What is a BVG certificate?

The occupational pension certificate is a personal document sent to you annually by your pension fund. It summarizes your entitlements and the assets you’ve accumulated under the 2nd pillar, which refers to occupational pension insurance in Switzerland (BVG/LPP). This certificate plays a key role in providing transparency about your retirement coverage, as well as in case of disability or death.

It contains key data such as:

- Your insured (coordinated) salary

- Your annual dues

- Accumulated retirement savings

- Insured benefits (old-age pension, disability, death)

- The conversion rate applicable to retirement

Legal basis of the BVG certificate

The Swiss Federal Law on Occupational Retirement, Survivors' and Disability Pension Plans (BVG/LPP) and its implementing ordinance BVV2 stipulate how the BVG/LPP certificate is to be drawn up and forwarded.

According to Article 11 of OPP2, every pension institution is required to maintain an individual retirement account and to inform the insured each year of the following elements:

- Amount of retirement savings

- Coordinated salary

- Contribution rates

- Entitlement to benefits in the event of retirement, death or disability

Every person insured with a pension fund — that is, any employee whose income exceeds the annual BVG threshold (CHF 22,680 in 2025) — receives an occupational pension certificate at least once a year, typically at the beginning of the year or after the close of the previous fiscal period.

How to read a BVG certificate

The BVG certificate contains essential information about your occupational benefits situation. Here's how to decipher the main points:

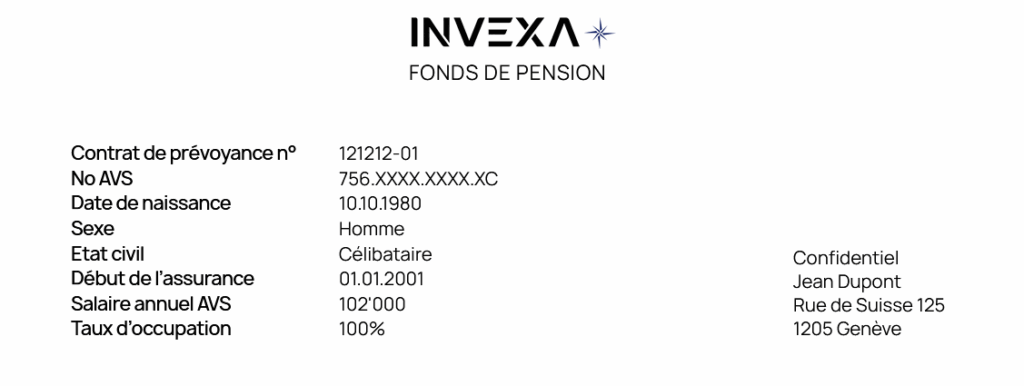

Personal information

Be sure to check your affiliation date: it must correspond to the date on which you started working for your current employer, or the date on which you changed funds. A mistake in these details can lead to complications in the event of a transfer, buy-out, divorce or claim for benefits.

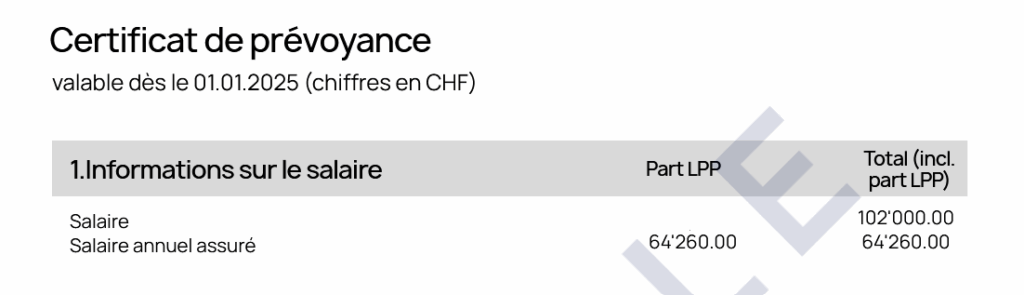

1. Salary information

The occupational pension certificate shows the salary elements taken into account by the pension fund to calculate your benefits. It usually includes two key figures: the actual (AVS) salary (based on your employment contract) and the insured salary, after applying the coordination deduction.

In the example below, the total salary corresponds to your gross annual AVS salary as declared by your employer. It includes all components subject to AVS contributions (fixed salary, variable pay, bonuses, etc.).

The insured annual salary is the basis on which your contributions and benefits are calculated. In 2025, the calculation follows these rules:

- AHV salary (CHF 102,000 but max: 90,720) - coordination deduction (CHF 26,460) = (CHF 26,460) = (CHF 26,460) = (CHF 26,460) = CHF 75,540

- However, as the maximum coordinated salary is CHF 64,260, this amount is retained.

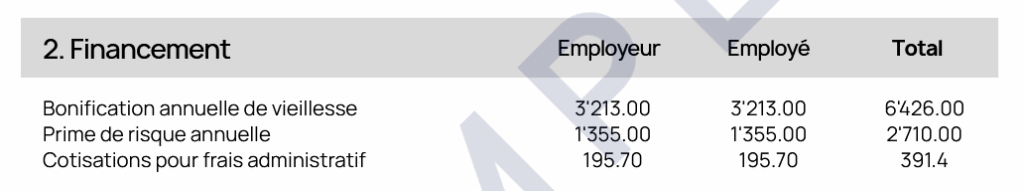

2. Financing

Your occupational pension certificate provides a detailed breakdown of how your pension is funded. These contributions help build your retirement capital, but also serve to insure you in case of disability or death.

The 3 components of contributions:

- Savings bonus: this is the portion earmarked for your retirement.

- Risk premium: covers benefits in the event of disability or death.

- Administrative costs: related to the management of your account.

Contributions are shared between you and your employer. The law sets two minimum requirements: the total savings contribution (retirement credits) depends on your age group (e.g. 10% from age 35), and the employer must contribute at least as much as the employee.

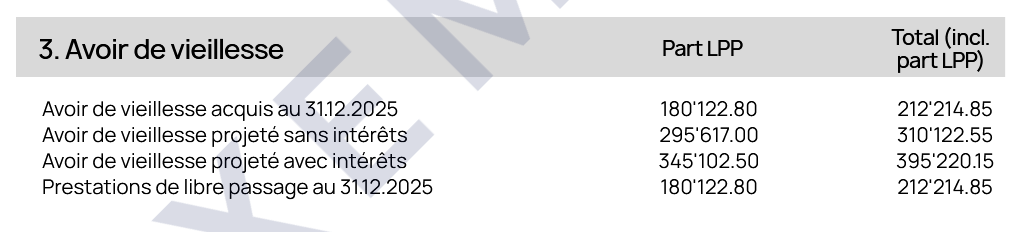

3. Retirement savings

Your retirement savings correspond to the savings accumulated in your pension fund to finance your retirement. A distinction is made between current and projected retirement savings (at the reference age). It consists mainly of

- Some pension credits paid each year (as a percentage of insured salary),

- Some interest credited based on caisse performance,

- And, where applicable, the redemptions or transfers vested benefits.

Assets are generally divided into two parts:

- LPP portion (compulsory): strictly in accordance with the law, with minimum contribution and interest rates.

- Extra-mandatory portion: linked to the more generous conditions set by certain funds or employers (higher contributions, coverage on a larger salary, etc.).

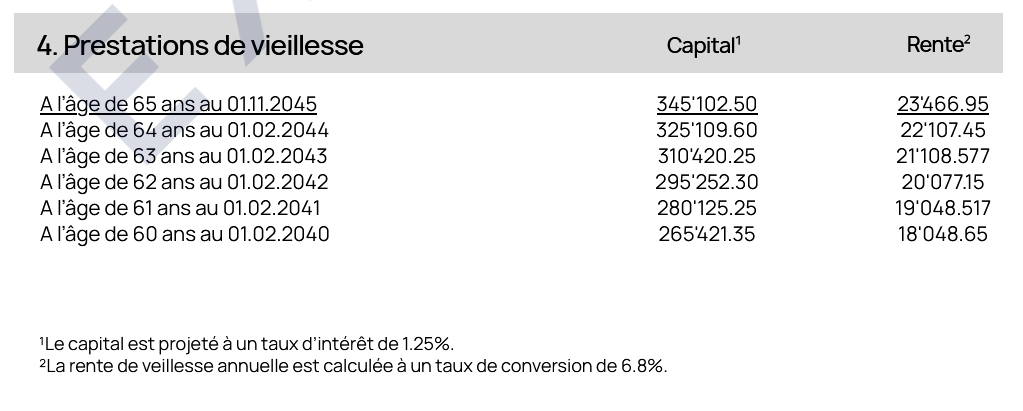

4. Retirement benefits

Retirement benefits refer to the pension you will receive upon retirement, calculated based on your retirement assets at the time you stop working. The certificate usually outlines several scenarios depending on the age at which you choose to retire. In most cases, it is possible to take early retirement from age 58 (depending on the pension fund's regulations).

The earlier you leave, the lower your pension and capital, as your retirement capital will be lower (fewer years of contributions), the lower the conversion rate and the longer the pension will have to be paid out. The minimum conversion rate is 6.8 % at the reference age of 65 for both men and women.

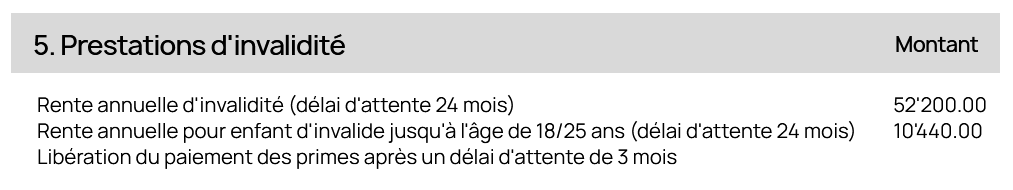

5. Disability benefits

In the event of long-term disability, your pension fund will pay you a disability pension in addition to the AI pension (Invalidity Insurance). These benefits are intended to compensate for income loss if you become unable to work over the long term due to illness (the LAA covers pensions in cases of earning incapacity resulting from a covered accident).

What the BVG covers in the event of disability:

- Annual disability pension: It is paid after a waiting period of 24 months of incapacity for work. The amount depends on your retirement assets and the degree of recognized disability (at least 40 % according to the LPP).

- Disabled person's child's pension: If you have children, an additional pension is paid for each child up to the age of 18 (or 25 if they are studying). It generally corresponds to 20 % of the main disability pension.

- Waiver of premium payments: In the event of disability, your caisse can take over your contributions (savings + risk). This means you can continue to build up your retirement capital without interruption.

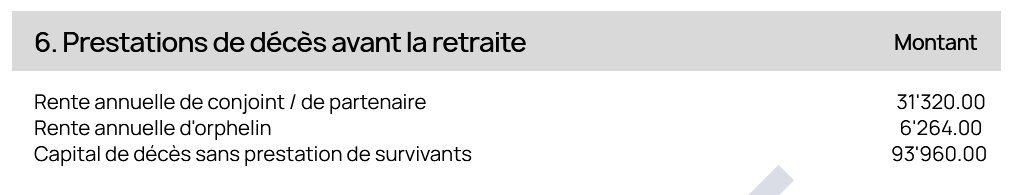

6. Pre-retirement death benefits

If you pass away before reaching retirement age, your pension fund provides benefits to protect your loved ones. These benefits vary depending on your family situation and the conditions set out in the pension fund’s regulations.

- Spouse's or partner's pension: An annual pension is paid to your spouse or registered partner if he or she meets the conditions (age, dependent children, length of time together, etc.). The amount corresponds to 60 % of your theoretical disability pension.

- Orphan's pension: Each child is entitled to an orphan's pension, paid until the age of 18 (or 25 if still in education). This pension represents 20 % of the insured disability pension.

- Death benefit: If there is no entitlement to a survivor's pension, a lump-sum death benefit is paid. In principle, this lump-sum payment corresponds to three times the insured annual widow's/widower's pension.

The definition of "partner" varies from fund to fund. It may be a registered partner or a cohabitee, provided that cohabitation is proven.

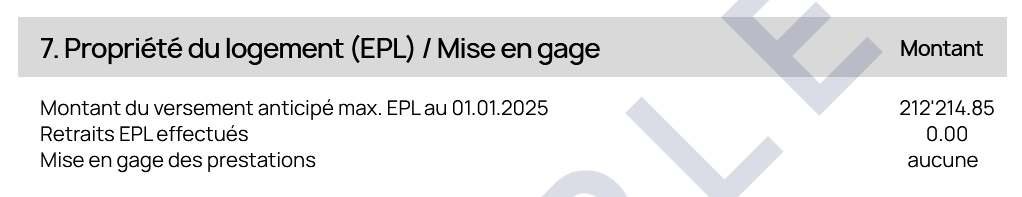

7. Home ownership (EPL)

The 2nd pillar can be used to finance the purchase of a primary residence. This mechanism is known as the Encouragement of Home Ownership (EPL). It allows you to either withdraw part of your retirement savings or pledge them as collateral for a mortgage loan.

- Advance payment (EPL): The maximum amount you can withdraw is indicated on your certificate. This withdrawal is subject to strict conditions and is intended only for the acquisition of a principal residence.

- Pledging: You can pledge your BVG/LPP assets or future benefits (pension, capital). This allows you to strengthen your case for a mortgage, without immediately reducing your capital, which will continue to grow.

The certificate also indicates any EPL withdrawals already made, as well as any pledged benefits.

8. Buy-ins and Repayments

Buying into your pension fund allows you to fill gaps in your occupational pension and increase your retirement savings. It’s a voluntary step, fiscally advantageous because it is fully tax-deductible, and it can significantly enhance your future pension.

- Maximum buy-in amount: The certificate indicates the maximum amount you can buy back. This amount depends on your age, your insured salary and your career path (periods of non-membership, part-time work, etc.).

- Buy-ins already made: The "Purchases already made" section shows the amounts you have already voluntarily paid into the 2nd pillar. These amounts bear interest and directly increase your retirement capital.

If you make a buy-in, you won’t be able to withdraw the funds for several years without incurring a tax penalty. In addition, if you previously withdrew funds (e.g., for home ownership), you must first repay the withdrawn amount before making a new buy-in.

Conclusion

Understanding your BVG certificate means regaining control over an essential part of your pension provision. Too often relegated to the status of a mere administrative paper, it contains the keys to your future: what you've already saved, what you'll receive tomorrow, and what will happen to your loved ones if life takes you by surprise. It also reflects your employer's commitments, the quality of your pension plan, and the room for manoeuvre you have to improve your situation.

Every figure, every line has its importance. An unused buyback amount, an underestimated pension, a conversion rate to watch out for: all of these can make the difference between an unplanned and a chosen retirement.

Frequently asked questions

The BVG certificate is sent to you every year by your pension fund, usually at the beginning of the year or after the close of the financial year. It can be sent by mail or e-mail.

The majority of pension funds now offer access to a customer area which contains your pension certificate.

The BVG is the Swiss Federal Law on Occupational Retirement, Survivors' and Disability Pension Plans. It forms the legal basis of the 2nd pillar in Switzerland. Its aim is to supplement the AVS (1st pillar) to ensure a decent standard of living after retirement or in the event of death or disability. Anyone employed in Switzerland and earning more than CHF 22,680 per year is affiliated to a BVG plan.

If you notice an error (incorrect salary, inaccurate personal data, missing contributions), contact immediately your employer or your pension fund. It's important to correct these elements quickly, as they have a direct impact on your future benefits.

Yes, but only in certain specific cases:

- Purchase of a principal residence (EPL)

- Definitive departure from Switzerland

- Transition to self-employment

- Total disability

- Small amounts (assets too small to generate an annuity)

Any early withdrawal reduces your future retirement benefits.

A buy-in allows you to fill gaps in your pension coverage and increase your future retirement benefits. It is deductible from your taxable income, making it an effective tax optimization tool as well. The maximum buy-in amount is indicated each year on your pension certificate.