What does the 1st pillar consist of?

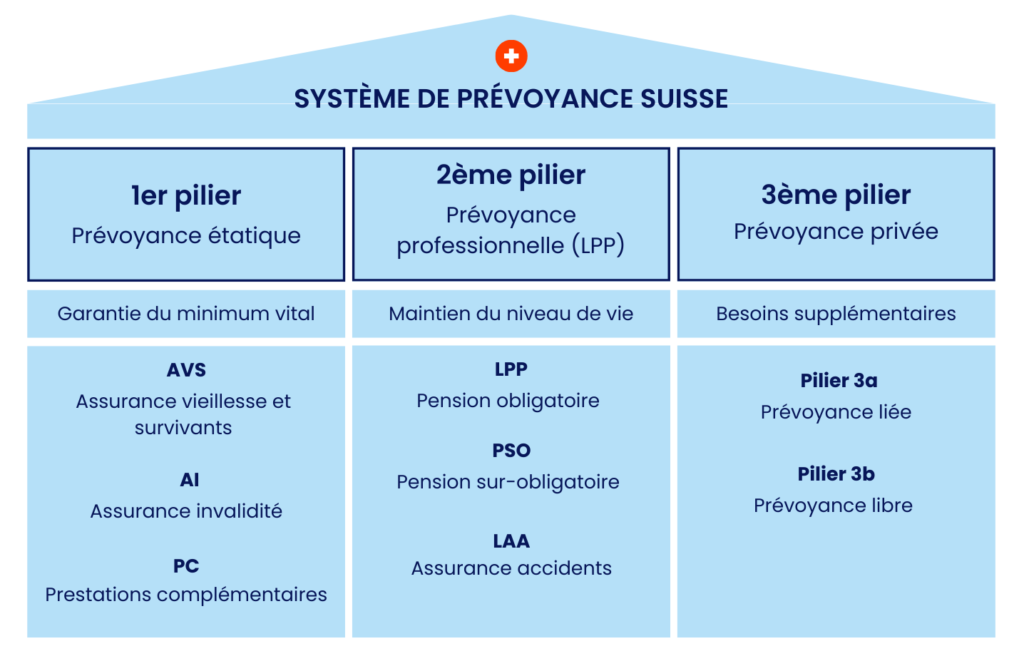

The 1st pillar of the Swiss pension system is made up of three closely interlinked social insurances. Together, they form the state pension system which is designed to ensure the safety of the living wage in the event of old age, death or disability. It is made up of three components:

- AHV (old-age and survivors' insurance): Pays a pension to retirees or survivors in the event of death.

- IV (disability Insurance): Supports people who have become disabled through reintegration measures and, if necessary, a pension.

- EL (supplementary benefits): Provides additional financial support if AHV/IV pensions are insufficient to cover basic needs.

1. Old-age and survivors' insurance (AVS)

The AHV (Old Age and Survivors Insurance), introduced in 1948, is the basic social insurance in Switzerland. It aims to guarantee a minimum income to elderly individuals or to the surviving relatives (spouse, children) of a deceased insured person. It is based on the principle of solidarity between generations: the working population finances the pensions of current retirees.

Who is required to contribute?

The AHV (Old Age and Survivors Insurance) applies to everyone living or working in Switzerland. Contributions are mandatory from the age of 17 for those engaged in gainful employment, and from 20 for those not employed. Employees, self-employed individuals, or retirees: all contribute according to their financial means.

How is AHV financed?

The system is based on the principle of intergenerational solidarity: today’s working population finances the pensions of current retirees. It is a pay-as-you-go model—not a capitalization system—which means contributions are not individually saved but immediately redistributed.

For employees, AHV contributions amount to 8.7% of gross salary, shared equally between employer and employee. Self-employed individuals pay according to a progressive scale that can reach up to 8.1%, while those without gainful employment contribute based on their assets and replacement income.

When can you draw your AHV pension?

The standard retirement age is currently set at 65 for men and 64 for women. However, under the AVS21 reform, the reference age for women will be gradually aligned with that of men by 2028. It is also possible to take early retirement or to defer pension payments.

Early retirement is possible from 63 years (men) or 62 years (women), with a lifelong reduction in the pension. Conversely, deferring retirement up to age 70 allows you to receive an increased pension.

How is the annuity amount calculated?

The AHV pension is not uniform. It mainly depends on two factors: the number of contribution years and the average annual income considered. A full career of 44 years (for men) or 43 years (for women born before 1961) entitles you to a full pension.

In 2025, the monthly AHV pension amount is defined in the scale 44 and ranges between CHF 1,260 (minimum pension) and CHF 2,520 (maximum pension). For married couples, the total of both pensions cannot exceed 150% of the maximum individual pension, i.e., CHF 3,780. This cap often results in a reduction of the combined pension.

Credits are granted to individuals who have raised children or cared for dependent relatives. These periods are included in the pension calculation, thereby recognizing the value of unpaid work.

AHV 2025 figures

- The maximum AHV pension is CHF 2,520 / month

- The minimum AHV pension is CHF 1,260 / months

- The maximum determining average annual income is CHF 90,720

What are the benefits for children and survivors?

The AHV also provides benefits for children and survivors to protect families in the event of the death or retirement of a parent or spouse. When an insured person receives an AHV or AI pension, they can receive a child’s pension for each child under 18 years old, or up to 25 years if still in education. This pension corresponds to 40% of the insured person’s pension.

In the event of death, the AHV pays survivor’s pensions to widows, widowers, and orphans under specific conditions. A widow can receive a pension if she has children or is over 45 years old and was married for at least five years. A widower, on the other hand, is entitled only if he has dependent minor children. Orphans receive a pension until age 18 (or 25 if they are still in education).

Early pension calculation

You can request an estimate of your AHV pension.

2. Disability insurance (IV)

The Disability Insurance (DI), integrated in 1960, is an essential part of the Swiss social security system, just like the AHV. It aims to protect insured individuals against the economic consequences of long-term work incapacity due to illness, accident, or congenital disability. However, contrary to what one might think, DI is not limited to paying pensions. Its primary mission is to prevent, reduce, or eliminate disability, always prioritizing reintegration measures over granting a pension.

What benefits does IV provide?

The guiding principle of DI is clear: rehabilitation takes precedence over pension. This means that anyone affected in their ability to work must first receive medical, professional, or social measures aimed at maintaining or restoring their earning capacity. These measures may include:

- Some medical treatments paid by the IV, if they are essential for reintegration,

- Some professional training, outplacement, or support for reintegration into suitable job,

- Advice, coaching or outplacements in the company,

- And in some cases, financial assistance for auxiliary means (such as a wheelchair, prosthesis or workstation adaptation).

IV also offers the possibility to implement so-called “new rehabilitation” measures, aimed at individuals already receiving a pension but who have potential for returning to work. These individualized approaches aim to preserve professional autonomy and reduce reliance on long-term benefits.

Who can benefit from IV?

Anyone residing in Switzerland with a physical or mental health impairment that may lead to disability can apply to the IV. Disability is defined as a lasting incapacity, partial or total, to engage in gainful employment or, for non-employed individuals, to perform usual tasks.

A waiting period of 12 months (max 24 months) is required: the limitation in working capacity must be medically attested over this period to qualify for a pension.

How are IV pensions calculated?

When reintegration measures are insufficient, a disability pension may be granted. This depends on the disability rate, determined by comparing the theoretical income without disability to the income still achievable despite the disability.

- From 40 % disability, a partial annuity is possible,

- A full pension is granted from a disability rate of 70 %.

The pension amount follows the same principles as the AHV: it varies according to the average annual income and the contribution period. In 2025, the full DI pension ranges between CHF 1,260 and CHF 2,520 per month, just like the AHV. Child pensions may also be paid if the insured has minor children or children in education.

3. Supplementary benefits (EO)

Supplementary benefits (PC) are financial assistance paid to people residing in Switzerland who receive an AHV or DI pension but whose income does not cover the basic living needs. They supplement pensions to ensure a decent standard of living.

How are supplementary benefits calculated?

- The expenses (rent, food, health insurance, care, etc.)

- The available income (pensions, assets, ancillary income)

If your recognized expenses are higher than your income, the government makes up the difference. This is not social assistance, but a legal right.

PCs also include the reimbursement of certain medical expenses, such as deductibles or treatment not covered by basic insurance. They are financed by the Confederation and the cantons.

Frequently asked questions

The 1st pillar is the compulsory state pension scheme. Its purpose is to guarantee living wage for the elderly, disabled or survivors of a death. It is based on three components:

AHV (old-age and survivors' insurance)

IV (disability insurance)

EL (supplementary benefits)

All persons residing or working in Switzerland must contribute :

The employees from age 17,

The independent from age 18,

The people not in gainful employment from age 20 (contributions based on wealth and replacement income).

Yes. It is possible to :

Anticipate annuities (from age 63 for men, 62 for women), with a permanent reduction in the amount,

Defer annuities up to the age of 70, with a surcharge.

Since the AVS21 reform, it has also been possible to take a partial pension.

Anyone receiving an AHV or IV pension can apply for supplementary benefits (EL) if their income is insufficient to cover basic expenses. These are financial aids calculated based on your actual needs. They do not depend on contributions but on your economic situation.

You can request an career statement from your compensation fund. This will enable you to check that all your contribution years have been taken into account.

An advance calculation can also be requested.

The 1st pillar is compulsory for everyone and is aimed at providing a minimum standard of living.

The 2nd pillar (BVG) is an occupational pension plan, compulsory only for salaried employees above a certain income threshold, and serves to maintain previous living standards.

No. The maximum AHV pension (CHF 2,450 in 2025) is often insufficient to cover all your needs, especially when it comes to housing in the city or medical expenses. It is therefore essential to supplement it with the 2nd and 3rd pillars.