

Of course, the amounts eligible for buy-ins are capped and depend on the gaps you've accumulated during your professional career. Ideally, these buy-ins should be planned over several years to optimize their tax efficiency.

2. Contribute to a pillar 3a

The second is to fully exploit the potential of the pillar 3a. This private pension plan is particularly well-suited to early retirement. Each year, you can contribute a set amount: in 2025, the ceiling is CHF 7,258 for people affiliated to the 2nd pillar. The amounts paid in are directly deducted from your taxable income, making it a doubly effective way of saving.

The earlier you start saving in a 3rd pillar A, the greater the effect of capitalization is powerful. As you approach early retirement, these funds can be withdrawn as a lump sum, providing valuable financial leeway to offset the reduction in your pension.

3. Taking out a pillar 3b

The pillar 3b is more flexible than 3a: it is not limited in terms of amounts paid in, and funds remain available without age restrictions. However, it does not automatically offer tax advantages at federal level. In fact, taxation depends on how the product is structured and the canton of residence.

When a 3b contract is designed to qualify as pension provision, the capital paid out at maturity is exempt from income tax. This makes it a very attractive instrument for those planning early retirement, as it allows you to build a tax-free capital sum for retirement.

Pension criteria

The purpose of Pillar 3b retirement provision is achieved when:

- Payment is made after age 60

- The contract is taken out before age 66

- Contract duration is 5 years (10 if linked to funds)

If the 3b takes the form of a life annuity funded by a single premium, taxation is different. Only a fraction of the capital converted into an annuity is subject to tax at a reduced rate. In 2025, this fraction is 4% of the annual annuity amount, compared to 40% of the theoretical income under the old rules applicable until 2024. This change makes single-premium life annuities significantly more attractive tax-wise for future retirees.

Finally, it’s important to highlight that in certain Swiss cantons—particularly Geneva and Fribourg—contributions to a 3rd pillar B are tax-deductible up to a specified limit.

4. Investment in securities

For those wishing to build up an additional financial reserve for early retirement, investing in securities represents an attractive solution.

From a tax perspective, capital gains realized on securities held in a private account are exempt from income tax in Switzerland. This means that if you sell your stocks or funds at a profit, you won’t pay tax on that gain as long as you are considered a private investor and not a professional. However, your portfolio is subject to wealth tax, calculated on the net value of the securities held at the end of the year.

Thus, investing in securities fits harmoniously into an overall financial plan alongside traditional pension solutions. However, it’s important to start early, as investing in stocks is beneficial primarily over a long-term horizon.

5. Pillar 3a redemption (from 2026)

From 2026 (for fiscal year 2025), it will be possible to buy back to ten years of unpaid Pillar 3a contributions, amounting to CHF 7,258 per year in addition to the regular membership fee.

To be eligible for this purchase, you must have received income subject to AHV during the year in question, and have already paid the maximum contribution at the time of purchase. The amounts bought back are fully deductible from your taxable income.

Frequently asked questions

If you stop all gainful activity before the normal retirement age, you are still required to contribute to the AVS as a person without gainful employment. The minimum amount is about CHF 530 per year (in 2025), but it can be much higher depending on your assets and replacement income.

Contributions to AHV, IV and EO are calculated on the basis of assets and annual pension income multiplied by 20.

An annuity provides a stable income for life, regardless of your life expectancy or market trends. It is particularly suitable if :

- You're looking for absolute financial security,

- You have a low tolerance for risk,

- You have no experience in asset management,

- You have no other regular retirement income.

Its main drawback: the capital remains in the fund, and no amount is passed on to heirs.

The capital is paid out in a single lump sum, usually at a reduced tax rate (which varies from canton to canton). This choice gives you :

- Total management freedom,

- The opportunity to invest, pay off a mortgage, help your children or optimize your estate,

- A lever for tax optimization, notably by splitting withdrawals.

But be careful: you're responsible for the long-term future of your capital over 25 to 30 years, depending on your life expectancy. This requires rigorous management. In practice, it's very difficult to match the performance offered by the pension fund (conversion rate of 6.8%).

In most cases, a annuity + capital combination offers a good balance: securing a base income with an annuity, while retaining part of the capital for specific needs or projects.

No, once you leave your job, you also stop contributing to the 2nd pillar. Your capital is transferred to a vested benefits account or policy. It no longer generates new retirement benefits, but remains invested according to the conditions of the chosen institution. Some vested benefits foundations allow you to optimize this capital until you reach ordinary retirement age.

If you are 58 years or older and have been laid off, you can remain affiliated with your current pension fund. You will continue to benefit from death and disability coverage while continuing to make contributions.

Even with early retirement, health insurance remains mandatory in Switzerland. If you leave your employer, you lose LAA coverage (accident insurance) and will need to take out accident insurance on your own. Be sure to carefully compare coverage levels as well as supplementary insurances.

Yes, from the age of 58. If you permanently stop your gainful activity and do not take up salaried employment again, you can request the payment of your vested benefits before retirement age. This withdrawal is subject to a separate, reduced taxation rate, calculated according to your canton of residence.

Once the funds have been withdrawn, you take sole responsibility for managing your capital to cover your needs until you reach AHV retirement age.

The main risk is depleting your capital prematurely, especially if your expenses are underestimated or expected returns don’t materialize. Poor forecasting of fixed costs (health insurance, taxes, housing) or future needs (healthcare, unexpected family events) can undermine your financial independence. Careful planning, made several years in advance, is essential to minimize these risks.

Pillar 3a is the most tax-efficient solution:

Tax-deductible up to CHF 7,258 in 2025 (for employees affiliated to a pension fund),

Available to the self-employed (up to 20% of annual income),

Possibility of investing in funds (equities, bonds, ESG strategies),

Withdrawal permitted up to 5 years before AHV retirement age

Other solutions are possible, notably in 3b (unrestricted pension provision), where tax deductions are available in some cantons and withdrawals are tax-free. Subsequently, you can add to your assets through individual investments in securities, cash, real estate, etc.

To find out whether early retirement is possible, you will need to draw up a balance sheet to analyze projected annuities, assets and liabilities, and identify all sources of income. A budget should also be drawn up to define fixed and variable expenses, as well as the desired standard of living.

Have a pension plan It's a modest investment to avoid costly mistakes.

Redemptions must be carefully planned. Each repurchase is deductible of taxable income, resulting in substantial tax savings, especially for higher incomes.

Buybacks fill the gap contribution gaps (e.g. career breaks, part-time work) and often allow :

A better retirement pension,

Greater flexibility over the amount of capital that can be withdrawn.

Be careful, however, as you won't be able to make a tax-free capital withdrawal after a buyback. for 3 years.

As soon as possible. At the age of 25, even if retirement seems a long way off, the first few years of working life are a real challenge. crucial to lay the foundations for your pension provision, and early years are ideal for benefiting from the cumulative effect of compound interest (notably via pension funds).

From 40 years oldwe're starting to get better visibility on your professional, family and asset situation. This is the ideal time to carry out an initial, comprehensive pension assessment, identify gaps, plan pension fund purchases, project a retirement age and structure your investments.

From 50 yearsplanning becomes more concrete. You can consider a precise estimate of AHV and BVG pensions, a tax analysis for capital withdrawals (BVG, 3a), asset decumulation strategies, as well as simulating an early or postponed retirement.

Starting early allows you to smooth out your efforts, reduce the financial pressure as you approach retirement, and keep all your options open (early retirement, gradual reduction, flexible retirement, optimized transmission).