What is AVS splitting?

The AVS splitting, also known as income sharing, is a mechanism provided by the Swiss Old-Age and Survivors Insurance (AVS), designed to fairly divide the income earned by spouses during their marriage. It applies in the event of a divorce or under certain other conditions, and directly impacts the calculation of future AVS pensions.

When does a splitting take place?

AVS splitting is not immediately automatic: it is triggered in certain specific situations, either on request or automatically at a given time. Here are the cases in which splitting is carried out:

1. In the event of divorce

This is the most common case.

The splitting can be requested as soon as the divorce is finalized, provided that:

- The marriage lasted at least one complete year

- Both spouses have been insured to the AHV during this period.

Splitting can be requested individually or jointly, but a joint request means faster processing.

2. Reaching the reference age

It doesn't matter that they're still married or divorced, if no splitting has been made, it will be automatically made by the compensation fund when both reach AHV legal age (65 from 2025). This means that marriage income can be included in the calculation of AHV pension, even without any action on your part.

3. Other cases

- Both spouses benefit from disability insurance(IV)

- A spouse reaches theretirement age and the other touches a IV pension

- A deceased spouse leaves a survivor affected byage reference or invalid

Every policyholder in Switzerland has a AVS individual account (CI) on which all income subject to contributions is recorded.

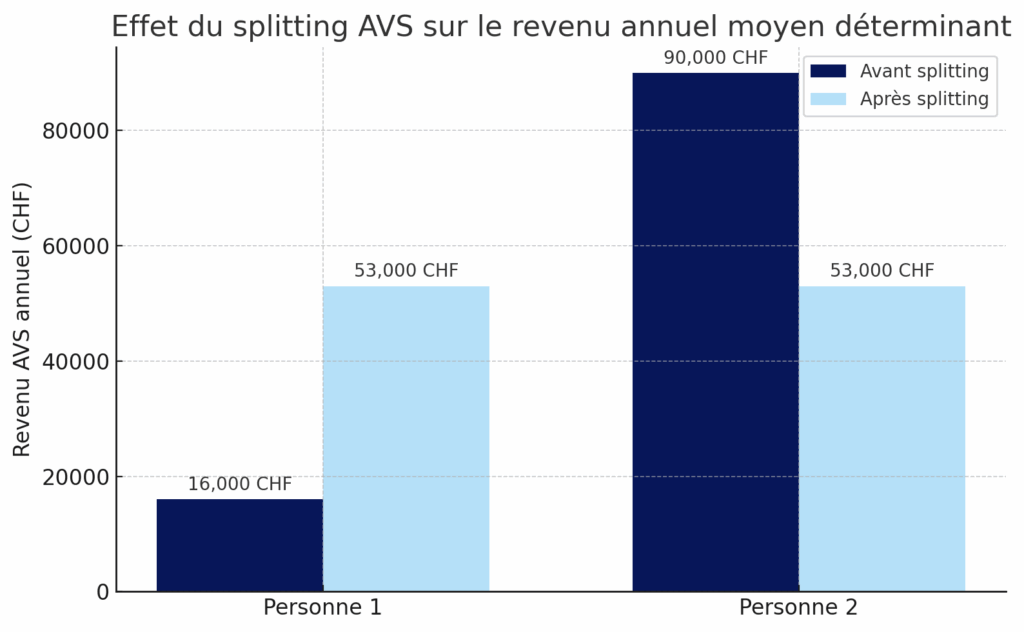

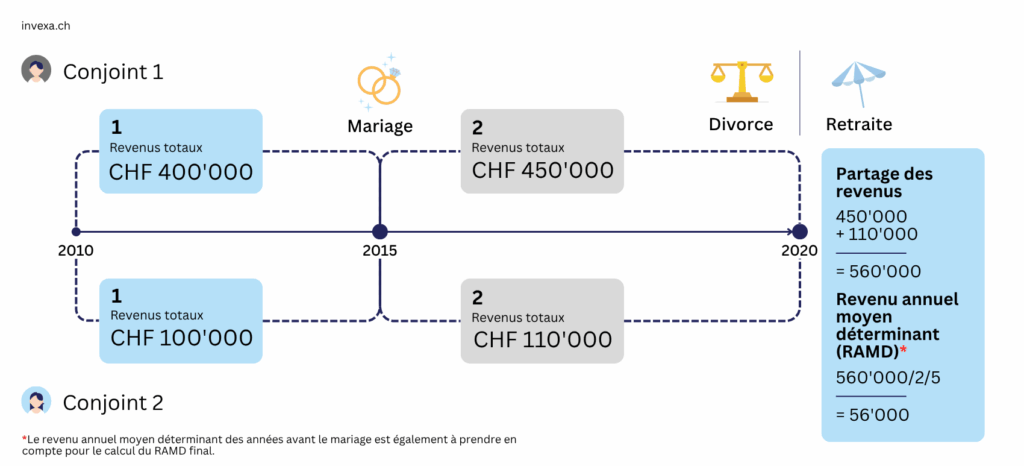

Before splitting, these accounts reflect the income received individually. The compensation fund then identifies full calendar years of marriage during which both spouses were AVS insured. Take the following example:

- Period

- Spouse 1

- Spouse 2

- Before marriage

- CHF 80,000/year

- CHF 20,000/year

- After marriage

- CHF 90'000/year

- CHF 22,000/year

During the marriage, the AHV income of both spouses is added together, year by year. In our example, the total income would be CHF 560,000 [(Income 1 + Income 2) x 5 years].

This total is divided into two equal shares of CHF 56,000 (560,000/2/5 years).

Consequences of splitting

- The average annual income of the high-income spouse decreases, as he shares part of his income.

- The average annual income of the low-income spouse rises sharply, resulting in a higher AHV pension.

This mechanism gives economic recognition to the unpaid work (often linked to the home, education or part-time work) in calculating pension benefits.

What happens if I don't apply for AVS splitting?

It is absolutely possible not to apply when one of the conditions is met. In this case, the compensation fund will automatically apply splitting when a right to a AHV pension or AI is open.

But even though splitting is automatic at retirement, failing to anticipate it can lead to administrative delays, and the pension calculation may be suspended or postponed until the splitting is completed. Therefore, submitting a joint request immediately after the divorce ensures a more efficient, more reliable process and secures each ex-spouse’s rights for retirement.