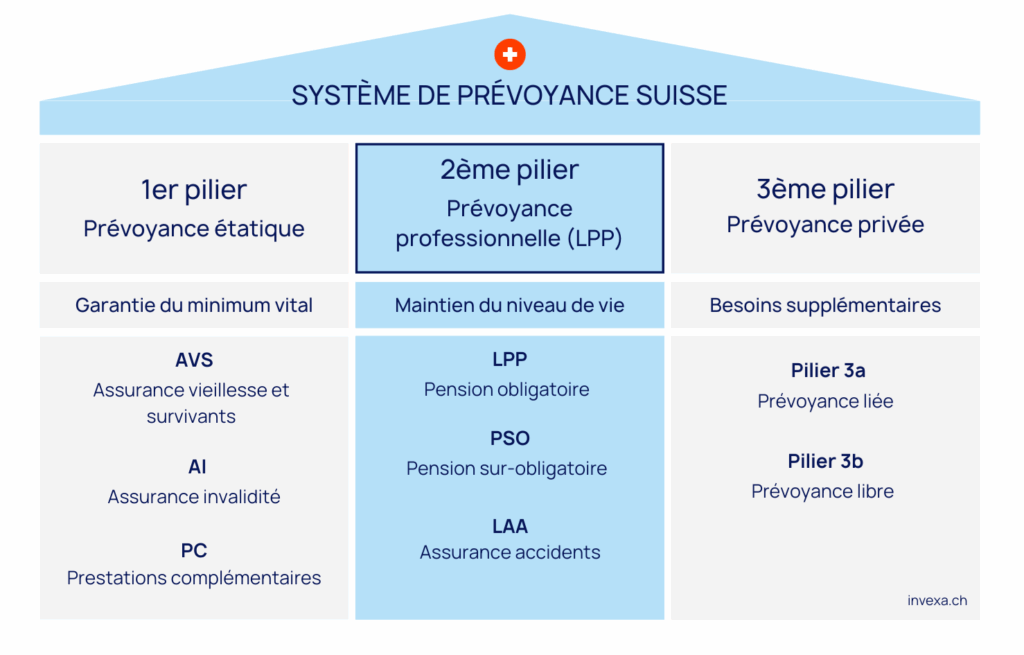

What is the 2nd pillar?

The 2nd pillar, also known as occupational pension or LPP (Law on Occupational Pensions), is a mandatory insurance system in Switzerland for employees whose income exceeds a certain threshold. It is part of the three-pillar system. Its purpose is to supplement the benefits of the AVS, ensuring a sufficient income in retirement, or in case of disability or death. Funded jointly by the employer and the employee, it is based on the principle of individual capital accumulation: each insured person saves for their own retirement.

Who contributes to the 2nd pillar?

Not all employees in Switzerland are automatically enrolled in the 2nd pillar. Mandatory affiliation depends on several conditions:

- Be employed and subject to AHV contributions

- Annual income over CHF 22,680 (threshold 2026)

- Must be at least 17 years old for death and disability insurance

- From the age of 24, start contributing to retirement too

Even if you do not meet the standard conditions, it is possible to join the 2nd pillar on a voluntary basis. For example, an employer may choose to cover an employee whose income is below CHF 22,680. Likewise, self-employed individuals or those on short-term contracts can opt to contribute, although it is not mandatory. From age 24, contributions also start to build up savings for retirement.

How do 2nd pillar contributions work?

Contributions to the 2nd pillar (LPP) are calculated on the annual salary says coordinated (i.e. after deduction of a fixed amount known as the coordination deduction, CHF 26,460 in 2026). Contributions are shared between employer and employee, with the employer paying at least half (except for the self-employed, who must pay the full amount). Contributions comprise several components, including retirement savings, risks and expenses.

1. Old-age contribution

Retirement credits represent the savings portion of the occupational pension plan, and the interest rate on these credits is set by the employer. increases with age to gradually build up retirement savings. Here is an overview of retirement credits in 2026, depending on the age of the insured in the compulsory portion:

- Age of insured

- Percentage %

- 25 - 34

7%

- 35 - 44

10%

- 45 - 54

15%

- 55 - 65

18%

2. Risk premiums

Risk premiums finance the coverage against the risks of disability and death. This means that if an insured person becomes disabled or dies before reaching retirement age, the pension fund will pay a disability pension or a survivor’s pension (to the spouse, registered partner, or children). These premiums vary depending on age and gender.

3. Contribution to the LPP Guarantee Fund

Each pension institution must pay a contribution to the LPP Guarantee Fund, which secures the statutory minimum benefits in the event of a pension fund’s insolvency. This mechanism protects insured persons from losing their retirement savings if their fund goes bankrupt. The fund also intervenes in cases of restructuring or exceptional situations, such as fund mergers.

What are 2nd pillar benefits?

The 2nd pillar also protects insured persons and their families against the risks of disability or death, as well as the inevitable risk of old age. Benefits are therefore paid out based on different life events, in the form of pensions. Here is a brief overview of the main benefits provided under the LPP:

- Risk

- Type of pension

- Details

- Retirement

- Retirement pension

Paid from the legal retirement age, the pension is calculated based on the accumulated retirement assets, using a conversion rate of 6.8%.

- Retirement capital

It is possible to withdraw 1/4 of the mandatory LPP assets as a lump sum. Some pension funds allow the full capital to be withdrawn.

- Pensioner's child's pension

20% of the retirement pension is paid per child, up to the age of 18 or 25 if the child is in education or training.

- Disability before retirement

- Disability pension

If the insured becomes disabled (according to the DI), they receive a pension based on the accumulated assets plus future retirement credits, without interest.

- Disabled person's child's pension

20% of the disability pension is paid per child, up to age 18 or 25 if in education or training.

- Death before retirement

- Spouse's pension

The surviving spouse receives 60% of the (retirement or disability) pension if the marriage lasted at least 5 years and the spouse is at least 45 years old, or if there are dependent children. Otherwise, a one-time payment equal to 3 annual pensions may be granted.

- Orphan's pension

20% of the (retirement or disability) pension is paid to each child until age 18, or 25 if in education or training.

What is a vested benefits account?

A vested benefits account is used to preserve your 2nd pillar assets when you leave a pension fund without immediately joining another one. It is a mandatory transitional solution to maintain your occupational pension rights.

This situation arises in particular if you:

- Leave your job without taking a new one immediately

- Become self-employed

- Reduce your work rate below the LPP threshold

- Move abroad

- Are unemployed for a period

The accumulated assets remain blocked, protected, and continue to earn interest. You can transfer them either to a vested benefits bank account or to a vested benefits insurance policy. This way, you maintain your link to the pension system while waiting for a new affiliation or another event (retirement, buyback, or early withdrawal under certain conditions).

How can I improve my 2nd pillar benefits?

Performing buying into your pension fund is the most effective way toimprove your services from the 2nd pillar. These payments volunteers allow you to make up any contribution gaps, for example after a change of job, unpaid leave or a reduction in your working hours.

The amount purchased directly increases your retirement assets, which means a higher pension when you retire. In addition to this advantage, purchases are tax-deductible, which means you can reduce your taxable income. However, certain conditions must be met, including a three-year waiting period before a lump-sum withdrawal can be made if you have made a purchase.

How do I withdraw my 2nd pillar?

The capital in your 2nd pillar can be withdrawn as follows certain conditions:

1. Retirement

You can request payment of all or part of your retirement capital in the form of a lump sum, in accordance with the rules of your pension fund. A formal request must be made several months in advance.

2. Permanent departure from Switzerland

3. Access to property

You can use your credit balance to finance the purchase of your principal residence, either by early withdrawal or as a guarantee (EPL - encouragement to home ownership).

4. Start of self-employed activity

5. Small amount

If your vested benefit credit is less than one year's contributions, you can apply to withdraw it.

Taxation of withdrawals

Each withdrawal is subject to tax at a rate of reduced rateseparate from ordinary income, to 1/5 tax rate. It is therefore advisable to plan this operation carefully.

Dividing the 2nd pillar in the event of divorce

In the event of divorce in Switzerland, the 2nd pillar assets accumulated during the marriage are in principle shared equally between the spouses, regardless of the division of assets or matrimonial property regime. This division concerns only the termination benefits (vested benefits) accrued during the couple's life together.

The amount is calculated as of the date on which the divorce proceedings are initiated. Each spouse is entitled to half pension assets saved by the other during the marriage. If one of the spouses has made little or no contributions (e.g., in the event of a career break to raise children), he or she can recover part of the other's assets in the form of a compensatory allowance.

The amount transferred is paid either into the beneficiary's pension fund or into a vested benefits accountif he is not immediately affiliated to a fund. There are exceptions (e.g. in the case of a different agreement validated by a judge, or where the pension is already in payment), but the principle of sharing remains the rule under Swiss law.

2nd pillar pensions in the event of death

If you are married or registered partnership, your surviving spouse or partner is entitled to a pension in the event of your death. This entitlement exists if the surviving spouse or partner is at least 45 years old, the marriage or partnership lasted at least 5 years, or if he or she is supporting at least one child.

If none of these conditions is met, a one-off allowance corresponding to three annual annuities is paid. The children orphans are also entitled to a pension up to the age of 18, or up to the age of 25 if they are in training.

Types of systems in the BVG

In Swiss pension funds, there are two main models for calculating benefits. defined contribution plan and the benefit plan. Some institutions also opt for a mixed formula, called duoprimat. Here's what you need to know.

Defined contribution plan

In this system, it is the amount of the contributions paid (by the employer and the employee) which determines the future benefits. Accumulated savings (known as retirement savings) earn interest at a minimum rate (set each year) and, on retirement, are converted into a pension at a conversion rate (currently 6.8 % for the mandatory BVG portion).

Primacy of benefits

In this model, the annuity amount is defined in advance by percentage of final salary insured. So it's not the accumulated savings that count, but the level of income before retirement. This model is becoming very rare in Switzerland, with only 2 % pension funds still using it.

Duoprimat

Today, many funds use a hybrid model, the duoprimat, which combines the two systems. Old-age benefits (retirement pension) are calculated on a defined-contribution basis, while risk benefits (death, disability) are calculated on a defined-benefit basis.

Frequently asked questions

The 2nd pillar supplements the AHV and helps maintain approximately 60% income prior to retirement. It is financed by contributions shared between employee and employer.

To the retirementor earlier in some cases: definitive departure from Switzerland, purchase of a home, start of self-employment or amount too low.

Every year, your pension fund sends you an annual pension certificate indicating your pension assets and expected benefits.

All 17 years old or more whose annual income exceeds CHF 22,680 (in 2025). The self-employed can join voluntarily.

You can unlock your 2nd pillar in Switzerland when you retire or earlier to buy a home, become self-employed or leave the country permanently.