Mortgage: make your real estate project a reality

We make your real estate project a reality

01

Contact us

We discuss your project and gather information about the borrower(s), such as income, expenses, source of equity, etc.

02

Document collection

We assemble the supporting documents required for the mortgage application and forward them to the banks.

03

Compare conditions

Based on the information provided, you can compare the loan conditions and interest rates of various banks.

04

Count on expert help

A dedicated mortgage expert accompanies and advises you at every stage of the property acquisition process.

360° support for your mortgage

Independence

Invexa is not affiliated with any bank or insurance company. We are on your side, defending your interests to the best of our ability.

Extensive network

Our network of banks and financial institutions enables us to find you the best financing conditions.

Simple and intuitive

Our platform is easy to use and intuitive. Managing your mortgage is easy and centralized.

All-round Support

An advisor is on hand to advise and support you throughout your mortgage application.

Frequently asked questions about mortgages

Here are the answers to the most frequently asked questions about real estate financing in Switzerland.

A mortgage is a real estate loan secured by the property you purchase. In the event of non-repayment, the bank can seize the property to recover the loan.

The main forms are :

- Fixed-rate mortgage: the rate remains constant for the entire term of the loan, offering stable monthly payments.

- Variable-rate mortgage: the rate may fluctuate according to market conditions, which may affect your payments.

- SARON mortgage: the rate may rise or fall according to the SARON index.

You can borrow up to 20% of the property sale price in the case of the purchase of a principal residence.

For a second home or investment property, banks generally require you to bring 1/3 (33%) of equity capital.

Financial institutions look at several criteria, including:

- Your personal contribution must amount to 20% of the value of the property (a maximum of 10% can come from occupational or tied pension provision).

- Your debt ratio must not exceed 1/3 of your total gross income.

Yes, it is possible to sell a property even if it is mortgaged.

At the time of sale, the proceeds of the transaction are generally used to reimburse the balance of the mortgage. The notary ensures that, when the property is transferred, the mortgage is lifted or discharged, enabling the seller to recover the remaining capital.

In some cases, it may also be advisable to transfer the mortgage to the buyer, subject to approval by the lending institution and acceptance by the future owner.

Yes, it is often possible renegotiate your interest rate or restructure your loan, especially when market conditions change.

If you are unable to make your monthly repayments, the bank may initiate foreclosure proceedings against the collateral.

That's why it's essential to assess your debt capacity before taking out a loan. An alternative is to pledge a 3A/3B insurance policy.

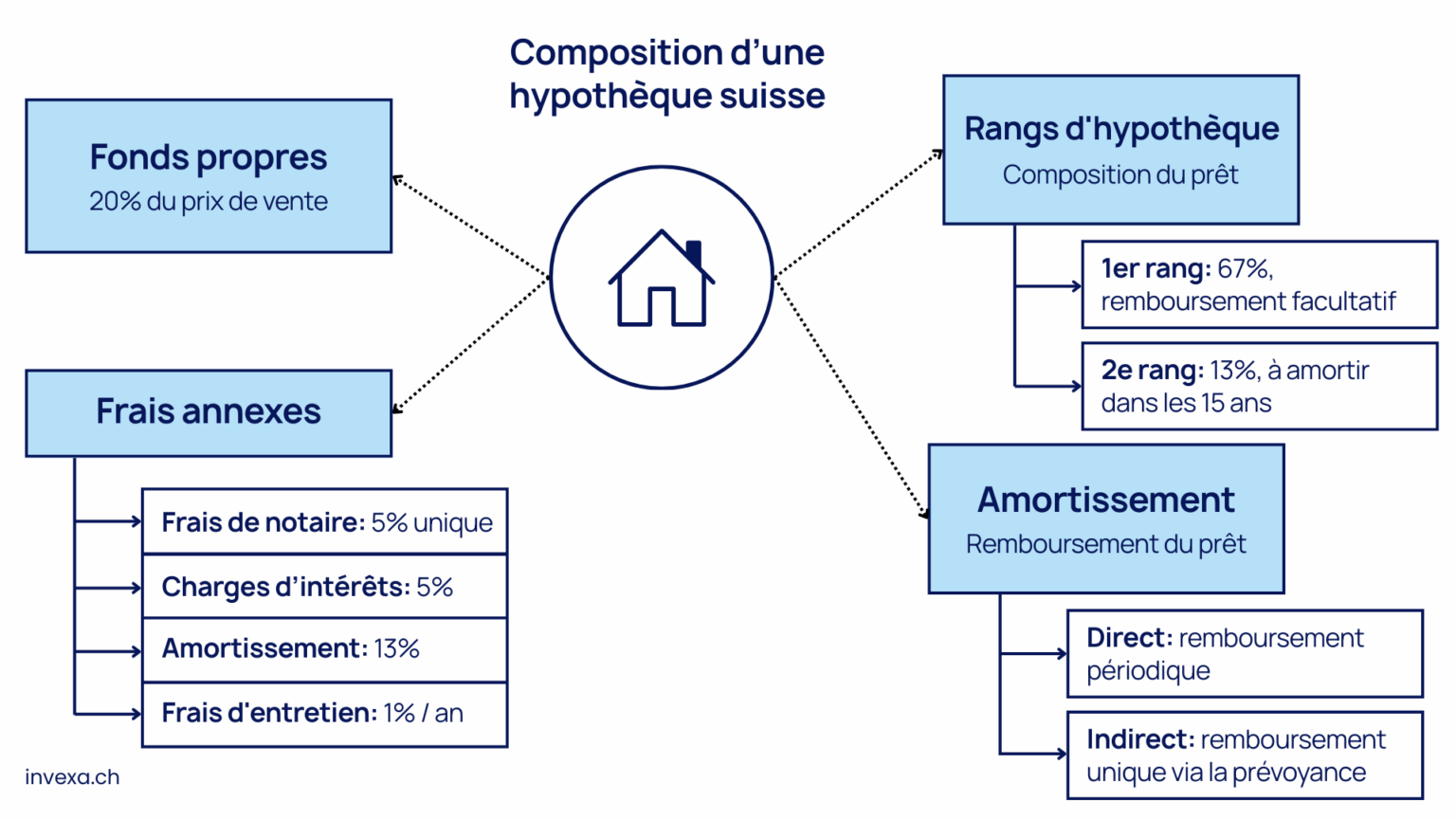

Amortization is the repayment of the mortgage debt. It is structured as follows:

- Direct amortization: the debt is reduced by fixed amounts per period.

- Indirect amortization: repayments are generally accumulated in a 3A or 3B pillar, then paid out in a lump sum at the end.

In Switzerland, a mortgage is divided into two parts:

- First mortgage: up to 67% of the value of the property

- Second mortgage: up to 13% of the value of the property

Only the first mortgage must be repaid within a period of 15 years or retirement (if less than 15 years). The second mortgage can remain open for as long as you wish.

Our mortgage partners

We work with a multitude of partners to find you the best financing conditions.

How does a mortgage work?

Buying real estate is often one of life's most important projects, and often involves mortgage financing. For this reason, it's important to understand the elements that make up a mortgage.

1. Shareholders' equity

Equity is the buyer's personal contribution. In other words, it's the part of the purchase price that you finance with your own savings, rather than a loan. Banks require that this contribution represents at least 20 % of the purchase price of the property, of which 10% maximum can come from pension provision (2nd or 3rd pillar).

Here's an example of equity capital:

- Sales price: CHF 1'000'000

- Maximum loan : CHF 800,000 (80%)

- Total shareholders' equity: CHF 200,000 (20%)

- including:

- Pension fund assets (LPP): CHF 100,000 (10%)

- Personal savings : CHF 100,000 (10%)

2. Amortization

When you take out a mortgage to finance the purchase of a property, amortization refers to the repayment of the mortgage. reimbursement of the loan. There are two main methods:

1. Direct amortization You pay back a fixed amount on a regular basis (often quarterly), which directly reduces the principal owed and, consequently, the interest payable.

Example For a second mortgage of CHF 150,000 to be repaid over 15 years, this corresponds to around CHF 10,000 per year, or CHF 2,500 per quarter.

2. Indirect amortization Payments are made into a pension plan (often Pillar 3a), which serves as collateral with the bank. The accumulated capital will pay off the mortgage when you retire.

3. Mortgage ranks

The financing obtained (the mortgage) is divided into two parts:

1. First mortgage (up to 67 % of the value) : No legal obligation to amortize, although repayment may be advantageous depending on your situation. This debt can remain open for as long as you wish.

2. Second mortgage (up to 13 % of the value) : Must be amortized within 15 years or before retirement, whichever comes first.

4. Ancillary expenses

When you buy a property and take out a mortgage, certain costs are added to the bill:

4.1. One-off charges

- Notary fees: 5%

Notary fees vary from canton to canton. It is generally acceptable to consider that these will average 5%. They are payable only once.

4.2 Recurring expenses

- Interests: 5%

Most of the time, an interest rate of 5% is retained, to ensure that even if rates rise, the buyer will still be able to bear the interest charges. Interest rates are currently much lower in Switzerland, at around 1.5%.

- Amortization: 13% of the value of the asset, divided by 15 years gives annual depreciation

- Maintenance costs: 1% of purchase price per year

How much do I have to earn to take out a mortgage?

When you take out a mortgage, it's essential to check that repayment is still bearable.

For this purpose, an indicator called debt ratio "is used. This measures the proportion of your income that would be spent on mortgage-related payments (interest, amortization, maintenance, etc.), assuming a theoretical rate of 5 %. The mortgage is generally considered bearable if these expenses do not exceed 33 % of your income. For example:

- For a CHF 900,000 property financed at CHF 600,000 with an income of CHF 120,000, if total expenses amount to CHF 35,000, the debt ratio is 29 %.

- On the other hand, if the financing is CHF 700,000 and total expenses amount to CHF 45,000, the debt ratio rises to 37.5 %, which may be considered excessive.

Get advice

Make a free appointment with one of our pension experts for personalized advice.