Pillar 3a at a glance

- Pillar 3a allows you tosave for retirement while enjoying a tax deduction yearly.

- Ceiling 2026: CHF 7,258 for employees affiliated to the 2nd pillar / up to 36,288 CHF (20 % of income) for the self-employed.

- Any person exercising a gainful activity subject to OASIincluding cross-border commuters.

- Withdrawal possible between -5 and +5 years retirement or earlier under certain conditions.

- Withdrawn capital is taxed separately at reduced rate, according to the canton.

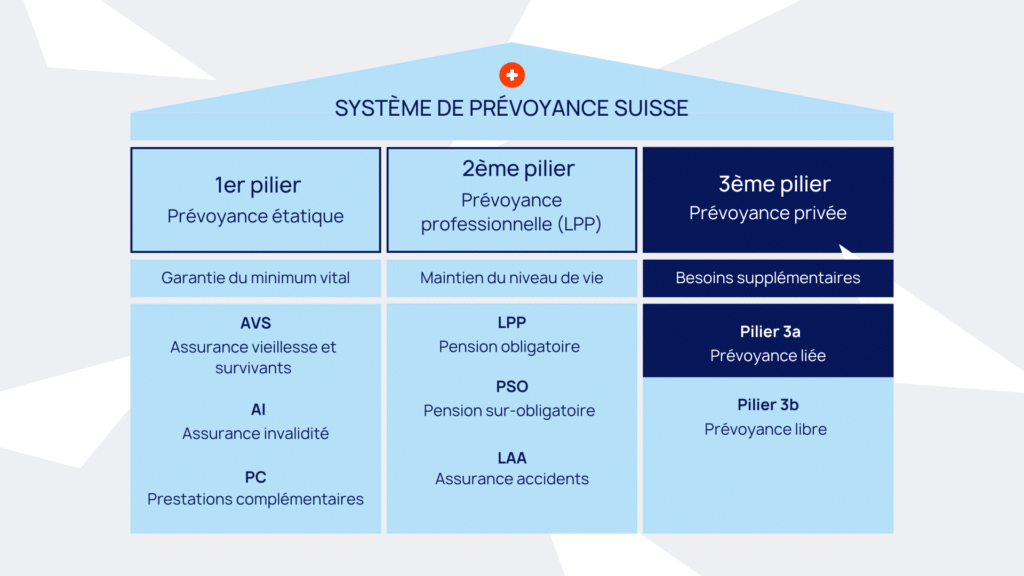

What is Pillar 3a?

Introduced into the Constitution in 1972, Pillar 3a represents the tied individual pension plans. It is characterized by its advantageous tax framework and its main aim is to preparing for retirement. This private pension plan represents a voluntary savings which completes the first two pillars (AHV and pension fund) in return for tax deductionsThis plan has restrictions on withdrawals. Accumulated funds can only be withdrawn in the event of retirement, disability, death, or for the purchase of a first home, under certain conditions.

Diagram: The role of Pillar 3a in the Swiss pension system

Who can open a linked pension account?

The opening of a Pillar 3a account or policy is open to all Swiss residents, whether employed or self-employed. you must be gainfully employed and earn a income subject to AHV. Pillar 3a is also open to frontier workers.

What are the tax benefits of Pillar 3a?

The contributions paid are deductible from taxable income, which helps reduce annual taxation. In addition, upon withdrawal, the capital is taxed at a reduced rate — at one-fifth of the normal income tax.

Furthermore, during the term of the contract, no wealth tax will be levied, allowing capital to grow without additional costs.

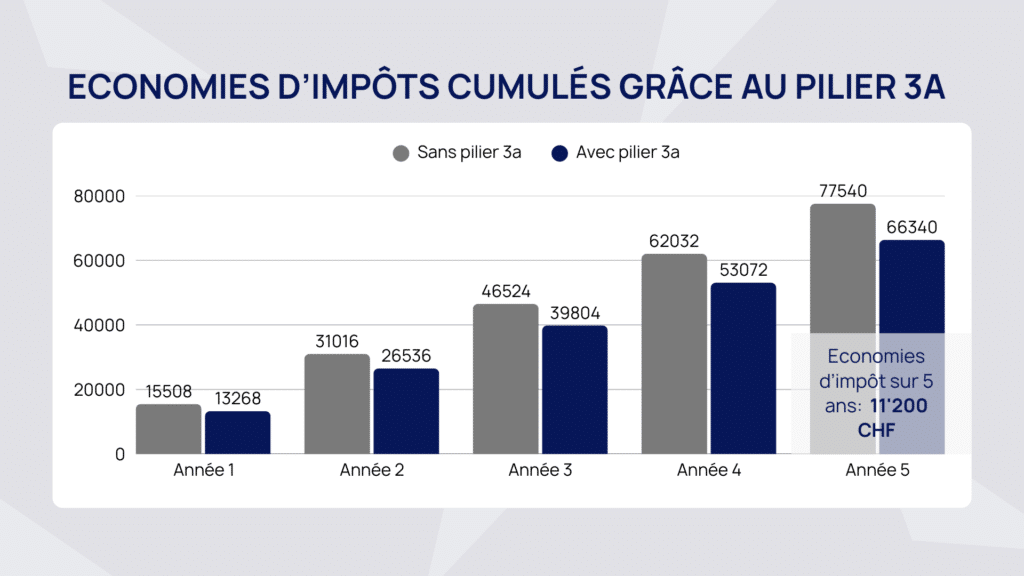

Chart: Cumulative tax savings from Pillar 3a contributions

Over the course of a year, you could potentially save CHF 2,240 in taxes. Over five years, this would represent approximately CHF 11,200 in tax savings.

Scenario: single person living in Geneva with a gross income of CHF 100,000.

Pillar 3a contribution limits

In 2026, it will be possible to pay out amounts in tied personal pension plans:

- Employees affiliated to a pension fund: Up to CHF 7,258 / year

- Self-employed or employees not affiliated to a pension fund: 20% of income, maximum CHF 36,288

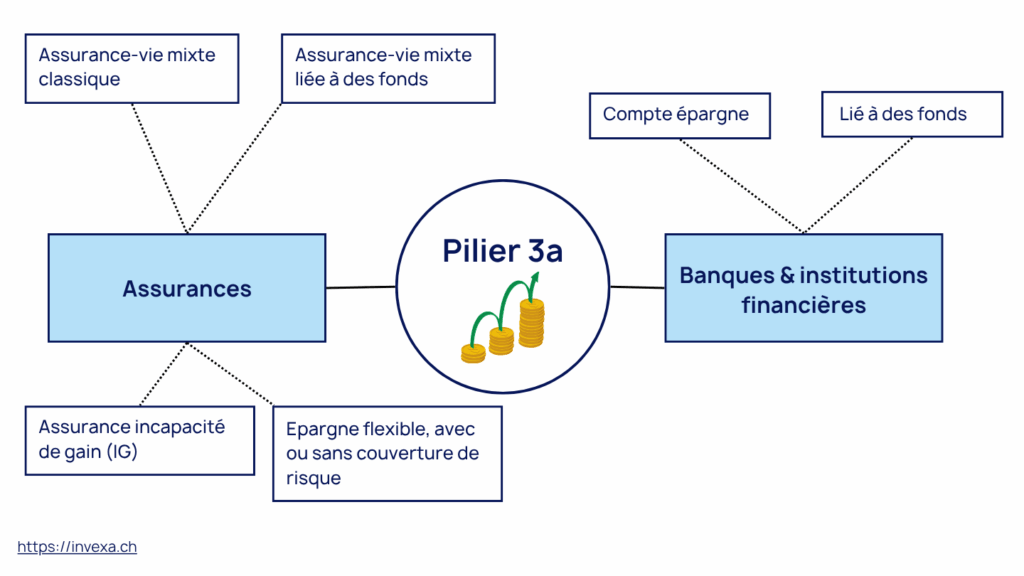

Possible shapes

There is a wide range of options within tied pension provision. We generally distinguish between two main categories: Pillar 3a with a bank and Pillar 3a with an insurance company.

At the bank

In a bank, several products are available under the tied pension scheme (pillar 3a). On one hand, there is the dedicated savings account, which generally offers a guaranteed interest rate and high capital security, but provides limited returns.

On the other hand, investment products, such as investment funds or ETFs, offer the possibility of achieving potentially more attractive returns by investing in a diversified portfolio. However, they carry risks linked to market fl

In insurance

Visit insurance, pillar 3a offers products designed to combine savings and protection. Life insurance contracts enable you to invest in a product that offers a capital guarantee while including coverage in the event of death or disability.

There are many forms, such asfund-linked endowment insurance in case of life, thedisability insuranceetc. Remuneration may vary according to the performance of the chosen investments, although some contracts offer guaranteed rates. In all cases, we strongly recommend that you compare 3rd pillar solutions in detail, given the many options available on the market and the variation in fees from one provider to another.

Expenses: insurance VS bank

A good 3a unit-linked insurance policy is usually cheaper than a pillar 3a bank over the long term. In insurance, however, fees are deducted at the beginning of the contract. This is something to bear in mind if you wish to withdraw early.

Diagram: Pillar 3a banking and insurance investment opportunities

Under what conditions can I make a withdrawal?

The early withdrawal conditions of Pillar 3a are strictly regulated to ensure that savings remain earmarked for pension provision and retirement. Here is a breakdown of the various situations in which it is possible to make an early withdrawal, either partially or in full:

1. Retirement age

Retirement benefits can be paid out as early as 5 years before the insured person reaches the standard OASI retirement age (“reference age”), and at the latest five years after.

2. Purchase of 2nd pillar contributions

Advance withdrawal is permitted when Pillar 3a savings are used to buy back contributions in a 2nd pillar pension scheme. This option enables you to top up or regularize your occupational pension capital in the event of retirement.

3. When receiving a full DI/IV pension

If the client receives a full disability pension from the DI and the risk of disability is not covered by the pension plan, the early withdrawal can be activated.

4. Change of self-employed activity

Early withdrawal is also possible for the policyholder who changes to a new self-employed activity. This allows access to the necessary liquidity to support their professional transition.

5. Starting a self-employed business

If the pension fund member sets up their own business, they can apply for early withdrawal. The aim is to provide financial support when starting a self-employed or entrepreneurial activity, which is often crucial in the early stages of setting up a business.

6. Final departure from Switzerland

If the policyholder permanently leaves Switzerland, they may make an early withdrawal of their funds. This provision is intended to allow the insured person to access their savings when settling abroad.

7. Home purchase or mortgage repayment

Early withdrawal is also possible when the funds are used to purchase a home for one's own needs or to repay mortgage loans. This condition facilitates home ownership by allowing insured persons to use their savings in a practical way for a real estate project.

Get your personalized comparison

Fill in our Pillar 3a quotation request form and one of our pension experts will contact you shortly with a quote. customized, no-obligation analysis.

How many 3a accounts can I have?

There is no legal limit to the number of 3a accounts you can hold. In practice, you may open several accounts — for example, a bank account and a life insurance policy.

However, the annual contribution ceiling remains the same and applies to the total of all your payments, which means that the total amount deposited cannot exceed the ceiling set by law.

New: 3a redemptions

In 2026, it will be possible to make subsequent Pillar 3a surrenders for the 2025 tax year of CHF 7,258 (ceiling).

Succession in 3a

When you die, your Pillar 3a assets do not follow traditional inheritance rules. It does not enter directly into the estate: it is paid out in priority to the beneficiaries. statutory beneficiaries or by the clause you have defined. Inheritance rules in 3a are governed by the’OPP3 (Ordinance on tax deductions for contributions to recognized pension schemes). In practice:

- First, the surviving spouse or the registered partner is protected.

- Next come the children.

- Failing this, other close relatives may be appointed, within the limits set by theOPP3 ordinance.

You can specify in your contract how this capital is to be distributed among your beneficiaries. This avoids conflicts and ensures that your wishes are respected. Please note: if your designations affect the reserved portion of your legal heirs, they may request a reduction. In this case, the surrender value of your 3a is included in the calculation of the estate. From changes in inheritance rules in 2027.

Pillar 3a vs. 3b: which to choose?

Two variants exist in the 3rd pillar (private pension provision). Pillar 3a is a linked retirement savingsoffering substantial tax deductions. Funds are locked in and can only be withdrawn in the event of specific events (retirement, home purchase, disability, permanent departure from Switzerland).

The pillar 3balso known as unrestricted pension planis, for its part, a additional savings more flexible, with no strict constraints on use. Although it benefits from fewer tax advantages when taken out as insurance, it allows funds to be used freely for a variety of projects. In short, making the difference between a 3a and a 3b flexibility and tax deductions to exploit.

Which Pillar 3a is right for you?

Choosing the best Pillar 3a in Switzerland depends on your profile, age and pension needs. To help you quickly identify which solution best suits your situation, we've created a comprehensive matrix with detailed explanations for each profile.

Decision table

- Profile

- Recommended solution

- Protection to include

- Priority

- Single employee < 40 years old

3a Insurance + 3a Bank (funds)

Disability due to illness

- Family with children

Priority 3a insurance + 3a Bank (funds or guaranteed capital)

- Self-employed without BVG

Assurance 3a (funds)

Death + Sickness and accident disability

- Cross-border commuter (quasi-resident)

Bank 3a (funds or interest-bearing account depending on horizon)

- Near retirement < 10 years

Bank 3a only (interest-bearing account or low % shares)

In practice, there is no universal Pillar 3a solution. The choice mainly depends on the’age, the family situation, from professional status and the’investment horizon. A combination of banking and insurance solutions can often optimize flexibility, protection and tax benefits.

A personalized analysis is essential to adapt your pension strategy to your actual needs, and to avoid making inappropriate decisions over the long term.

We recommend

Subscribing to a 3a pillar is an important decision that deserves careful analysis. It is essential to define your profile and needs before selecting and comparing the various solutions available. The fees and conditions can vary significantly from one provider to another, which can have a major impact on your long-term returns.

Frequently asked questions

Pillar 3a is a form of tied individual pension provision in Switzerland. It allows you to save for retirement while benefiting from tax advantages. It is subject to strict conditions regarding beneficiaries, amounts paid in, and withdrawal possibilities.

Anyone who exercises a gainful activity in Switzerland and pays contributions to the AVS can contribute to pillar 3a. This includes:

- Employees,

- Cross-border commuters,

- Independents,

- Unemployed persons under certain conditions.

Pillar 3a allows :

- To supplement AHV and BVG pensions,

- Reduce taxable income (thanks to tax deductions),

- To finance a real estate project or a transition to independence.

Yes, but at a reduced rate of 1/5 of the tax rate, separate from other income.

You must make Pillar 3a payments no later than December 31 to be tax deductible in the current year.

Yes. In the event of your death, your 3a credit balance is transferred first to surviving spouse or registered partner, then to the children. Failing that, other relatives may be beneficiaries, depending on the law and your beneficiary clause.

Visit 2026the maximum amount is CHF 7,258 per year for employees affiliated to the 2nd pillar. Self-employed people without a 2nd pillar can contribute up to 20 % of their income, with a ceiling of CHF 36,288 per year.

Yes. 3a assets are strictly regulated. Placed with approved insurance companies or banks, they benefit from legal protection and are considered highly secure savings for retirement.

You can transfer the entire balance of your pillar 3a account to another (for example, from a bank to an insurance company) without tax consequences. The transfer amount is unlimited, but fees vary from one provider to another.

There is no "best" universal Pillar 3a. A 3a bank account is more flexible and less costly, while 3a insurance combines savings and protection (death, disability). The choice depends on your age, family situation and risk tolerance.