Table of main tax deductions in Fribourg

| Deduction | Category | Maximum amount |

|---|---|---|

| Travel expenses | Professional | ICC: max. CHF 12,000 IFD: max. CHF 3,300 Car: 70 ct/km (up to 10'000 km), 60 ct/km (10'001-20'000 km), 50 ct/km (>20'000 km) Motorcycle: 40 ct/km Light vehicles (bicycle, moped): CHF 700 |

| Meal expenses | Professional | CHF 15/day (max. CHF 3,200/year) CHF 7.50/day with employer contribution (max. CHF 1,600/year) |

| Out-of-home expenses | Professional | CHF 30/day (max. CHF 6,400/year) Reduction to CHF 7.50 for lunch if employer participates |

| Other business expenses (flat rate) | Professional | 3% of net salary IFD: min. CHF 2,000, max. CHF 4,000 |

| Continuing education and training costs | Professional | Actual costs max. CHF 12,000/year (not limited to training related to current activity) |

| Dual careers for spouses | Professional | IFD: 50% lowest net income (min. CHF 8,600, max. CHF 14,100) |

| Building maintenance - Flat-rate (built after 31.12.2013) | Housing | 10% of total rental value |

| Building maintenance - Flat-rate (built before 31.12.2013) | Housing | 20% of total rental value |

| Building maintenance - Actual costs | Housing | Energy-efficient investments, repairs, renovations, insurance, administration |

| 3rd pillar A (employee with BVG/LPP) | Pension | CHF 7,258 |

| 3rd pillar A (self-employed without BVG/LPP) | Pension | 20% net income (max. CHF 36,288) |

| 2nd pillar (BVG) purchases | Pension | Gap amounts (Please note: no further repurchases may be made within the following 3 years) |

| Health insurance premiums | Pension | ICC: Flat-rate deduction according to personal situation Single person: CHF 4,810 Married couple: CHF 9,620 Child <18 ans: 1'140 chf Young student aged 18-25: CHF 4,210 IFD: Cumulative lump-sum deduction (see guide) |

| Interest on savings capital (debt) | Pension | Deduction limited to yields (codes 3.210, 3.220, 3.240, 3.250) Married couple: CHF 300 Other taxpayers: CHF 150 |

| Private debt (mortgage interest, loans, etc.) | Pension | Deductible up to gross asset income + CHF 50,000 |

| Childcare expenses | Family | Per child <14 ans ICC: max. CHF 12,000 IFD: max. CHF 25,800 (Supporting documents required) |

| Social deductions for children | Family | Declining balance according to net income (code 6.910) Examples: Income ≤62'700 CHF: 8'600 CHF (1 child) Income ≤72'800 CHF: 17'200 CHF (2 children) Income ≤82'900 CHF: 26'800 CHF (3 children) (See complete scale in the guide) |

| Other dependents | Family | CHF 5,000 per needy person (Maintenance costs: min. CHF 6,700/year) |

| Taxpayer in school or apprenticeship | Family | CHF 3,600 (Up to the age of 25) |

| Wheelchair activity | Family | CHF 2,500 (If gainfully employed and no OASI/DI pension) |

| Orphan of mother and father | Family | CHF 8,600 (If minor, student or apprentice) |

| Social deduction for home care | Family | Amount actually received as lump-sum compensation (ICC only) |

| Maintenance payments | Family | Amount actually paid |

| Medical and sickness expenses | Health | ICC: Amount exceeding 0.5% of net income IFD: Amount exceeding 5% of net income |

| Disability-related expenses | Health | Full amount (without deductible) |

| Donations to charitable organizations | Other | ICC & IFD: min. CHF 100, max. 20% of net income (code 4.910) (Exempt legal entities with registered office in Switzerland) |

| Donations to political parties | Other | ICC: max. CHF 5,000 (Party obtaining min. 3% of the vote in cantonal elections) IFD: max. CHF 10,600 |

| Low-income deduction | Other | Decreasing amount according to situation and net income Examples (ICC only): Single person (income ≤20'300): CHF 4'100 Married couple (income ≤24'300): CHF 5'100 Single AHV/IV pensioner (income ≤24'300): CHF 9'100 (See complete scales in the guide) |

| Social deduction on wealth | Other | Declining balance according to net assets Single person (assets ≤75'000): CHF 55'000 Married couple (assets ≤125,000): CHF 105,000 (See complete scales in the guide) |

| Tax rate reduction | Other | 50% for married couples and single-parent families (Full splitting - automatic, ICC only) |

1. Medical expenses

Automatic lump-sum deduction

Medical expenses are an important deduction, but their eligibility threshold is higher than in other cantons. To be deductible, your medical expenses must exceed 5% of your income net (code 4.910).

Example of deductible expenses:

- Medical treatment and hospitalization

- Prescription drugs

- Medical devices

- Glasses and contact lenses (with medical certificate)

- Supplementary health insurance premiums

- Substantial dental costs

- Medically prescribed therapies

Practical example: Couple with a net income of CHF 80,000 and medical expenses of CHF 6,000 :

- Threshold: 80,000 × 5% = CHF 4,000

- Possible deduction: 6,000 - 4,000 = CHF 2,000

Disability-related expenses

People who take care of elderly, sick or disabled relatives can deduct the amount they actually receive as a tax deduction.’lump-sum allowances in home care.

Please note: This deduction only applies to cantonal tax.

2. Volunteer payments: optimize your donations

General conditions

Charitable donations represent an opportunity to reduce your tax burden while supporting causes close to your heart. The canton of Fribourg applies specific rules for this deduction.

Eligible organizations:

- Legal entities headquartered in Switzerland

- Tax-exempt institutions with a public service or charitable purpose

- Confederation, cantons, municipalities and their institutions

- Red Cross, Winter Relief, Pro Juventute

- Museums and public hospitals

- Assistance institutions

Deduction limits:

- Minimum amount: CHF 100 per fiscal year

- Maximum amount: 20% net income (code 4.910)

- Donations of cash and securities are accepted

- The date of payment is decisive for the deduction.

Advice on major gifts: If you are planning to make a substantial donation, please contact the cantonal tax department beforehand to avoid any misunderstanding regarding deductibility. In special cases of overriding public interest, the Conseil d'Etat may authorize a deduction in excess of 20%.

List of institutions: A non-exhaustive list of tax-exempt legal entities headquartered in Fribourg is available.

3. Social deductions for children

The canton of Fribourg applies a particularly generous system of child deductions, but with one particularity: the amount decreases progressively according to the taxpayer's net income.

Conditions of eligibility

The deduction is granted for:

- Each minor child (born between 2008 and 2025)

- Every child learning or studying

- Children with a gross annual income of less than CHF 18,000

Important rule: The situation on December 31 is decisive. However, the deduction is maintained if the child dies during the year.

Notable exceptions:

- A child who starts a long-term gainful activity in November is no longer considered a dependent on December 31.

- A child who stops working at the end of November to go back to school remains a dependant on December 31.

Scale of deductions based on net income

Tax deductions for children based on net income in Switzerland decrease progressively as income rises.

- For 1 child: The deduction starts at CHF 8,600 for incomes up to CHF 62,700 and decreases in increments of around CHF 100 to CHF 7,100 for incomes over CHF 76,701.

- For 2 children: The deduction starts at CHF 17,200 for incomes up to CHF 72,800 and gradually decreases to CHF 14,200 for incomes over CHF 86,801.

- For 3 children: The deduction starts at CHF 26,800 for incomes up to CHF 82,900 and drops to CHF 22,300 for incomes over CHF 96,901.

- For 4 children: The deduction starts at CHF 36,400 for incomes up to CHF 93,000 and decreases to CHF 30,400 for incomes over CHF 107,001.

4. Other social deductions

Other dependents

Deduction of CHF 5,000 for each needy person you support for at least CHF 6,700 per year.

Terms and conditions:

- The person is unable to support him/herself

- You pay the maintenance costs

- This deduction does not apply to spousal payments.

Taxpayer in school or apprenticeship

Deduction of CHF 3,600 for the taxpayer himself if he is:

- An apprentice or student

- Maximum age 25

- This deduction applies to the taxpayer's own tax return.

Wheelchair activity

Deduction of CHF 2,500 if you meet these three cumulative conditions:

- Medical or insurance certificate proving the need to use a wheelchair

- You are not receiving an AHV/DI pension

- You are in gainful employment (main or secondary)

Orphan of mother and father

- Minor

- Students or apprentices

This deduction must be entered on the taxpayer's own tax return. The system of limitations and reductions follows the same scale as for child deductions.

5. Low-income deduction

The canton of Fribourg provides an additional deduction for people on modest incomes, with scales differentiated according to family situation and pensioner status.

- AHV/IV pensioners living alone without children: The deduction starts at CHF 9,100 for incomes up to CHF 24,300 and gradually decreases to CHF 0 for incomes over CHF 54,301.

- AHV/IV pensioners married or with child(ren): The deduction starts at CHF 11,100 for incomes up to CHF 30,300 and decreases to CHF 0 for incomes over CHF 57,301.

- Non-annuitant taxpayers living alone: The deduction starts at CHF 4,100 for incomes up to CHF 20,300 and decreases to CHF 0 for incomes over CHF 40,301.

- Non-annuitant taxpayers married or with child(ren): The deduction starts at CHF 5,100 for incomes up to CHF 24,300 and decreases to CHF 0 for incomes over CHF 49,301.

6. Social deduction on wealth

The canton of Fribourg also offers a deduction on net wealth, exclusive to cantonal tax.

- Single people without children: The deduction starts at CHF 55,000 for assets up to CHF 75,000 and gradually decreases to CHF 0 for assets over CHF 200,001.

- Married couples or single people with children: The deduction starts at CHF 105,000 for assets up to CHF 125,000 and decreases to CHF 0 for assets over CHF 300,001.

In short, as net wealth increases, the deduction decreases, and couples or parents benefit from higher deduction amounts.

7. Deduction for recognized forms of pension provision

2nd pillar purchases

The buying back contribution years in occupational pension plans represent a significant tax advantage. However, the amounts paid in cannot be withdrawn as capital for a period of three years. All early withdrawal results in the cancellation of the tax advantage, accompanied by a tax reminder procedure.

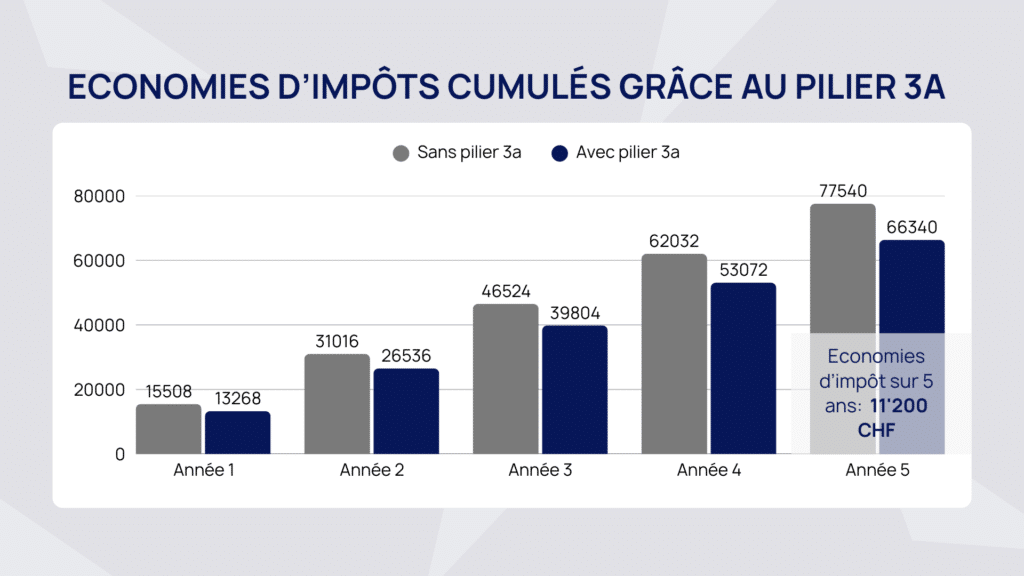

Contributions to a pillar 3a pension plan

- If you are affiliated to the 2nd pillar: maximum CHF 7,258 for 2025

- If you are not affiliated to the 2nd pillar: 20% of net earned income (maximum CHF 36,288)

Optimize your taxes with Invexa

Life insurance payments

This item covers insurance for which premiums have not already been taken into account elsewhere, such as life insurance with or without surrender value, insurance covering only the risk of death, daily allowance insurance and life annuity insurance.

The maximum deductible amounts are from:

- Single person: CHF 750

- Married persons living in the same household: CHF 1,500

8. Business expenses

Income acquisition costs for salaried employees

Income acquisition expenses apply only to dependent activities as their main occupation. Salaried secondary occupations are subject to specific rules. Furthermore, when one spouse works in the other's business, expenses are only allowed if a genuine employment relationship can be proven, with social insurance coverage, and if this activity clearly goes beyond normal mutual assistance between spouses.

No deductions are allowed for expenses already covered by the employer, or for expenses related to children in training, such as transport, accommodation or board.

Transportation to and from work

Travel expenses can be deducted when the distance between the home and the workplace is exceeds 1.5 km. The deduction is capped at CHF 12,000 per year for cantonal and municipal taxes.

Calculation methods vary according to the means of transport used:

- Public transport: deduction of actual expenses in 2nd class (or 1st class if justified)

- Bike: annual lump sum

- Motorized vehicles: in principle, the deduction corresponds to the cost of public transport.

When the use of public transport is not possible or reasonably required (lack of connections, unfavorable schedules, infirmity, remoteness), a deduction per kilometer is allowed, with decreasing rates according to the number of kilometers traveled.

Meals away from home, weekly holiday and night work

Meals eaten away from home are deductible when it is impossible to return home for lunch, notably because of distance, irregular working hours or short breaks. The deduction is limited to CHF 15 per meal, with an annual ceiling. When the employer subsidizes meals, only a half-deduction is allowed.

People staying at their place of work during the week can deduct:

- Meal expenses

- Accommodation costs

- Travel expenses for the weekly trip home

People working continuous shifts or night shifts can also benefit from a daily deduction, provided that these expenses are not already covered by the employer. In principle, this deduction cannot be combined with deductions for meals or accommodation away from home.

Other business expenses

A flat-rate deduction corresponding to 3 % of net salary is provided, with an annual minimum and maximum. It covers in particular:

- Professional tools

- Hardware and software

- Specialized books

- Professional clothing

- Voluntary teleworking costs

- Exceptional wear and tear due to activity

- Using a private room for business purposes

Secondary salaried activity

For a secondary salaried activity, a deduction proportional to income is allowed, within minimum and maximum limits. Any higher deductions must be supported by documentary evidence.

When both spouses are gainfully employed and taxed jointly, a deduction is granted on the gross income. lowest income. This rule also applies when one spouse provides significant professional assistance to the other.

9. Real estate-related deductions

Building maintenance costs

- The deduction of actual expenses, or

- flat-rate deduction.

Flat-rate deduction: it applies to private real estate and is calculated on the gross yield:

- 10 % for buildings constructed after 2015

- 20 % for older buildings

Deduction of actual costs: actual costs must be detailed, justified and correctly broken down. Only amounts actually paid are taken into account, after deduction of subsidies, insurance or discounts. Remuneration for the owner's personal work is never deductible.

Energy savings and demolition

- Replacement of obsolete installations

- Adding new installations to existing buildings

- Private photovoltaic solar installations

These deductions are not allowed for buildings new or during the first 5 years following their construction.

If the amounts cannot be fully deducted in a single year, the balance can be deducted in the following way deferred over the following two fiscal periods.

The demolition costs for a replacement building are also deductible, subject to conditions and prior notification to the tax authorities.

9. Bank charges and other deductions

Securities administration fees

In particular, only expenses directly linked to the management of the securities are deductible:

- Custody fees

- Safe deposit box rental

- Collection fees

- Payroll expenses

Expenses incurred for the purchase or sale of securities, consultancy fees, tax costs or personal work are not deductible.

Bets linked to gaming winnings: Stakes on winnings from lotteries, betting or casino games are deductible at a flat rate of 5 % du gain, with a ceiling of CHF 5,000 per gain.

Annuities, long-term charges and housing rights

- Annuities arising from legal, contractual or inheritance obligations

- Long-term charges linked to real rights, such as housing rights

Alimony paid

The alimony and child support paid to a divorced or separated spouse are deductible if proven.

Contributions paid on behalf of minor children are also deductible when the beneficiary parent has parental authority.

On the other hand, contributions paid for children over the age of majority are not deductible and are not taxable in the child's home. Social security deductions for children depend on the actual cost of maintenance.

10. Tax rate reduction: full splitting

The canton of Fribourg applies a system of full splitting particularly advantageous for married couples and single-parent families.

Splitting principle at 50%: Overall taxable income (code 7.910) is taxed at the rate corresponding to 50% of this income. The minimum tax rate (1%) remains applicable.

This discount automatically applies to:

- All married couples who are not living separate and apart

- Couples not in gainful employment (AHV/IV pensioners)

- Single-parent families: widowed, separated, divorced or single taxpayers living in the same household with children or needy people for whose maintenance they are responsible

Important: No action is required, as the reduction is applied automatically by the tax authorities.

Tips for optimizing your Fribourg tax return

1. Check your situation on December 31

2. Plan your BVG & 3a buy-ins

If you are planning to buy into your pension fund, spread the purchases over several years rather than making them all at once. This maximizes the tax advantage by avoiding excessive growth.

Proceed to redemptions in pillarv3a from 2026 (for the year 2025).

4. Check the eligibility of institutions

Before making a major donation, consult the list of recognized institutions on the cantonal website, or contact the tax authorities directly.

5. Keep all your receipts

6. Take advantage of the 3rd pillar until December 31

To ensure that your 3rd pillar (A and/or B) is deductible for the current tax year, it must be made before December 31. Don't delay, as some establishments have processing deadlines.

Did you know?

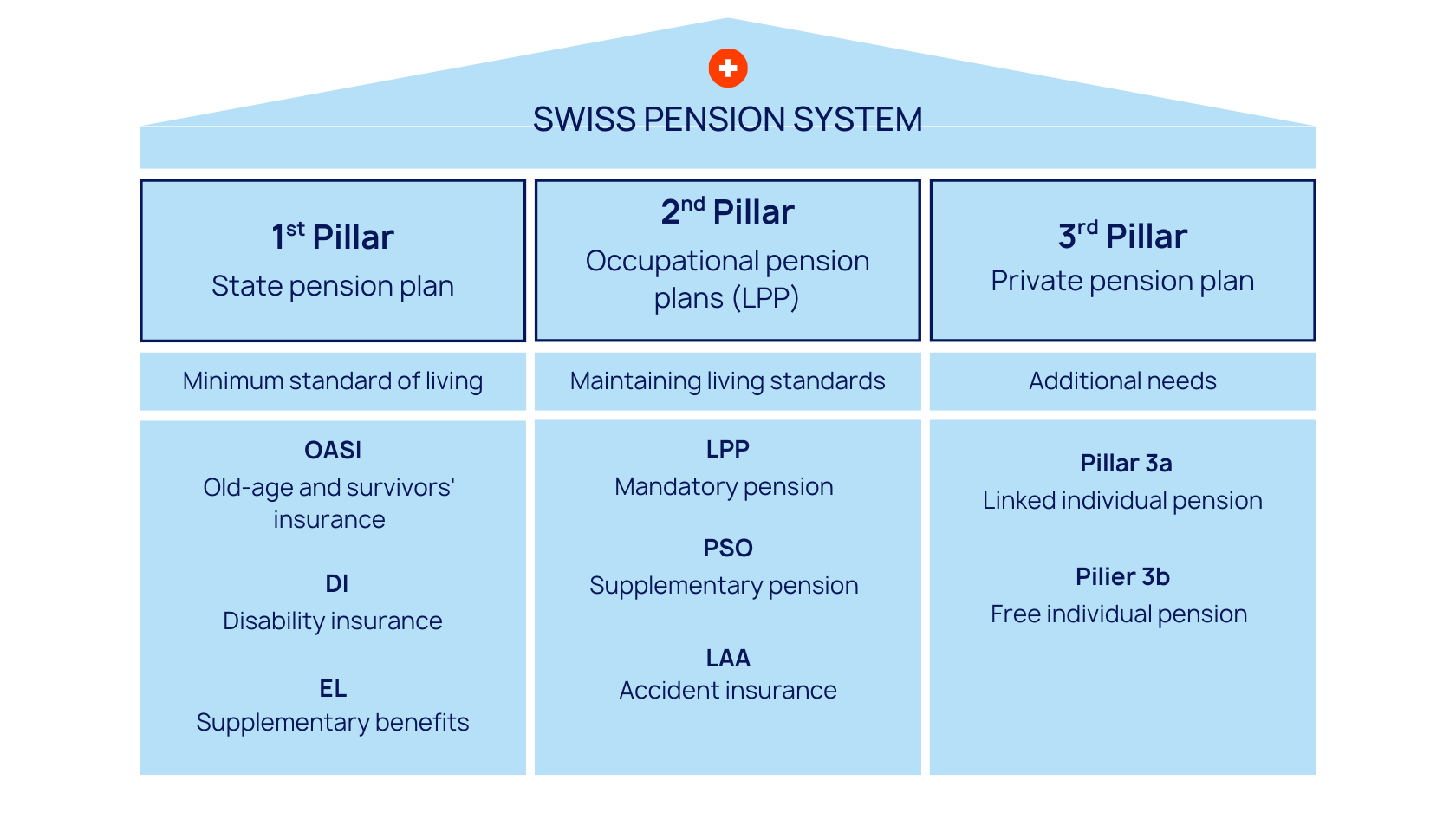

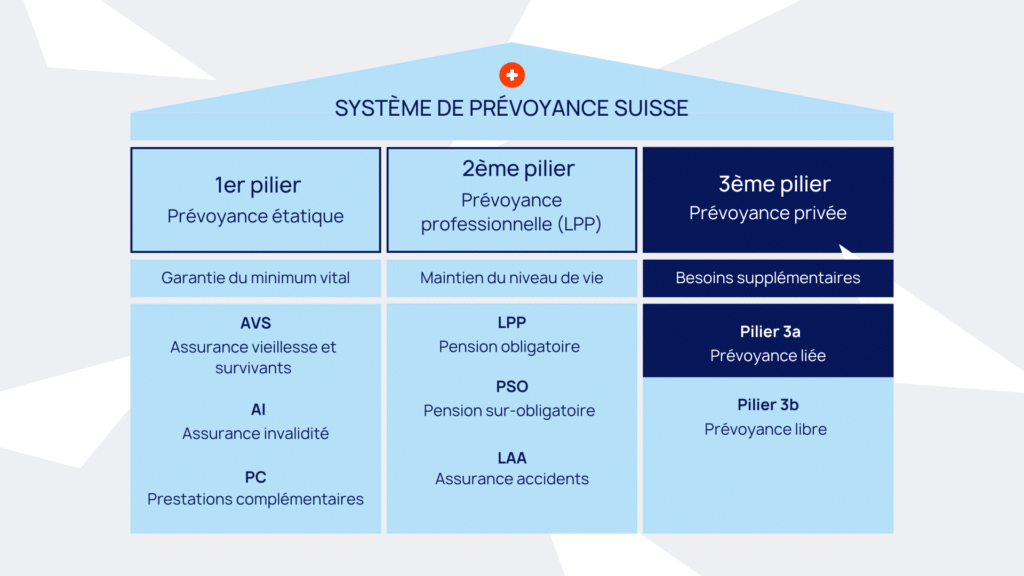

The combined benefits of the 1st pillar and 2nd pillar generally cover only about 60% of previous income.

What is the 13th AHV pension?

The 13th AHV pension represents an additional monthly pension paid once a year, in December, to all recipients of an old-age pension. In concrete terms, it corresponds to one twelfth of the total amount of old-age pensions received during the year.

The amount of the 13th AHV pension is calculated according to the following rules:

- It is equivalent to 1/12 of your annual retirement pension.

- Supplementary pensions, children's pensions and special supplements (in particular for women of the AVS 21 transitional generation) are not taken into account.

- The amount is rounded to the nearest franc

- A precise calculation is only possible in December, as the pension may vary during the year.

Who benefits from the 13th AVS pension?

All individuals entitled to an old-age pension in the month of December will automatically receive the 13th AHV pension. The payment will be made at the same time as the regular December pension.

Important to remember

Only old-age pensions are affected by this additional annual payment. Survivors’ pensions (widows, widowers, orphans) and disability pensions (IV) will continue to be paid only 12 times per year.

In the event of death between January and November, beneficiaries will not be entitled to the payment of the 13th AHV pension.

Implementation schedule

The first payment of the 13th AHV pension will take place in December 2026. The payment arrangements were adopted by the Federal Council at its meeting on November 12, 2025, and then unanimously approved by the National Council.

No action is required on your part: the payment will be made automatically if you receive an old-age pension in December.

Financing the 13th AHV pension

The cost of this measure is estimated at CHF 4.2 to 4.3 billion per year from 2026, of which around 850 million will be borne by the Confederation. Without additional funding, the AHV compensation fund would rapidly fall below the legal threshold of 100% of annual expenditure.

The Federal Council proposes to finance the AHV through a uniform increase in VAT (standard rate at 8.8%, reduced rate at 2.8%, and accommodation at 4.2%), which would ensure the system’s balance until 2030. Meanwhile, the Council of States favors a mixed solution combining a moderate increase in employee contributions starting in 2028, a capped VAT increase (with 0.5 points dedicated to the 13th AHV pension), and a relaxation of the compensation fund. This approach aims to better distribute the burden between workers and retirees and to prepare for potential future reforms, while parliamentary discussions continue in 2026 to reconcile the positions of both chambers.

Impact on supplementary benefits

The 13th AHV pension will not be taken into account when calculating the income required to qualify for the supplementary benefits (PC). It will therefore not lead to a reduction or elimination of any of your PCs.

Anticipating pension gaps

While the 13th AHV pension is a welcome improvement, it does not address the structural challenges of old-age provision in Switzerland. Pensions from occupational pension funds continue to decline due to low interest rates and increasing life expectancy.

All too often, AHV and occupational pension benefits cover only 50% of the last salary, while 70% to 80% is needed to maintain one’s standard of living. This gap in coverage must be filled through private savings (3rd pillar).

Our recommendation

- Take stock of your future income and expenses

- Drawing up a retirement budget

- Calculate your pension gaps precisely

- Set up an appropriate financing plan

Even with the 13th AHV pension, careful planning is still essential if you want to enjoy your retirement with peace of mind.

Need help analyzing your situation? Our pension experts can assist you in setting up a retirement planning strategy tailored to your needs. Contact us for a personalized, no-obligation assessment.

Frequently asked questions about the 13th AHV pension

No. Only old-age pensions are paid 13 times a year. Disability pensions continue to be paid 12 times a year.

A precise calculation is only possible in December of the year of payment, as your pension may vary during the year. For an estimate, divide your annual retirement pension by 12.

The competent fund is the one that pays your December AHV pension. Contact it directly for any information requests.

No. Survivors' pensions (widows, widowers and orphans) are not affected by the 13th pension. Only old-age pensions benefit from this additional payment.

If you die between January and November, your heirs will not be entitled to the 13th AHV pension for that year.

No. The extraordinary supplement granted to women born between 1961 and 1969 is paid only 12 times a year. Only the basic old-age pension is paid 13 times.

Yes, like the ordinary AVS pension, the 13th pension is subject to income tax.

Did you know?

The combined benefits of the 1st pillar and 2nd pillar generally cover only about 60% of previous income.

Pension gaps: more than just a question of money

When discussing pension gaps related to part-time work, the first thing that comes to mind is the reduction of retirement capital. This is indeed a major issue, but it is not the only one. Gaps also affect risk coverage: life insurance, disability insurance in case of illness (LPP) or accident (LAA).

This distinction is crucial because these two types of risks are treated differently. Accident coverage falls under the LAA (Accident Insurance Act), while protection in the event of disability due to illness depends on your pension fund (LPP). Poorly planned part-time work can leave you vulnerable on both fronts, but especially in the case of illness-related disability.

The main problem: lack of pension fund affiliation

Most people working part-time are not affiliated with a pension fund. It should be noted that the LPP entry threshold is set at CHF 22,680 per year (as of 1.1.2026). Below this amount, you are simply not insured under the 2nd pillar.

In practical terms, this means:

- No capital accumulation for retirement via the 2nd pillar

- No death cover to protect your loved ones

- No disability insurance in the event of illness (UVG only covers accidents)

Voluntary 2nd pillar affiliation

Even if your salary is below the LPP/BVG threshold, some pension funds allow voluntary affiliation. This option can be attractive for obtaining death and disability coverage while also accumulating retirement capital.

Check with your employer to see if the rules of their pension fund allow for this option. If not, other solutions are available.

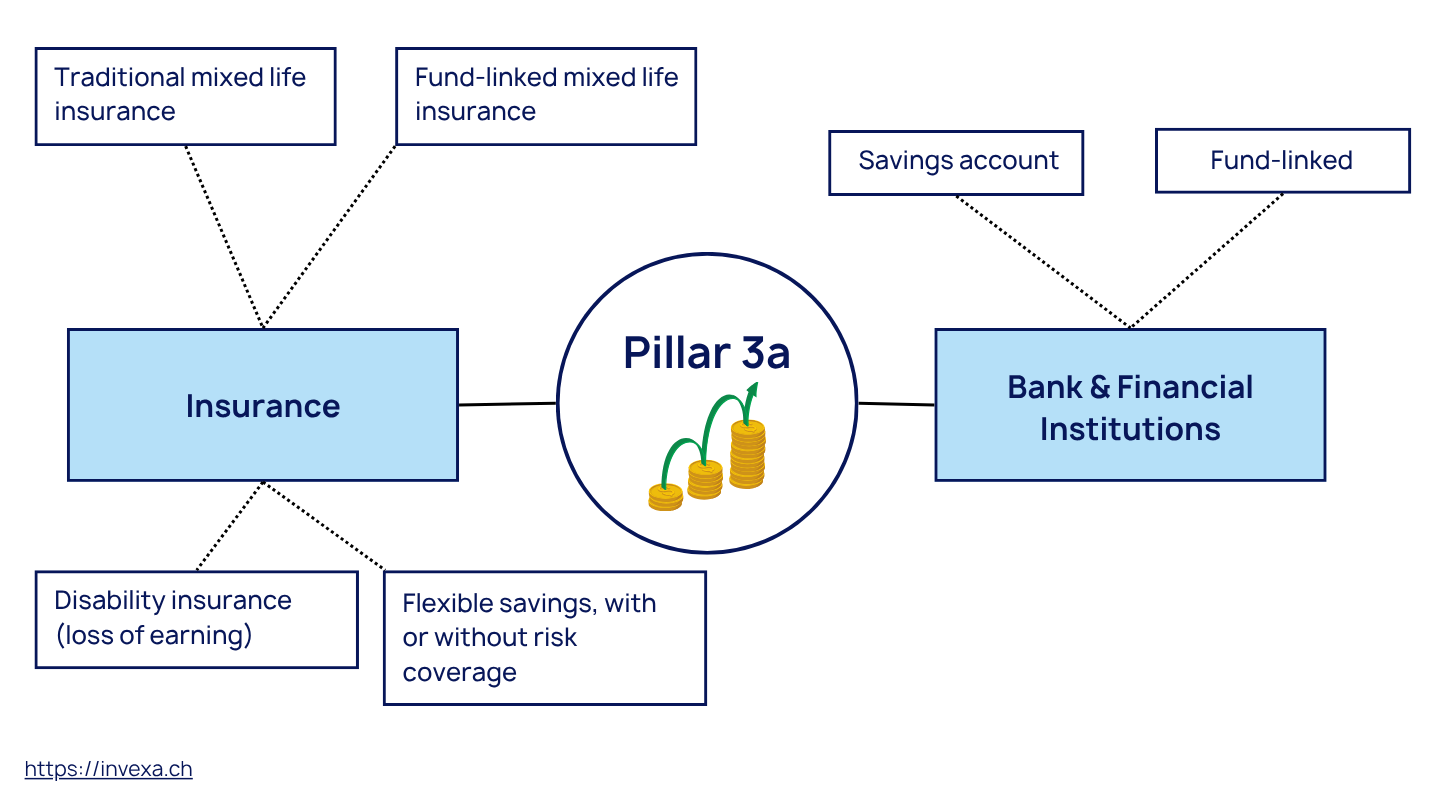

The solution: Pillar 3a as an essential alternative

In the absence of LPP coverage, the 3rd pillar (tied pension plan) becomes your main tool to fill these gaps. However, be aware that not all 3rd pillar plans are equally suitable for your situation.

3a in insurance: the solution tailored for part-time work

For part-time workers without LPP affiliation, a 3rd pillar in insurance offers several decisive advantages:

- Death and disability protection: Unlike a 3a bank policy, a 3a insurance policy includes cover in the event of death or disability. These guarantees compensate for the absence of BVG protection.

- Guaranteed savings: even in the event of disability, your contributions continue to be paid, thanks to the waiver of premiums. Your retirement capital continues to build up without you having to pay.

- Flexibility: you can tailor the level of coverage to your personal situation and protection needs.

Pillar 3a contribution limits

In 2026, it will be possible to pay out amounts in tied personal pension plans:

- Employees affiliated to a pension fund: Up to CHF 7,258 / year

- Self-employed or employees not affiliated to a pension fund: 20% of income, maximum CHF 36,288

If you are not affiliated with a pension fund due to part-time work, you therefore benefit from a significantly higher contribution ceiling. This is an opportunity to take advantage of to compensate for the absence of a 2nd pillar, provided you have the financial capacity to do so.

Complete with a 3a bank

Once risk coverage is secured through an insurance-based 3rd pillar, you can consider supplementing it with a bank-based 3rd pillar for the purely savings component. This approach offers:

- More flexibility on payments (no obligation to make regular payments)

- Potentially from higher yields on investment funds

- A slightly higher liquidity in case of need (under strict conditions)

A combined strategy is therefore ideal: a 3a insurance policy for protection, complemented by one or more 3a bank policies to maximize savings within the annual limit.

Why choose Invexa for your 3rd pillar?

- We are one of the few brokers who clearly explain the real costs, in plain language, with no hidden catches.

- We focus on fund performance, the transparency and the relevance for your situation, not about pushing a product.

- We work exclusively with selected service providers, and we only recommend solutions that really suit you.

Spouse protection: an often overlooked aspect

If you work part-time and care for children, it is essential that your partner names you as beneficiary of their pension fund, life insurance, and 3rd pillar plan.

Key point: this protection is automatic if you are married, but not if you are in a cohabiting relationship. In that case, your partner must take explicit steps to designate you as a beneficiary. Certain conditions must be met; generally, five years of living together are required.

Accident insurance: not to be forgotten

Under the LAA, you are insured against both occupational and non-occupational accidents if you work more than 8 hours per week for the same employer.

If you work less than 8 hours per week, you remain covered for occupational accidents but not for non-occupational accidents. In that case, you must arrange this coverage yourself through basic health insurance, where the gaps can be significant.

Warning: the amount of daily benefits and pensions depends on your insured earnings, which are naturally reduced in the case of part-time work. Make sure that the coverage level is sufficient to maintain your standard of living in the event of an accident.

Concrete steps to secure your pension coverage

To avoid unpleasant surprises, here are the steps to follow:

1. Check your LPP/BVG membership: ask your employer for your pension certificate. If your annual salary is less than CHF 22,680, find out whether you can join voluntarily.

2. Open a 3a in insurance: Choose this solution to benefit from death and disability cover, which compensates for the absence of a 2nd pillar.

3. Complete with a banking 3a: if your finances permit, maximize your payments up to the annual limit.

4. Secure your family situation: if you are cohabiting, make sure you are named as beneficiary in your partner's pension fund, life/death insurance and Pillar 3a.

5. Check your accident coverage: confirm that you are insured against non-work-related accidents, especially if you work less than 8 hours a week.

6. Check your AHV statement regularly: order your individual account statement (CI) to check that there are no gaps in your contributions. You have five years in which to fill them.

Concrete steps to secure your pension coverage

Part-time work need not be synonymous with future financial insecurity. With the right strategy and the right tools, such as Pillar 3a insurance for protection and Pillar 3a banking for savings, you can effectively compensate for the absence of BVG coverage.

The key is to act quickly: every year without protection is a year in which you and your loved ones are exposed to significant financial risk. Don't wait to put your pension strategy in place.

Need help analyzing your situation? Our pension experts can help you set up a strategy tailored to your part-time situation. Contact us for a no-obligation personal assessment.

Frequently asked questions

You are automatically enrolled in a pension fund if your annual salary exceeds CHF 22,680 (as of 1.1.2026). Below this threshold, you are not insured under the 2nd pillar, unless your pension fund allows for voluntary affiliation.

- The maximum amount for the 3rd pillar in 2025 is CHF 7,258 for individuals affiliated with a pension fund (LPP).

- For self-employed individuals without a 2nd pillar, the ceiling is 20% of income, up to CHF 36,288.

The 3rd pillar can be withdrawn in the following cases:

- 5 years before AHV retirement age

- Purchase of principal residence

- Mortgage amortization

- Departure from Switzerland

- Independence

- Disability or death

There are a wide range of options for the 3rd pillar, either through a bank or an insurance provider. Most products can be subscribed to within both tied pension schemes (pillar 3a) and flexible pension schemes (pillar 3b).

In insurance, a third pillar is often set up in the form of a life insurance policy or income protection insurance, while in banking, a 3a or 3b most often corresponds to a standard savings account or one linked to investment funds.

Comparing 3rd pillar plans will help you choose the solution best suited to your profile and goals.

For part-time workers without LPP affiliation, a insurance-based 3rd pillar is generally recommended as the first option because it offers:

- Death and disability cover to compensate for the absence of a 2nd pillar pension plan

- Waiver of premiums in the event of disability

- Protection for your loved ones

Yes, if you are affiliated with a pension fund (salary > CHF 22,680), you can make voluntary buy-backs to cover gaps in your pension provision. These purchases are tax-deductible.

What is the 3rd pillar?

1. Pillar 3a (tied pension provision): primarily intended for retirement, it offers significant tax advantages by allowing contributions to be deducted from taxable income. For 2025, the maximum amount deductible is CHF 7’258 for employees affiliated with a pension fund. In return, the capital remains locked in until retirement, except under specific conditions (home purchase, moving abroad, starting self-employment).

1. Pillar 3a (tied pension provision): mainly intended for retirement provision, it offers tax advantages but imposes certain withdrawal conditions.

2. Pillar 3b (unrestricted pension provision): more flexible, allowing more flexible use of the savings accumulated.

AXA 3rd pillar solutions

AXA offers a 3rd pillar insurance (3a/3b) with risk coverage. The offer is structured around three distinct plans, each meeting different objectives.

1. SmartFlex Pension Plan (3a/3b)

The principle is based on regular payments from CHF 600 per year (i.e. CHF 50 per month) and until maximum amount in 3a. This accessibility makes it possible to start early, even with a limited budget. The minimum term is 7 years for Pillar 3a and 10 years for Pillar 3b.

Flexible premium allocation is the central element of SmartFlex. With each payment, you decide how to divide your premium between 2 compartments:

1. The secure capital functions like a traditional savings account. Your money is legally guaranteed at 100% within AXA’s tied assets. It earns a technical interest rate (currently 0% according to the provided offer) plus a potential variable surplus interest (projected at 1.50% in the moderate scenario). The drawback: potentially limited returns over the long term.

2. The performance-oriented capital is invested in equities through diversified funds. You benefit from financial market growth and historically higher returns. The capital is guaranteed up to the current value of the fund units. The advantage: higher return potential driven by equity markets. The drawback: short-term fluctuations depending on market movements.

Key features

- Periodic premium from CHF 600 per year

- Minimum duration of 7 years for 3a, 10 years for 3b

- Coverage of death risk and disability included

- Tax benefits and inheritance lien

2. SmartFlex Capital Plan (3a/3b)

The AXA SmartFlex Capital Plan is an investment solution under the 3a pillar (transfer only) and 3b pillar that combines performance, security, and flexibility. You can freely decide what portion of your capital is invested in equities to seek returns and what portion remains securely placed at a preferential rate currently set at 2.2%. This allocation can be adjusted at any time, free of charge.

One of the great advantages of SmartFlex is its tax benefitsPillar 3b: dividends and interest are not subject to income tax if the Pillar 3b conditions are met. In the event of death or bankruptcy, the capital also benefits from legal protection, as it is excluded from the estate and protected from creditors. Thanks to very low fund charges, similar to those of large institutional investors, the potential return is more attractive than on a conventional savings account.

You can strengthen the security of your investment by activating, free of charge and at any time, options such as staggered investment management (to smooth out market entry risks), gain protection, or the progressive reallocation of capital towards the end of the contract.

Key features

- Minimum single contribution of CHF 15,000 for 3a, CHF 25,000 for 3b

- Time between 10 and 30 years

- Old-age provision with death cover minimum

- Capital collection at maturity

3. SmartFlex Income Plan (3b only)

The AXA SmartFlex Income Plan is designed for those who wish to turn a single lump sum into regular income while maintaining full control over their savings. You make an initial contribution of CHF 15,000 or more and define the amount, frequency, and duration of the payments you wish to receive. If your needs change, the contract remains flexible — you can adjust both the withdrawals and the capital allocation at any time.

The investment is divided into two parts. The secure capital earns a fixed preferential rate and is 100% protected in the event of AXA’s insolvency. The performance-oriented capital, on the other hand, is invested in diversified equity funds according to the investment theme you choose.

Key features

- Minimum single contribution of CHF 15,000

- Time between 10 and 30 years

- Preferred interest rates

- Plannable monthly income

Comparison of the three AXA plans

- Criteria

- Pension plan

- Capital Plan

- Income Plan

- Main objective

Savings + protection

Placement

Regular income

- Financing

Periodic premium

Lump sum

Lump sum

- Type of plan

3a/3b

3a (transfer)/3b

3b

- Risk insurance

Yes

No

Four investment themes available

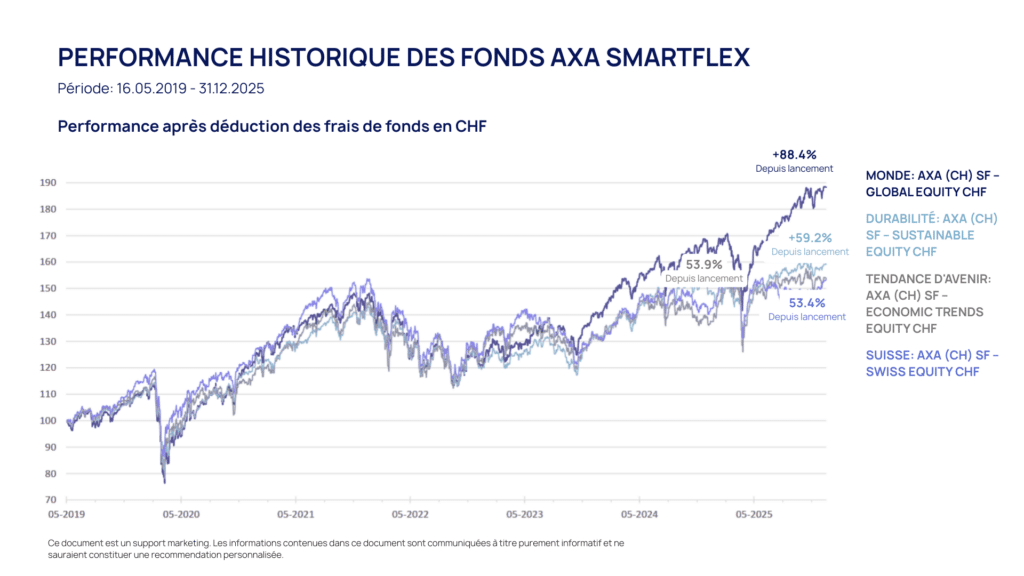

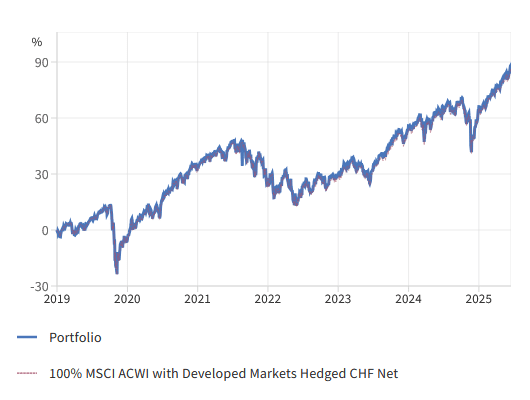

- World - Replicates the MSCI ACWI index (2,558 companies, 47 countries). Low-cost passive management (0.16%/year). High exposure to the United States (65%), followed by Japan (4.9%), the United Kingdom (3.4%) and China (3.2%). Main sectors: technology (23%), finance (18%) and consumer (11%). Ideal theme for global diversification.

- Switzerland - Invested in major Swiss companies (Nestlé, Novartis, Roche). Offers familiar but geographically and sectorally concentrated exposure. SPI historical performance: +7.2%/year over 25 years.

- Durability - Selection of ESG-compliant companies, excluding tobacco, weapons, coal, oil and gas. Combines ethical values with competitive returns.

- Future trends - Focus on innovative sectors (AI, renewable energies, digital healthcare). Riskier in the short term, but high potential in the long term.

What are AXA's 3rd pillar fees?

AXA's SmartFlex plan also stands out for its clear, low-cost structure. Fund charges vary according to the investment theme chosen: between 0.13 % and 0.39 % per annum, and there are no issue or redemption fees. When contract management and administration fees are added, the total cost (including TER) averages around 0.9 to 1.3% per year, according to configuration and the duration of the plan. In all cases, contract fees are as follows indicated clearly in the’offer.

This is a low level for an insured pension product, especially when compared to other 3a solutions on the market, which often exceed the 2 %. In practice, AXA manages to keep these costs down thanks to its largely passive and institutional management. AXA's Pillar 3a is one of the least expensive insurance products in Switzerland.

Are you interested in AXA's 3rd pillar solution?

Receive a offer as well as a objective assessment within 24 hoursadvantages, limits and relevance to your age, professional situation and savings objectives.

Conclusion

AXA's SmartFlex is one of the world's leading pension solutions. modern and efficient, designed for those who want to grow their savings without tying their hands. By combining flexibility, tax advantages, security options and controlled costs, this plan brings the world of insurance closer to that of pure investment.

The result is an intelligent hybrid product: secure enough for retirement, but performing well enough to generate real long-term capital growth thanks to high-quality funds with very competitive fees (TER at 0.13% for the «World» fund). For those looking for an alternative to the classic 3a account, and who want to retain control over their allocation between security and yield, SmartFlex is clearly one of the most coherent options on the Swiss market today.

Frequently asked questions

AXA offers 4 funds for SmartFlex products:

1. AXA (CH) Strategy Fund Global Equity CHF (TER: 0.13%)

2. AXA (CH) Strategy Fund Swiss Equity CHF (TER: 0.37%)

3. AXA (CH) Strategy Fund Trends Equity CHF (TER: 0.34%)

4. AXA (CH) Strategy Fund Sustainable Equity CHF (0.24%)

The best-performing funds is the historical Global Equity CHF (1), a passively managed global index fund that replicates the MSCI ACWI, hedged in Swiss francs at around 85 % against currency risks. The TER (annual costs) amounts to only 0.13%. Performance since launch in 2019 amounts to +87.72%.

AXA’s 3rd pillar is aimed at anyone looking to build capital over the long term while benefiting from a favorable tax framework.

It is particularly well suited for those who wish to prepare for retirement proactively, protect their loved ones in the event of death, or simply invest in a disciplined way. Thanks to its flexibility, SmartFlex adapts equally well to young professionals, self-employed individuals, or families seeking a balance between security and performance.

The difference between 3a and 3b is as follows:

- Pillar 3a is linked to occupational pension provision: deposits are tax-deductible, but withdrawals are restricted by law (retirement, property purchase, independence, etc.).

- Pillar 3b, However, the money remains accessible at all times, and some solutions (such as SmartFlex 3b) offer inheritance benefits and protection in the event of bankruptcy.

In all cases, compare the 3rd pillars will help you find the solution that's best for you.

Returns depend on the proportion invested in yield-oriented capital (equities) and the investment theme chosen. Historically, SmartFlex funds have posted solid performances: the «World» theme, for example, has generated 87.72% in returns (+10% annualized) since its launch in 2019. This fund has even outperformed its benchmark of 86.27. Naturally, results vary according to market and investment horizon.

Absolutely. You can switch from one theme to another, for example from «World» to «Sustainability», free of charge, at any time.

The minimum annual premium is around CHF 600 for versions 3a and 3b. For the SmartFlex income plan, the initial contribution must be at least CHF 15,000.

Historically, equity investments have delivered higher long-term returns than so-called “safe” assets such as bonds or savings accounts. If you have more than 15 to 20 years before retirement, allocating a portion to equities is often recommended to generate stronger returns.

The key is to adjust the allocation to your risk profile and gradually reduce the equity portion as you approach retirement.

In the event of a loss of earning capacity, AXA provides a premium waiver.

In practical terms, if you become unable to work due to illness or an accident, AXA steps in and continues paying the premiums on your behalf, ensuring that your retirement plan remains fully intact.

It works as follows:

- As soon as a loss of earning capacity of at least 25% is recognized, AXA covers a portion of the premiums.

- If the disability reaches 66 % or more, you are completely free of premium payments.

- The waiting period before coverage begins depends on the contract (3, 6, 12, or 24 months, depending on your selection).

During this period, your SmartFlex plan continues to function normally: savings remain invested, guarantees remain in force, and you do not lose your tax benefits or your protection in the event of death.

Main Tax Deductions in the Canton of Geneva

| Deduction | Category | Maximum amount |

|---|---|---|

| Travel expenses | Professional | ICC: max. CHF 534 IFD: max. CHF 3,300 |

| Meal expenses | Professional | CHF 15/day (max. CHF 3,200/year) CHF 7.50/day with employer contribution (max. CHF 1,600/year) |

| Other business expenses (flat rate) | Professional | 3% of net salary ICC: min. CHF 640, max. CHF 1,812 IFD: min. CHF 2,000, max. CHF 4,000 |

| Dual careers for spouses | Professional | ICC: CHF 1,051 IFD: 50% lowest net income (min. CHF 8,600, max. CHF 14,100) |

| Family deduction (married couple) | Family | CHF 2,800 |

| Building maintenance - Fixed price (≤10 years) | Housing | ICC: 15% rental value after allowance IFD: 10% gross rental value |

| Building maintenance - Fixed price (>10 years) | Housing | ICC: 25% rental value after allowance IFD: 20% gross rental value |

| Building maintenance - Actual costs | Housing | Energy-efficient investments, repairs, renovations, insurance, administration, additional property taxes |

| 3rd pillar A (employee with BVG/LPP) | Pension | CHF 7,258 |

| 3rd pillar A (self-employed without BVG/LPP) | Pension | 20% net income (max. CHF 36,288) |

| 2nd pillar (BVG) purchases | Pension | Gap amounts |

| Health insurance premiums | Pension | ICC: Premiums actually paid Child: max. CHF 3,965 19-25 years: max. CHF 12,842 Adult: max. CHF 17,122 IFD: Cumulative lump-sum deduction (see guide) |

| Interest on savings capital (debt) | Pension | IFD: Cumulative lump-sum deduction with insurance (see guide) |

| Childcare expenses | Family | Per child <14 ans ICC: max. CHF 26,320 IFD: max. CHF 25,800 |

| Dependent child or relative (fully loaded) | Family | ICC: 13,660 CHF IFD: CHF 6,800 (capped at CHF 10,508 if childcare costs deductible) |

| Half-dependent child or relative | Family | ICC: CHF 6,830 IFD: CHF 3,400 (Capped at CHF 5,254 if childcare costs deductible) |

| Single-parent deduction | Family | See conditions in the guide |

| Deduction for modest taxpayers | Family | See conditions in the guide |

| Maintenance payments | Family | Amount actually paid |

| Medical and sickness expenses | Health | ICC: Amount exceeding 0.5% of net income (code 92.20) IFD: Amount exceeding 5% of net income (code 92.20) |

| Disability-related expenses | Health | Full amount (without deductible) |

| Donations to charitable organizations | Other | ICC: max. 20% of net income (code 92.40) IFD: max. 20% of net income (code 92.40), minimum CHF 100 |

| Donations to political parties | Other | ICC: max. CHF 10,000 IFD: max. CHF 10,600 |

| Bank account and securities administration fees | Other | Effective, limited costs (see guide) |

1. Professional Expenses: Lump Sum or Actual Costs?

Automatic lump-sum deduction

For employees, a flat-rate deduction of 3% net income is applied by default. This lump sum has different ceilings depending on the type of tax:

- ICC: between CHF 640 and CHF 1,812

- IFD: between CHF 2,000 and CHF 4,000

This deduction is automatically calculated by GeTax on the basis of gross income less compulsory social security contributions (AVS/AI/APG, and unemployment/AANP/AMat) and contributions to the 2nd pillar.

When to opt for actual costs?

In some situations, the actual expenses incurred far exceed the 3% flat rate. This is particularly the case for people who live far from their place of work, or who have specific business expenses. In such cases, you can opt out of the flat-rate system and deduct your actual expenses, provided they can be justified. This option mainly concerns:

- Travel expenses

- Meal expenses

- Other expenses directly related to your professional activity

Travel expenses: strict limits

- ICC: maximum CHF 534 (regardless of transport)

- IFD: maximum CHF 3,300

- Public transport: effective subscription cost

- Bicycle, moped or light motorcycle: lump sum CHF 700

- Motorcycle (+50 cm³): CHF 0.40 per kilometer

- Automotive: generally limited to the cost of public transport, except in exceptional circumstances (lack of public transport, incompatible schedules, disability), in which case CHF 0.70 per kilometer

Meal expenses: eligibility requirements

- CHF 15 per day (maximum CHF 3,200 per year)

- CHF 7.50 per day if employer contributes to costs (maximum CHF 1,600 per year)

- CHF 15 per day (maximum CHF 3,200 per year) with no travel time requirement

- Shiftwork allowance: CHF 15 per day (maximum CHF 3,200 per year) if shown on salary certificate

- These two IFD deductions cannot be combined.

Is teleworking tax-deductible?

Teleworking only qualifies for a deduction in the following cases:

- One room in your home must be exclusively and permanently dedicated to your professional activity.

- The employer does not provide you with a workstation on its premises.

- You must be able to deduct the part of the rent corresponding to this room.

- Attach a copy of the lease and prove that the property is used exclusively for business purposes

- Expenses relating to personal convenience or paid by the employer are not deductible.

Workers outside the canton: what deductions?

- Travel expenses: 534 CHF (ICC) / 3,300 CHF (IFD)

- Meal expenses: CHF 15 per day (maximum CHF 3,200 per year)

- Travel expenses: 534 CHF (ICC) / 3,300 CHF (IFD)

- Meal expenses: up to CHF 30 per day for lunch and dinner (maximum CHF 6,400 per year)

- ICC accommodation costs: effective rent up to CHF 500 per month

- IFD accommodation costs: usual price of a room at the workplace

2. Pensions: Pillars 2 and 3A

2nd pillar purchases

The buying back contribution years in an occupational pension plan is an important tax deduction, but these payments must not be withdrawn as a capital sum for at least three years. A early withdrawal will result in a tax reassessment and cancellation of the deduction.

Contributions to a pillar 3a pension plan

- If you are affiliated to the 2nd pillar: maximum CHF 7,258 for 2025

- If you are not affiliated to the 2nd pillar: 20% of net earned income (maximum CHF 36,288)

Optimize your taxes with Invexa

Health and accident insurance

- Age range

- Maximum deduction 2025

- 0-18 years

- 19-25 years

- 26 years and over

- CHF 3,965

- CHF 12,842

- CHF 17,122

Important: Even if a subsidy fully covers your basic premium, report the total amount under code 52.21 and the subsidy under code 16.30.

For the IFD, health insurance premiums are combined with life insurance premiums and savings interest in an overall package:

- Situation

- Base amount

- If not affiliated to 2nd/3rd pillar

- Single person

- Couple

- For family responsibilities

- CHF 1,800

- CHF 3,700

- + CHF 700

- + 50% (2,700 CHF)

- + 50% if no member (CHF 5,550)

- + CHF 700

Life insurance: optimize your tax deductions

For persons domiciled in Geneva, the maximum deductible amounts for a life insurance in 3rd pillar B are:

1. Cantonal and municipal tax (ICC)

- Single / widowed / divorced / separated: CHF 2,232

- Married couple or registered partners: 3,348 CHF (2 × 1,674 CHF)

- Per dependent: 913 CHF

2. Direct federal tax (IFD)

- Single / widowed / divorced / separated: CHF 1,800

- Married couple or registered partners: CHF 3,600

- Per dependent: 700 CHF

In both cases, the amounts are increased by half if the taxpayer is not affiliated to a 2nd pillar or pillar 3a.

Invexa helps you choose the best life insurance policies

Medical expenses: high deductibility thresholds

- ICC: only the portion exceeding 0.5% of net income

- IFD: only the portion exceeding 5% of net income

Practical example: Couple with child, medical expenses of CHF 7,000

- Net income

- Threshold

- Deduction

- ICC

- IFD

- CHF 60,000

- CHF 80,000

- 300 CHF (0.5%)

- 4,000 CHF (5%)

- CHF 6,700

- CHF 3,000

Deductible medical expenses:

- Medical treatment and hospitalization

- Prescription drugs

- Therapeutic vaccinations

- Medical equipment

- Glasses and contact lenses

- Various therapies

- Treatments for drug dependence

Important: Supporting documents must be retained but not attached to the declaration.

Disability-related expenses

- Assistance costs

- Housekeeper and childcare expenses

- Transportation and vehicle expenses

- Guide dog expenses

- Home improvement costs

Or flat-rate annual deduction for recipients of disability allowances:

- Type of disability

- Annual amount

- Low impotence

- Medium impotence

- Severe impotence

- People who are deaf or on dialysis

- CHF 2,500

- CHF 5,000

- CHF 7,500

- CHF 2,500

4. Family deductions

Family expenses: significant amounts

For ICC:

- Full load: CHF 13,660

- Half-load: CHF 6,830

-

Capping if childcare expenses deducted: CHF 10,508 (full load) / CHF 5,254 (half load)

Capping if childcare expenses deducted: CHF 10,508 (full load) / CHF 5,254 (half load)

For IFD (CHF 6,800 per dependant):

- Each minor child you support

- Each adult child in training (as at 31.12 of the fiscal year)

- Each person unable to work (if your assistance amounts to at least CHF 6,800)

- Alternating custody: each parent can claim half the deduction

Childcare costs

Deductible expenses:

- Day-care centers

- After-school (before/after-school care, excluding school kitchens)

- Vacation camps and summer camps

- Vacation camps and summer camps

- Care at home or with a third party (day mothers, nannies, au pairs)

- Theme camps: fixed price CHF 50/day (maximum CHF 250/week)

Annual limits per child up to the month of the child's 14th birthday:

- ICC: CHF 26,320

- IFD: CHF 25,800

Important: Please enclose invoices with full details of the person being paid.

Deduction for dual-earner couples

- ICC: Flat-rate deduction of CHF 1,051 on lower income.

- IFD: Deduction of 50% from the net income of the lowest activity:

- Net income from lowest activity

- Deduction

- Less than CHF 8,600

- Between CHF 8,600 and CHF 17,200

- More than CHF 17,200

- Limited to net income

- CHF 8,600

- 50% of income (max. CHF 14,100)

Deduction for married couples (IFD)

Flat-rate deduction of CHF 2,800 for married couples or couples in a registered partnership, regardless of their activity.

Deductions for AHV/IV pensioners (ICC)

Decreasing deductions based on income are granted to beneficiaries of AHV pension/AI:

For couples (max. income CHF 98,080):

- Income

- 1 annuitant

- 2 annuitants

- 0 - CHF 61,300

- 61,301 - 69,509 CHF

- 69,510 - 78,464 CHF

- 78,465 - 87,632 CHF

- 87,633 - 98,080 CHF

- CHF 10,661

- CHF 8,529

- CHF 6,397

- CHF 4,264

- CHF 2,132

- CHF 12,260

- CHF 9,808

- CHF 7,356

- CHF 4,904

- CHF 2,452

For single people (max. income CHF 85,287): maximum deduction of CHF 10,661, decreasing according to a similar scale.

5. Maintenance Contributions and Life Annuities

Alimony: full deductibility subject to conditions

Amounts fully deductible:

- Pension for your ex-spouse (for himself/herself and any minor children in his/her care)

- Contributions to the other parent for your minor children born out of wedlock

Important: all supporting documents must be supplied (payments, copy of judgment, etc.). Pensions for adult children are deductible only up to the month of majority.

Life annuities paid

- Provide full beneficiary details

- Enclose proof of payment

- Copy of life annuity contract (if concluded during the year)

6. Donations and payments to political parties

Charitable donations: conditions and limits

Eligible organizations:

- Tax-exempt legal entities (public service, public utility, religious purpose)

- Confederation, cantons, municipalities and their institutions

Deduction limits:

- ICC

- IFD

- Total donations up to 20% of net income (before deduction of donations)

- Total donations up to 20% of net income (before deduction of donations)

- Minimum total of CHF 100 to be deductible

-

Non-deductible donations to churches and voluntary religious contributions

Non-deductible donations to churches and voluntary religious contributions

Payments to political parties

Deductible amounts:

- ICC: maximum CHF 10,000

- IFD: maximum CHF 10,600

6. Capital allowances (ICC only)

Social deduction on wealth

Basic amounts:

- Situation

- Deduction

- Single person

- Married/partnered couple

- Single person with minor children

- + Per family load

- CHF 87,632

- CHF 175,264

- CHF 175,264

- + CHF 43,816

The net personal assets of the adult child are subtracted from the CHF 43,816.

The net personal assets of the adult child are subtracted from the CHF 43,816. Deduction from business assets

- Deduction = 50% of assets invested in the business

- Pro rata to shareholding

- Maximum CHF 533,042

7. Property maintenance, bank charges and other deductions

Property maintenance costs

- Flat-rate deduction OR actual expenses

- See instructions for terms and conditions

Account and securities administration fees

- Actual costs, limited in certain cases

- Negative interest

Professional training costs:

- Maximum 12,756 CHF (ICC) / 13,000 CHF (IFD)

- Terms and conditions: Secondary II diploma OR 20 years minimum for other training

Deduction for occupational pension benefits

For services that began before certain dates:

- 20% of the pension if personal contributions represent at least 20% of the benefits

- 40% (IFD only) if personal contributions account for 100% of the benefit

- No deduction for benefits commencing on or after January 1, 2002

Non-taxable but declarable income

Social benefits:

- Supplementary OASI/DI benefits (SPC)

- Supplementary family benefits

- Supplementary benefits from the City of Geneva

- Allowances for dependent persons

- Transitional benefits for older unemployed people

- Social assistance from Hospice général

Other exempt income:

- Scholarships from the Scholarships and Student Loans Department (SBPE)

- Donations from public and private institutions

- Lump-sum benefits from 2nd and 3rd pillar A (taxed separately at 1/5 of the scale)

Non-deductible expenses

List of expenses excluded from any deduction:

- Maintenance costs for the taxpayer and his family (home rent, private expenses)

- Debt repayment

- Costs of acquiring, producing or improving assets

- Interest on construction loans

- Taxes on income, property gains and wealth

- Commissions not justified by name

- Secret commissions paid to public officials

If you are planning to buy into your pension fund, spread the purchases over several years rather than making them all at once. This maximizes the tax advantage by avoiding excessive growth.

Buy into 3a from 2026 (for the year 2025).

Tips for optimizing your tax return in Geneva

1. Keep all your receipts

2. Compare flat-rate and actual expenses

3. Plan your BVG & 3a buy-ins

If you are planning to buy into your pension fund, spread the purchases over several years rather than making them all at once. This maximizes the tax advantage by avoiding excessive growth.

Proceed to redemptions in pillarv3a from 2026 (for the year 2025).

4. Anticipate building work

5. Declare your childcare expenses

6. Take advantage of the 3rd pillar until December 31

To ensure that your 3rd pillar (A and/or B) is deductible for the current tax year, it must be made before December 31. Don't delay, as some establishments have processing deadlines.

Source: Guide to the 2025 personal income tax return, getax.ch, General Directorate of the Cantonal Tax Administration.

How are BVG lump-sum benefits taxed?

- In Switzerland, lump-sum benefits from pension funds (such as the 2nd pillar) are taxed at a reduced rate, corresponding to 1/5 of the usual tax rate in most cantons.

- The tax is collected by the canton of residence. A copy of the pension fund statement should be sent to the cantonal tax authorities.

- Persons domiciled abroad are taxed directly at the source in Switzerland.

Taxation of buybacks

A buy-in to the 2nd pillar allows you to fill gaps in your pension coverage. It is made directly with your pension fund, which will inform you of the amount you can buy in.

Buybacks are 100% tax-deductible, but to fully benefit from them, you must not withdraw your BVG capital within the following 3 years. In case of early withdrawal, the tax authorities will revoke the deduction by issuing a tax reassessment.

Tax on 2nd pillar withdrawals: rates by canton

The table below provides a detailed comparison of the tax rates applied to the withdrawal of LPP capital (also applicable to pillar 3a withdrawals) across all 26 Swiss cantons. The data is calculated for the 2025 tax year and reflects the situation of a single 65-year-old man with no dependent children and no religious affiliation.

We have selected realistic withdrawal amounts ranging from 50,000 CHF to 2,000,000 CHF, allowing you to estimate the tax applicable to your situation. The indicated rates include all taxes (federal, cantonal, and municipal).

| Canton, Commune | 50'000 | 100'000 | 200'000 | 300'000 | 500'000 | 1 mio | 2 mio |

|---|---|---|---|---|---|---|---|

| Aargau (Aarau) | 3.2 % | 4.9 % | 6.57 % | 7.43 % | 8.3 % | 8.8 % | 9.0 % |

| Appenzell Inner-Rhodes (Appenzell) | 2.4 % | 3.3 % | 4.33 % | 4.78 % | 5.2 % | 5.3 % | 5.3 % |

| Appenzell Ausserrhoden (Herisau) | 7.6 % | 8.0 % | 8.69 % | 9.14 % | 9.9 % | 11.1 % | 11.7 % |

| Bern (Bern) | 3.6 % | 4.7 % | 6.04 % | 6.97 % | 8.4 % | 9.7 % | 10.5 % |

| Basel-Landschaft (Liestal) | 3.5 % | 3.9 % | 4.59 % | 5.04 % | 6.7 % | 9.6 % | 9.7 % |

| Basel-Stadt (Basel) | 3.7 % | 5.3 % | 7.67 % | 8.66 % | 9.5 % | 10.0 % | 10.1 % |

| Fribourg (Fribourg) | 2.0 % | 3.3 % | 5.79 % | 7.74 % | 9.3 % | 10.4 % | 10.9 % |

| Geneva (Geneva) | 2.9 % | 4.6 % | 5.73 % | 6.57 % | 7.8 % | 8.5 % | 8.7 % |

| Glarus (Glarus) | 4.8 % | 5.2 % | 5.92 % | 6.37 % | 6.7 % | 6.9 % | 6.9 % |

| Grisons (Chur) | 2.9 % | 3.2 % | 4.04 % | 4.49 % | 5.7 % | 5.9 % | 5.9 % |

| Jura (Delémont) | 5.4 % | 6.2 % | 8.02 % | 8.92 % | 9.7 % | 10.1 % | 10.2 % |

| Lucerne (Luzern) | 3.8 % | 5.1 % | 5.07 % | 5.71 % | 8.0 % | 8.4 % | 8.5 % |

| Neuchâtel (Neuchâtel) | 4.9 % | 5.7 % | 7.51 % | 8.01 % | 8.5 % | 8.8 % | 8.8 % |

| Nidwalden (Stans) | 2.7 % | 3.7 % | 4.74 % | 5.19 % | 5.6 % | 5.7 % | 5.7 % |

| Obwalden (Sarnen) | 5.4 % | 5.8 % | 6.41 % | 6.86 % | 7.3 % | 7.5 % | 7.5 % |

| St. Gallen (St. Gallen) | 5.5 % | 5.9 % | 6.64 % | 7.09 % | 7.5 % | 7.6 % | 7.6 % |

| Schaffhausen (Schaffhausen) | 2.1 % | 3.3 % | 4.52 % | 5.01 % | 5.5 % | 5.7 % | 5.7 % |

| Solothurn | 3.5 % | 5.0 % | 6.54 % | 7.26 % | 7.7 % | 7.8 % | 7.8 % |

| Schwyz (Schwyz) | 1.3 % | 2.4 % | 4.36 % | 5.97 % | 8.5 % | 10.4 % | 10.4 % |

| Thurgau (Frauenfeld) | 6.2 % | 6.6 % | 7.36 % | 7.81 % | 8.2 % | 8.4 % | 8.4 % |

| Ticino (Bellinzona) | 4.0 % | 4.4 % | 5.15 % | 5.60 % | 7.3 % | 8.1 % | 8.1 % |

| Uri (Altdorf) | 3.9 % | 4.3 % | 5.00 % | 5.45 % | 5.8 % | 6.0 % | 6.0 % |

| Vaud (Lausanne) | 3.4 % | 4.6 % | 6.36 % | 7.40 % | 8.4 % | 9.1 % | 9.3 % |

| Valais (Sion) | 4.4 % | 4.8 % | 5.50 % | 6.72 % | 9.1 % | 10.3 % | 10.3 % |

| Zug (Zug) | 1.8 % | 2.9 % | 4.17 % | 4.99 % | 5.8 % | 6.3 % | 6.4 % |

| Zurich (Zürich) | 4.5 % | 4.9 % | 5.63 % | 6.08 % | 7.2 % | 11.2 % | 15.8 % |

Example of tax on 2nd pillar withdrawals in French-speaking cantons

1. Canton of Geneva, commune of Geneva

Withdrawal amount

CHF 50,000

CHF 100,000

CHF 250,000

CHF 500,000

CHF 1,000,000

Single person

1'457.55 CHF

CHF 4'620.85

CHF 16,725.40

39,272.85 CHF

CHF 84,957.70

Married person

464.70 CHF

CHF 3,126.60

CHF 14,622.80

CHF 35,746.50

CHF 80,379.30

2. Canton of Vaud, municipality of Lausanne

Withdrawal amount

CHF 50,000

CHF 100,000

CHF 250,000

CHF 500,000

CHF 1,000,000

Single person

CHF 1'690.60

4,658.85 CHF

CHF 17,552.35

CHF 42,172

90,781.30 CHF

Married person

CHF 1'345.55

3,691.15 CHF

15,236.15 CHF

CHF 38,187.15

87,097.50 CHF

Single-parent family

1'502.95 CHF

CHF 4,098.50

CHF 16,390.70

CHF 40,469.65

CHF 89,399.95

3. Canton of Valais, municipality of Sion

Withdrawal amount

CHF 50,000

CHF 100,000

CHF 250,000

CHF 500,000

CHF 1,000,000

Single person

CHF 2,185.55

CHF 4,760.45

CHF 14,483.20

38,041.30 CHF

CHF 103,000

Married person

CHF 2,100.40

CHF 4,498.60

CHF 14,052.20

CHF 37,171.15

CHF 101,400

4. Canton of Fribourg, municipality of Fribourg

Withdrawal amount

CHF 50,000

CHF 100,000

CHF 250,000

CHF 500,000

CHF 1,000,000

Single person

986 CHF

CHF 3,260

CHF 17,483

CHF 46,583

CHF 104,000

Married person

762 CHF

CHF 2,723

CHF 16,362

45,362 CHF

CHF 103,100

The different cantonal calculation methods

The taxation of lump-sum benefits from pension plans is calculated differently from one canton to another. There are 4 main calculation methods.

1. Method proportional to the income tax rate

This method applies a fraction of the ordinary income tax rate. In practice, the tax on lump-sum pension benefits corresponds to a portion of the tax that would have been owed if the amount had been regular annual income.

For example, if the tax rate for an income of 250,000 CHF is 15%, the canton will apply 1/5 of that rate (i.e., 3%) to the withdrawn capital. This is why it is referred to as a “reduced tax.” The reduction varies by canton (generally 1/3, 1/4, or 1/5 of the normal rate).

Cantons concerned: Swiss Confederation, Aargau (AG), Appenzell Inner-Rhodes (AI), Geneva (GE), Lucerne (LU), Neuchâtel (NE), Nidwalden (NW), Obwalden (OW), Schaffhausen (SH), Solothurn (SO), Vaud (VD) and Zug (ZG)

2. Pension-rate system

This method is more complex. The canton first converts the capital into a fictitious annual pension using a conversion rate. It then determines the tax rate that would apply to this annual pension according to the income tax scale. Finally, that rate is applied to the total amount of capital withdrawn.

For example, for a withdrawal of 250,000 CHF with a coefficient of 1/25, a fictitious pension of 10,000 CHF is first calculated. If the tax rate for 10,000 CHF of income is 2%, that 2% rate is then applied to the 250,000 CHF of capital.

Cantons concerned: Graubünden (GR), Schwyz (SZ), Ticino (TI), Valais (VS) and Zurich (ZH)

3. Separate tax scale for lump-sum benefits

These cantons have created a specific and independent tax scale for lump-sum pension benefits, completely separate from the regular income-tax scale. This progressive scale is written directly into their cantonal tax law.

This method offers complete transparency, since the scale is specifically designed for capital withdrawals and not derived from other calculations.

Cantons concerned: Appenzell Ausserrhoden (AR), Bern (BE), Basel-Landschaft (BL), Basel-Stadt (BS), Jura (JU) and Zug (ZG)

4. Fixed rate for lump-sum benefits

These cantons apply the simplest method: a fixed tax rate on the entire lump-sum benefit, regardless of the amount withdrawn. The rate remains the same whether you withdraw 50,000 CHF or 1,000,000 CHF.

In these cantons, the slight increase visible in the comparisons comes solely from the federal tax, which remains progressive. At cantonal level, the rate remains fixed.

Cantons concerned: Glarus (GL), St. Gallen (SG), Thurgau (TG) and Uri (UR)

Important notes

- Some cantons apply minimum or maximum tax rates to avoid extreme situations.

- Some cantons (AG, BE, BS, FR, GR, VS) offer tax-free amounts.

- Ticino and Valais use conversion tables that take gender and age into account, as these factors influence the calculation of the notional pension.

How can I save tax on a BVG/LPP withdrawal?

The LPP capital tax is progressive: the larger the lump-sum withdrawal, the higher the effective tax rate. The golden rule is to spread out withdrawals so that each one is taxed at a lower rate.

Another option is to legally establish residence in a canton with favorable tax conditions in the year of withdrawal. The tax domicile must be genuine and recognized by the cantonal authorities. Each canton applies its own tax scale on capital benefits, and the differences are significant: some cantons (Zug, Obwalden, Schwyz) have much lower rates than others (Vaud, Geneva, Neuchâtel).

Withdrawal of the 2nd pillar for cross-border commuters

1. Social security contributions: when they apply

When a French resident is affiliated with the general social security system (unemployment, employment in France, self-employment in France, or receiving a French pension), the withdrawn 2nd-pillar capital is subject to social contributions.

The rate depends on the tax reference income from two years earlier, but in practice, nearly all taxpayers end up at the maximum rate, which pushes the social contribution burden close to 9%.

The amounts to be declared appear in the usual boxes dedicated to foreign-source income, and must be reported gross, without subtracting the withholding tax paid in Switzerland.

2. Taxation of capital in France

There are two mechanisms for taxing capital in France.

1. The flat-rate tax (optional): Swiss pension capital can be taxed through a specific levy of 7.5%, applied after a 10% deduction. This system is advantageous because the taxation is final and separate from the rest of the income. The option is irrevocable.

The sensitive point concerns “fractioning.” The tax authorities consider a split payment to be a voluntary choice to spread the withdrawal of the capital, which would prevent the application of the flat-rate tax.

However, for the Swiss 2nd pillar, cases where the taxpayer genuinely chooses to split the payment are extremely rare. French authorities now consider withdrawals linked to a property purchase or to a standard early withdrawal as each being an independent event, which makes it possible to use the flat-rate tax multiple times for withdrawals triggered by different reasons.

2. The progressive scale (default): If the withdrawal falls into a situation considered as split, the capital is added to the household’s income and taxed according to the standard brackets.

An attenuation mechanism (the quotient) is possible: only 1/4 of the capital is included in the income, and then the additional tax is multiplied by four. This limits the bracket jump but remains less advantageous than the flat-rate tax in most cases.

3. CMU contributions

For cross-border workers or retirees covered by the CMU/CNTFS, the 2nd-pillar capital is included in the income base used to calculate the contributions. In other words, the withdrawal increases the income taken into account by the CNTFS two years later, which can trigger a very high contribution (approx. 8% of the income).

The CNTFS systematically checks declarations: failure to declare capital never escapes automatic correction.

The only possible lever is to change health-insurance regime (switch back to LAMal or enroll in the French mandatory system) before the year in which the CNTFS factors the capital into its calculation.

4. Overall consequences for a cross-border commuter

When a French resident withdraws their 2nd pillar after having worked in Switzerland, the charges add up: Swiss withholding tax, then French taxation (flat-rate or progressive scale), then social contributions, and finally, for those under the CMU, an additional contribution two years later. In the end, the total burden easily reaches around 15 to 16% and can even exceed that level depending on the health-insurance regime, timing of the withdrawal, and tax income.

For a capital of 200,000 CHF, a typical cross-border worker ends up, for example, with a combined tax burden of around 32,000 CHF: about 12,000 CHF of withholding tax depending on the canton, around 13,500 CHF from the French flat-rate tax (after the 10% deduction), plus roughly 6,000 to 7,000 CHF in social contributions if their tax income does not qualify them for the reduced rate. If the person is also affiliated with the CMU, the contribution calculated two years later can add several more thousand francs to the bill.

It is this accumulation, and not a single tax, that explains why withdrawing from the 2nd pillar, once back in France, is far more costly than many anticipate.

Optimizing tax on 2nd pillar capital

1. Stagger the withdrawals

The progressiveness of the tax is the most significant optimization lever. The higher the amount withdrawn at once, the higher the effective tax rate becomes. By splitting the withdrawals, each payment is taxed at a lower rate.

Here are the staggering strategies to set up:

- Separate 2nd and 3rd pillar A withdrawals over several fiscal years

- For example, first remove the pillar 3a at age 60, then the BVG/LPP at age 65

- If you have several 3a accounts, withdraw them over separate years

- For couples, coordinate withdrawals of both spouses in separate years

- In case of vested benefit accounts, make split between 2 foundations on opening to defer withdrawal

For example, a single withdrawal of 500,000 CHF in Geneva is taxed at around 7.8%, which equals 39,000 CHF. By splitting this amount into two withdrawals of 250,000 CHF spaced one year apart, the rate drops to about 5.7% per withdrawal, for a total of 28,500 CHF in tax. The resulting savings amount to 10,500 CHF.

2. Select withdrawal canton

The tax residence at the time of the withdrawal determines the applicable tax rate. The differences between cantons are substantial, with gaps that can exceed 5 percentage points for the same amount.

However, for a change of canton to be recognized for tax purposes, the move must be genuine and the new residence established before the withdrawal. The tax authorities verify the reality of the relocation (rental contract, municipal registration, deregistration from the previous canton). This strategy requires advance planning and represents a significant personal commitment, but it can generate substantial savings on large capital amounts.

3. Optimize BVG/LPP buy-backs

Buy-ins to the 2nd pillar are 100% deductible from taxable income, which creates an immediate tax saving. This deduction is applied at the marginal tax rate, which can reach 40–45% in some cantons for high earners.

Rules to follow:

- Do not withdraw capital within 3 years following a buy-in, under penalty of tax assessment

- Plan redemptions according to the withdrawal date planned

- Give preference to redemptions during years of high income to maximize tax savings

Make regular buy-ins during your working life (especially after age 50), while respecting the 3-year waiting period before any early withdrawal. This reduces income tax during working years while building capital that will be taxed more favorably at the time of withdrawal.

4. Choosing the right time for withdrawal

The timing of the withdrawal can influence the overall tax burden, particularly for cross-border commuters or people with variable incomes.

Things to consider:

- Withdrawing capital in a year when others revenues are low (particularly in the year following cessation of activity)

- For French cross-border commuters: prefer to withdraw before returning permanently to France to avoid cumulative taxation

- Coordinate with other events (property sale, inheritance) to avoid unfavorable cumulation

Conclusion

The tax optimization of a 2nd-pillar withdrawal requires early planning, ideally 5 to 10 years before the withdrawal. The potential gains can reach several tens of thousands of francs on a large capital. This approach fits naturally into a broader estate-planning strategy, which considers all your financial and inheritance objectives.

Feel free to consult a financial advisor to develop a personalized strategy tailored to your situation.

Frequently asked questions

Capital benefits tax is due when you withdraw assets from your 2nd pillar, a vested benefits account, or your pillar 3a. This withdrawal can occur in several situations:

You're off to retirement and request all or part of the capital instead of an annuity.

You buy or renovate your house with your pension assets.

You become self-employed and leave the occupational pension plan.

You leave definitively Switzerland, under certain conditions.

You receive a capital in the event of divorce or asset sharing.

You become invalid and receive a lump-sum benefit.

You inherit a BVG capital inheritance following a death.