What is the 3rd pillar?

1. Pillar 3a (tied pension provision): primarily intended for retirement, it offers significant tax advantages by allowing contributions to be deducted from taxable income. For 2025, the maximum amount deductible is CHF 7’258 for employees affiliated with a pension fund. In return, the capital remains locked in until retirement, except under specific conditions (home purchase, moving abroad, starting self-employment).

1. Pillar 3a (tied pension provision): mainly intended for retirement provision, it offers tax advantages but imposes certain withdrawal conditions.

2. Pillar 3b (unrestricted pension provision): more flexible, allowing more flexible use of the savings accumulated.

AXA 3rd pillar solutions

AXA offers a 3rd pillar insurance (3a/3b) with risk coverage. The offer is structured around three distinct plans, each meeting different objectives.

1. SmartFlex Pension Plan (3a/3b)

The principle is based on regular payments from CHF 600 per year (i.e. CHF 50 per month) and until maximum amount in 3a. This accessibility makes it possible to start early, even with a limited budget. The minimum term is 7 years for Pillar 3a and 10 years for Pillar 3b.

Flexible premium allocation is the central element of SmartFlex. With each payment, you decide how to divide your premium between 2 compartments:

1. The secure capital functions like a traditional savings account. Your money is legally guaranteed at 100% within AXA’s tied assets. It earns a technical interest rate (currently 0% according to the provided offer) plus a potential variable surplus interest (projected at 1.50% in the moderate scenario). The drawback: potentially limited returns over the long term.

2. The performance-oriented capital is invested in equities through diversified funds. You benefit from financial market growth and historically higher returns. The capital is guaranteed up to the current value of the fund units. The advantage: higher return potential driven by equity markets. The drawback: short-term fluctuations depending on market movements.

Key features

- Periodic premium from CHF 600 per year

- Minimum duration of 7 years for 3a, 10 years for 3b

- Coverage of death risk and disability included

- Tax benefits and inheritance lien

2. SmartFlex Capital Plan (3a/3b)

The AXA SmartFlex Capital Plan is an investment solution under the 3a pillar (transfer only) and 3b pillar that combines performance, security, and flexibility. You can freely decide what portion of your capital is invested in equities to seek returns and what portion remains securely placed at a preferential rate currently set at 2.2%. This allocation can be adjusted at any time, free of charge.

One of the great advantages of SmartFlex is its tax benefitsPillar 3b: dividends and interest are not subject to income tax if the Pillar 3b conditions are met. In the event of death or bankruptcy, the capital also benefits from legal protection, as it is excluded from the estate and protected from creditors. Thanks to very low fund charges, similar to those of large institutional investors, the potential return is more attractive than on a conventional savings account.

You can strengthen the security of your investment by activating, free of charge and at any time, options such as staggered investment management (to smooth out market entry risks), gain protection, or the progressive reallocation of capital towards the end of the contract.

Key features

- Minimum single contribution of CHF 15,000 for 3a, CHF 25,000 for 3b

- Time between 10 and 30 years

- Old-age provision with death cover minimum

- Capital collection at maturity

3. SmartFlex Income Plan (3b only)

The AXA SmartFlex Income Plan is designed for those who wish to turn a single lump sum into regular income while maintaining full control over their savings. You make an initial contribution of CHF 15,000 or more and define the amount, frequency, and duration of the payments you wish to receive. If your needs change, the contract remains flexible — you can adjust both the withdrawals and the capital allocation at any time.

The investment is divided into two parts. The secure capital earns a fixed preferential rate and is 100% protected in the event of AXA’s insolvency. The performance-oriented capital, on the other hand, is invested in diversified equity funds according to the investment theme you choose.

Key features

- Minimum single contribution of CHF 15,000

- Time between 10 and 30 years

- Preferred interest rates

- Plannable monthly income

Comparison of the three AXA plans

- Criteria

- Pension plan

- Capital Plan

- Income Plan

- Main objective

Savings + protection

Placement

Regular income

- Financing

Periodic premium

Lump sum

Lump sum

- Type of plan

3a/3b

3a (transfer)/3b

3b

- Risk insurance

Yes

No

Four investment themes available

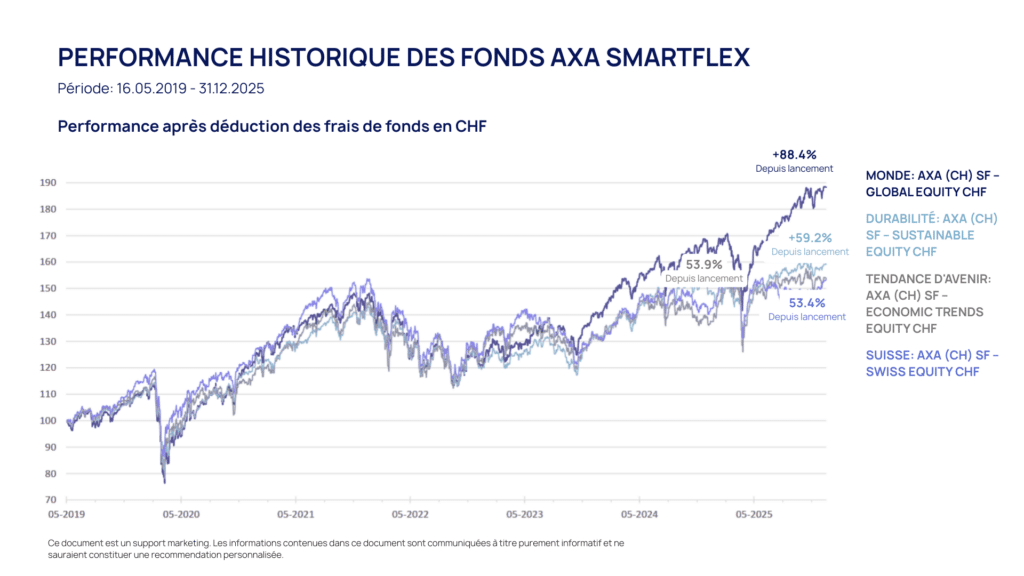

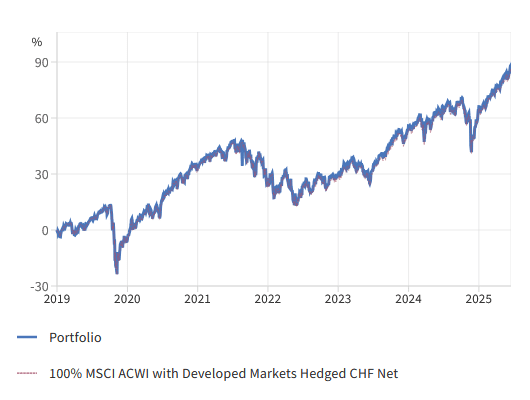

- World - Replicates the MSCI ACWI index (2,558 companies, 47 countries). Low-cost passive management (0.16%/year). High exposure to the United States (65%), followed by Japan (4.9%), the United Kingdom (3.4%) and China (3.2%). Main sectors: technology (23%), finance (18%) and consumer (11%). Ideal theme for global diversification.

- Switzerland - Invested in major Swiss companies (Nestlé, Novartis, Roche). Offers familiar but geographically and sectorally concentrated exposure. SPI historical performance: +7.2%/year over 25 years.

- Durability - Selection of ESG-compliant companies, excluding tobacco, weapons, coal, oil and gas. Combines ethical values with competitive returns.

- Future trends - Focus on innovative sectors (AI, renewable energies, digital healthcare). Riskier in the short term, but high potential in the long term.

What are AXA's 3rd pillar fees?

AXA's SmartFlex plan also stands out for its clear, low-cost structure. Fund charges vary according to the investment theme chosen: between 0.13 % and 0.39 % per annum, and there are no issue or redemption fees. When contract management and administration fees are added, the total cost (including TER) averages around 0.9 to 1.3% per year, according to configuration and the duration of the plan. In all cases, contract fees are as follows indicated clearly in the’offer.

This is a low level for an insured pension product, especially when compared to other 3a solutions on the market, which often exceed the 2 %. In practice, AXA manages to keep these costs down thanks to its largely passive and institutional management. AXA's Pillar 3a is one of the least expensive insurance products in Switzerland.

Are you interested in AXA's 3rd pillar solution?

Receive a offer as well as a objective assessment within 24 hoursadvantages, limits and relevance to your age, professional situation and savings objectives.

Conclusion

AXA's SmartFlex is one of the world's leading pension solutions. modern and efficient, designed for those who want to grow their savings without tying their hands. By combining flexibility, tax advantages, security options and controlled costs, this plan brings the world of insurance closer to that of pure investment.

The result is an intelligent hybrid product: secure enough for retirement, but performing well enough to generate real long-term capital growth thanks to high-quality funds with very competitive fees (TER at 0.13% for the «World» fund). For those looking for an alternative to the classic 3a account, and who want to retain control over their allocation between security and yield, SmartFlex is clearly one of the most coherent options on the Swiss market today.

Frequently asked questions

AXA offers 4 funds for SmartFlex products:

1. AXA (CH) Strategy Fund Global Equity CHF (TER: 0.13%)

2. AXA (CH) Strategy Fund Swiss Equity CHF (TER: 0.37%)

3. AXA (CH) Strategy Fund Trends Equity CHF (TER: 0.34%)

4. AXA (CH) Strategy Fund Sustainable Equity CHF (0.24%)

The best-performing funds is the historical Global Equity CHF (1), a passively managed global index fund that replicates the MSCI ACWI, hedged in Swiss francs at around 85 % against currency risks. The TER (annual costs) amounts to only 0.13%. Performance since launch in 2019 amounts to +87.72%.

AXA’s 3rd pillar is aimed at anyone looking to build capital over the long term while benefiting from a favorable tax framework.

It is particularly well suited for those who wish to prepare for retirement proactively, protect their loved ones in the event of death, or simply invest in a disciplined way. Thanks to its flexibility, SmartFlex adapts equally well to young professionals, self-employed individuals, or families seeking a balance between security and performance.

The difference between 3a and 3b is as follows:

- Pillar 3a is linked to occupational pension provision: deposits are tax-deductible, but withdrawals are restricted by law (retirement, property purchase, independence, etc.).

- Pillar 3b, However, the money remains accessible at all times, and some solutions (such as SmartFlex 3b) offer inheritance benefits and protection in the event of bankruptcy.

In all cases, compare the 3rd pillars will help you find the solution that's best for you.

Returns depend on the proportion invested in yield-oriented capital (equities) and the investment theme chosen. Historically, SmartFlex funds have posted solid performances: the «World» theme, for example, has generated 87.72% in returns (+10% annualized) since its launch in 2019. This fund has even outperformed its benchmark of 86.27. Naturally, results vary according to market and investment horizon.

Absolutely. You can switch from one theme to another, for example from «World» to «Sustainability», free of charge, at any time.

The minimum annual premium is around CHF 600 for versions 3a and 3b. For the SmartFlex income plan, the initial contribution must be at least CHF 15,000.

Historically, equity investments have delivered higher long-term returns than so-called “safe” assets such as bonds or savings accounts. If you have more than 15 to 20 years before retirement, allocating a portion to equities is often recommended to generate stronger returns.

The key is to adjust the allocation to your risk profile and gradually reduce the equity portion as you approach retirement.

In the event of a loss of earning capacity, AXA provides a premium waiver.

In practical terms, if you become unable to work due to illness or an accident, AXA steps in and continues paying the premiums on your behalf, ensuring that your retirement plan remains fully intact.

It works as follows:

- As soon as a loss of earning capacity of at least 25% is recognized, AXA covers a portion of the premiums.

- If the disability reaches 66 % or more, you are completely free of premium payments.

- The waiting period before coverage begins depends on the contract (3, 6, 12, or 24 months, depending on your selection).

During this period, your SmartFlex plan continues to function normally: savings remain invested, guarantees remain in force, and you do not lose your tax benefits or your protection in the event of death.